Notice 3 Form Fillable For Irs

Description

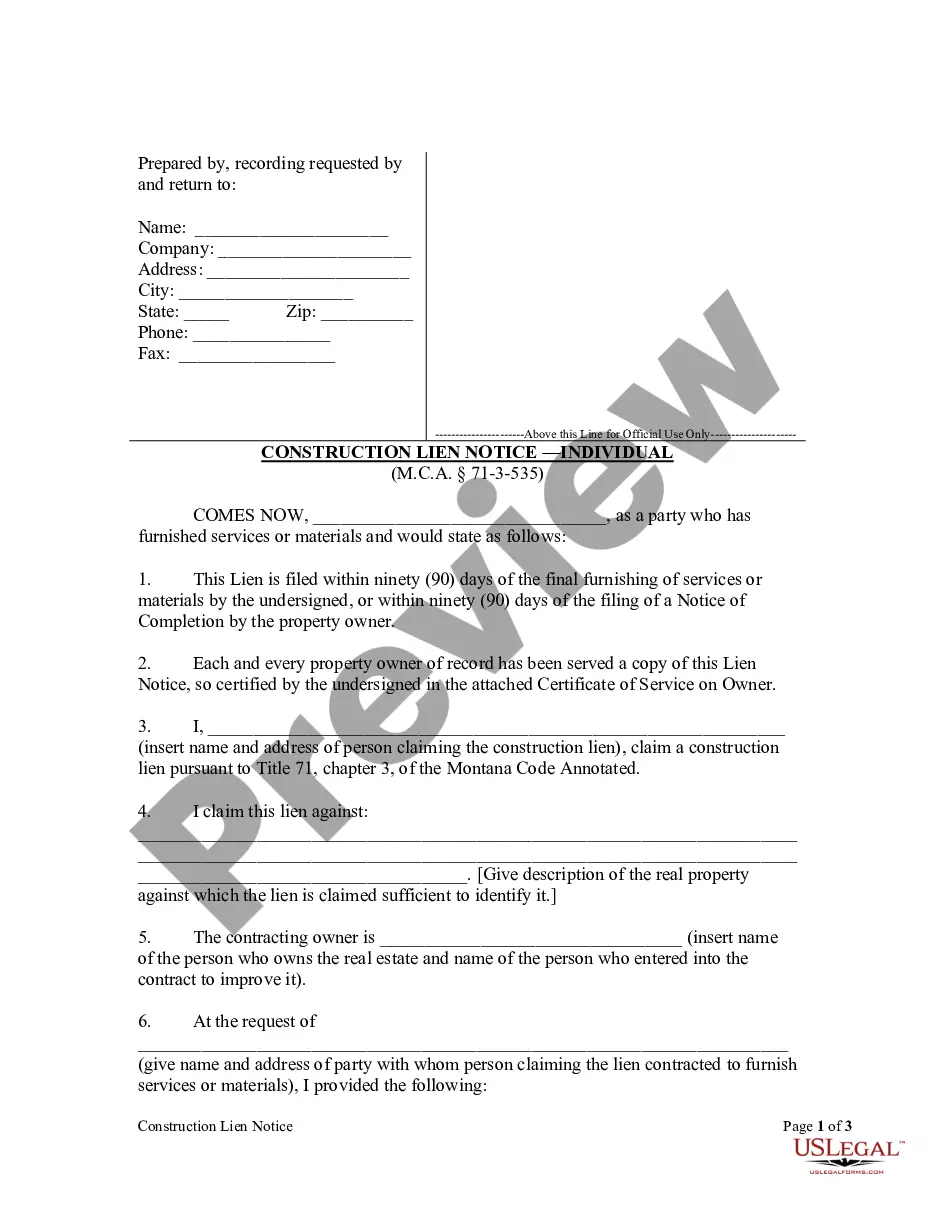

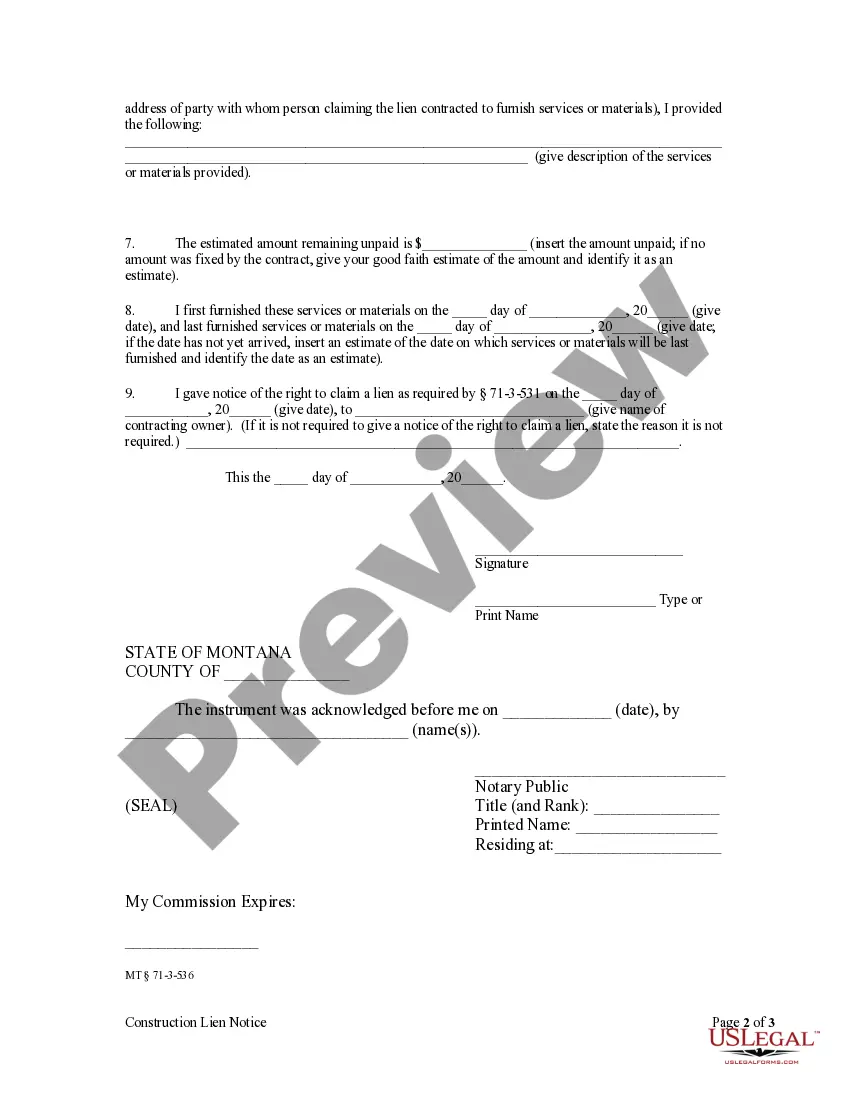

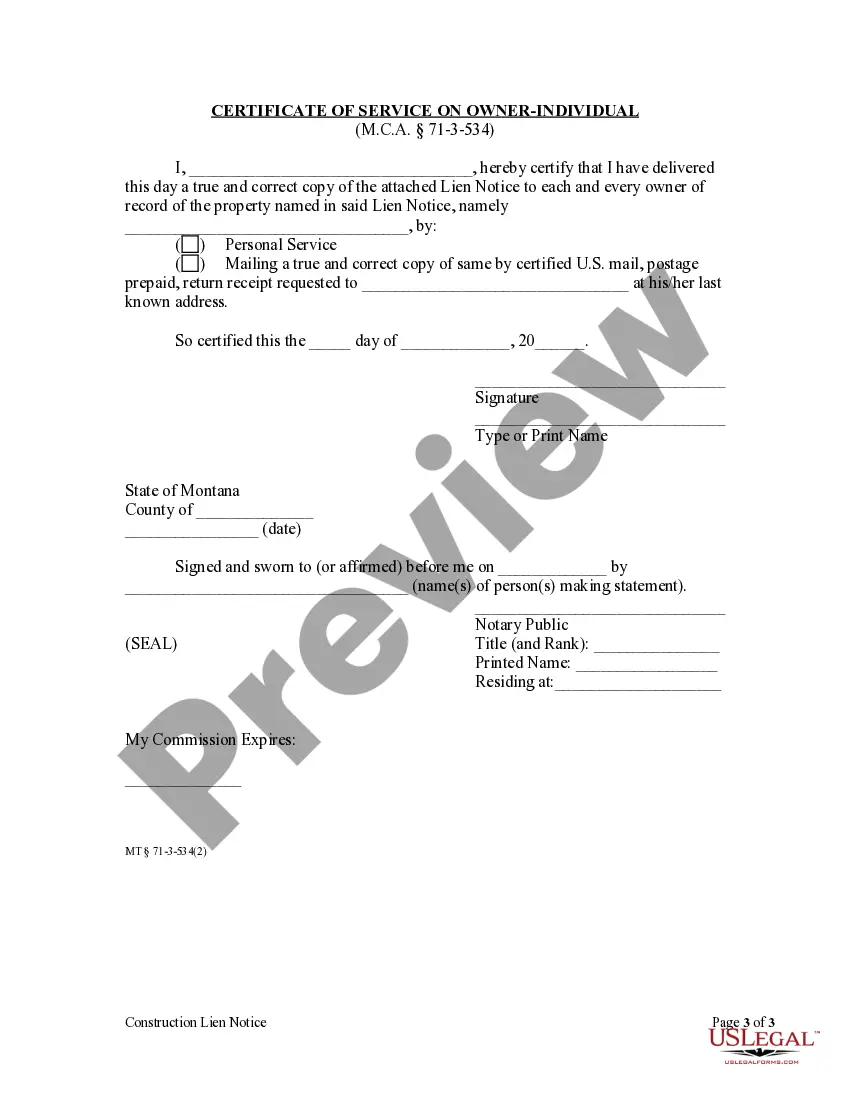

How to fill out Montana Construction Lien Notice - Individual?

- If you are a returning user, log in to your US Legal Forms account and navigate to the Downloads section to access your desired form. Ensure your subscription is active to avoid interruptions.

- For first-time users, start by reviewing the form in Preview mode to confirm it aligns with your jurisdiction's requirements.

- If the form does not meet your needs, utilize the Search feature to explore additional templates until you find the correct one.

- Purchase the document by clicking the Buy Now button, selecting your preferred subscription plan, and registering for an account to unlock the resource library.

- Complete your purchase by entering your credit card information or using your PayPal account for payment.

- Once purchased, download the form to your device for easy access and completion. You can also find it later in the My Forms section of your account.

In conclusion, US Legal Forms facilitates a quick and hassle-free way to secure legal documents like the Notice 3 form fillable for IRS. The extensive library and expert assistance ensure that you are supported throughout the process.

Start utilizing US Legal Forms today to streamline your legal documentation needs!

Form popularity

FAQ

