Property Lien Montana Withholding

Description

How to fill out Montana Construction Lien Notice - Individual?

Managing legal papers and processes can be a lengthy addition to your whole day.

Property Lien Montana Withholding and similar forms generally necessitate that you search for them and figure out how to fill them out correctly.

Consequently, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and functional online directory of forms at your disposal will be very beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms and a variety of tools to assist you in completing your documents with ease.

Is this your first experience using US Legal Forms? Sign up and create your account in a matter of minutes, which will grant you access to the form catalog and Property Lien Montana Withholding. After that, follow the steps below to fill out your form: Ensure you have found the correct form using the Preview feature and reviewing the form description. Click Buy Now when ready and select the subscription plan that fits your requirements. Select Download then fill out, sign, and print the form. US Legal Forms has twenty-five years of expertise assisting users in managing their legal documents. Obtain the form you need now and simplify any process without breaking a sweat.

- Explore the collection of applicable documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms available at any time for download.

- Protect your document management processes by utilizing a high-quality service that allows you to prepare any form in minutes without additional or hidden fees.

- Simply Log In to your account, find Property Lien Montana Withholding, and download it instantly from the My documents section.

- You also have the ability to access forms you have previously downloaded.

Form popularity

FAQ

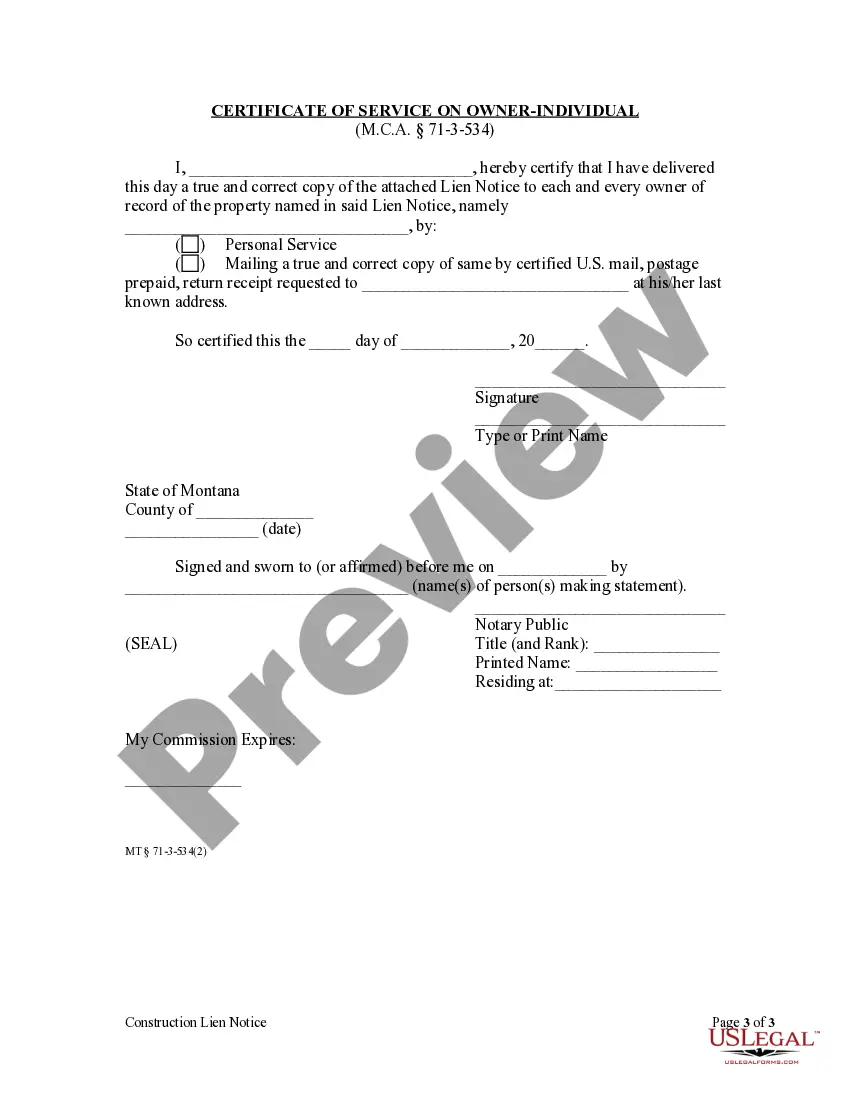

File A Lien An action to enforce a mechanics lien in Montana must be initiated within 2 years from lien's filing. Notice of Lien Rights served on owner within 20 days of first delivering materials or labor and filed with recorder within 5 days of delivery to owner.