Some IRS notices may not be available online due to specific regulations regarding their distribution. For example, the Notice 3 form fillable for IRS is designed to be accessible electronically, but other notices may only be sent via mail. If you need a particular notice that cannot be found online, consider contacting the IRS directly or exploring platforms like US Legal Forms for additional resources. It's essential to ensure you have the correct notices for your tax requirements.

You can save a fillable IRS form by first completing the necessary fields in your PDF editor. After filling out the Notice 3 form fillable for IRS, use the 'Save As' option to keep your changes. This ensures that all your entries remain intact when you reopen the document. Make sure to save it in a location where you can easily find it later for filing.

Yes, many IRS PDF forms are fillable, including the Notice 3 form fillable for IRS. These forms allow you to enter information directly into the document electronically. This feature simplifies the process of completing your forms, making it easier for you to submit them accurately. Always ensure you have the latest version of the form to utilize its fillable features.

Yes, you can fill out Form 1096 by hand, but it is essential to ensure all information is legible and accurate. Handwriting can lead to errors, especially when it comes to numbers and dates. To avoid mistakes, consider using a Notice 3 form fillable for IRS, which provides a clean and structured format for accurate entries.

To file 1099-MISC Box 3, you need to report any other income that does not fall under earned income for the recipient. Ensure you included the correct taxpayer identification number and amount. Utilizing a Notice 3 form fillable for IRS can simplify the filing process, allowing you to ensure every detail is captured correctly.

Yes, you must file a separate Form 1096 for each type of 1099 form you are submitting. This requirement ensures the IRS receives accurate reporting for different types of income. Using a Notice 3 form fillable for IRS helps streamline the process of managing multiple filings, making it easier to keep organized.

When filling out a letter to the IRS, start with your name, address, and the date at the top. Clearly state the purpose of your letter, and attach any relevant documents or forms needed. Using a Notice 3 form fillable for IRS can help guide you in structuring your correspondence, ensuring you include all critical details.

Box 3 of Form 1096 is where you record the total number of informational returns being submitted with your Form 1096. This could include various forms such as 1099-NEC or 1099-MISC. It’s essential to use a Notice 3 form fillable for IRS to ensure you capture this data accurately and efficiently.

To fill out Form 1096 Box 3, you'll need to enter the total number of forms you are submitting for the corresponding 1099 type. Make sure to double-check the figures for accuracy. Additionally, using a Notice 3 form fillable for IRS can simplify this process, providing you with a clear and organized method to complete your information.

The W3 format is a summary of all W2 forms that report wage and tax information to the IRS. This form consolidates the data from multiple employees into a single submission. Understanding the requirements of the W3 format is crucial for compliance. Utilizing a Notice 3 form fillable for IRS can help you format this information correctly and efficiently.