New Filings UCC1 Lien$7.00Federal Tax Lien$7.00DPHHS Notice Of Child Support Lien$7.00Title 71 Crop Lien For Seed Or Grain$7.00Title 71 Crop Lien For Hail Insurance$7.008 more rows

About Montana Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

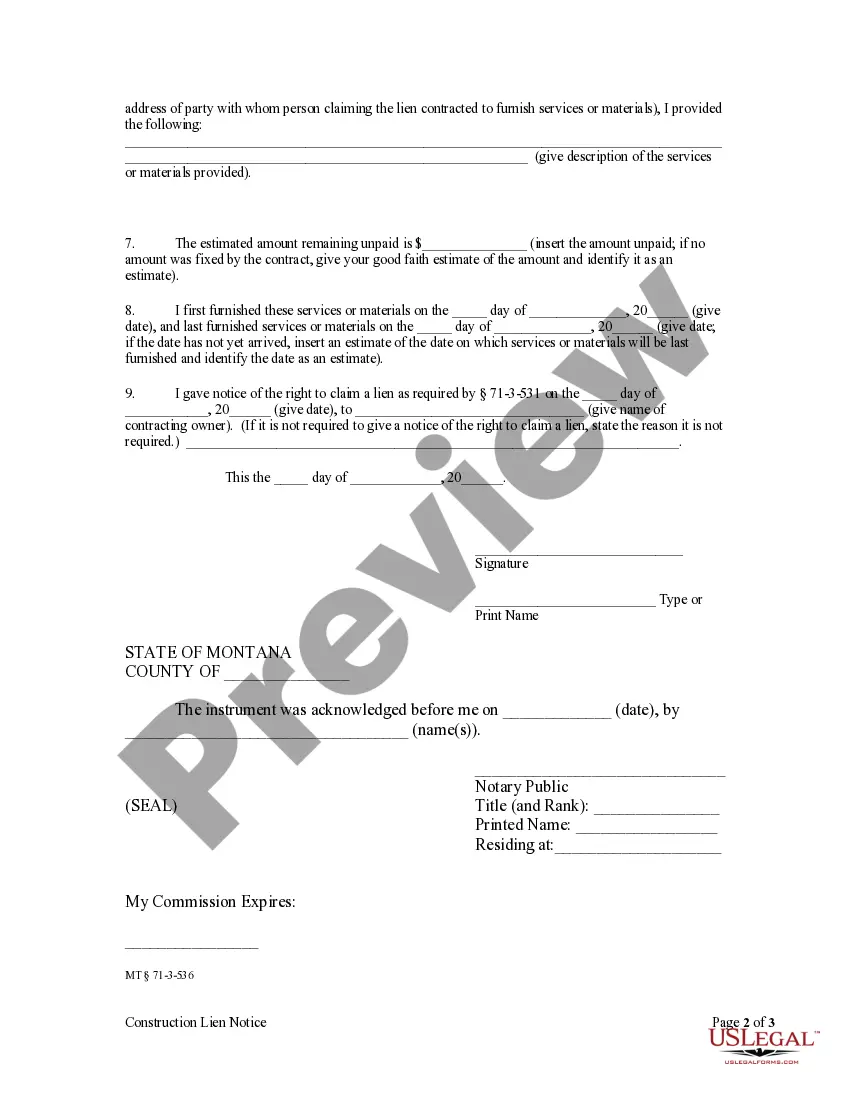

How to File a Montana Mechanics Lien | A Step-by-Step Guide to Get You Paid Properly identify yourself. Identify the property owner(s) Describe the labor or materials provided. Identify the hiring party. State the amount of the lien claim. Provide the first and last dates when labor or materials were provided.

Ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.