53583-3

Description

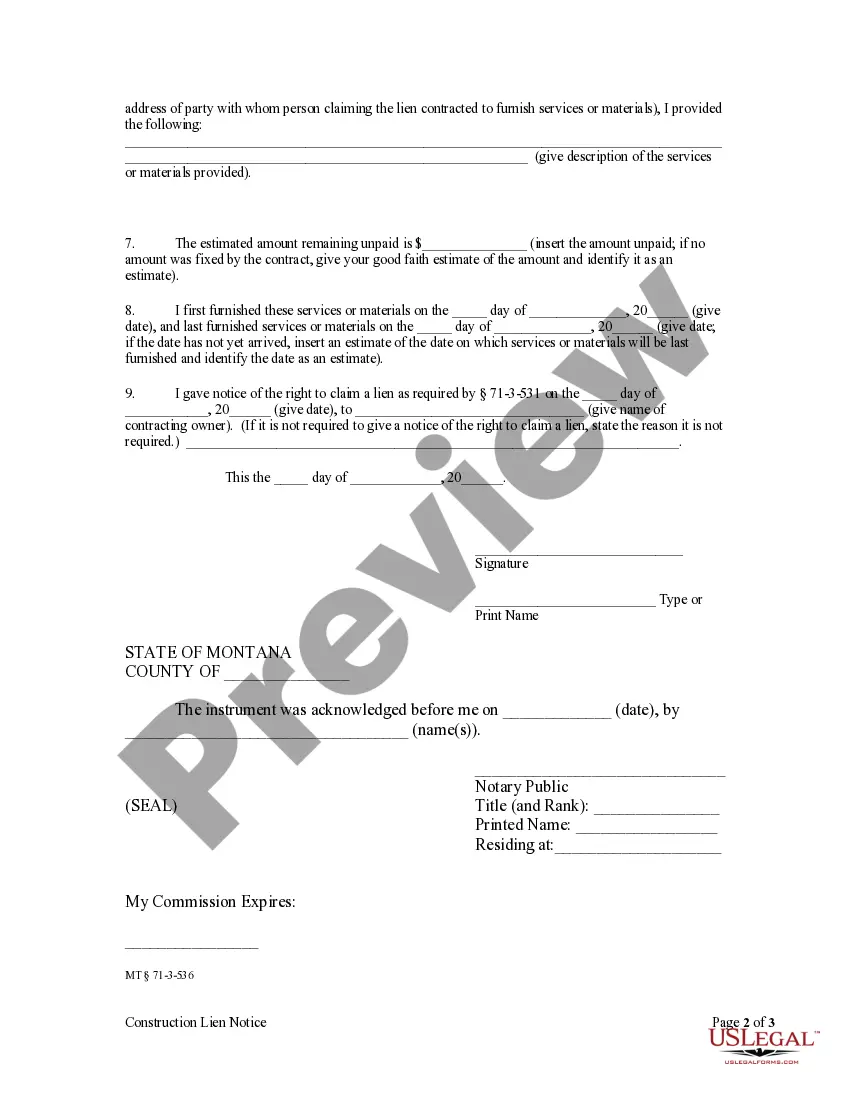

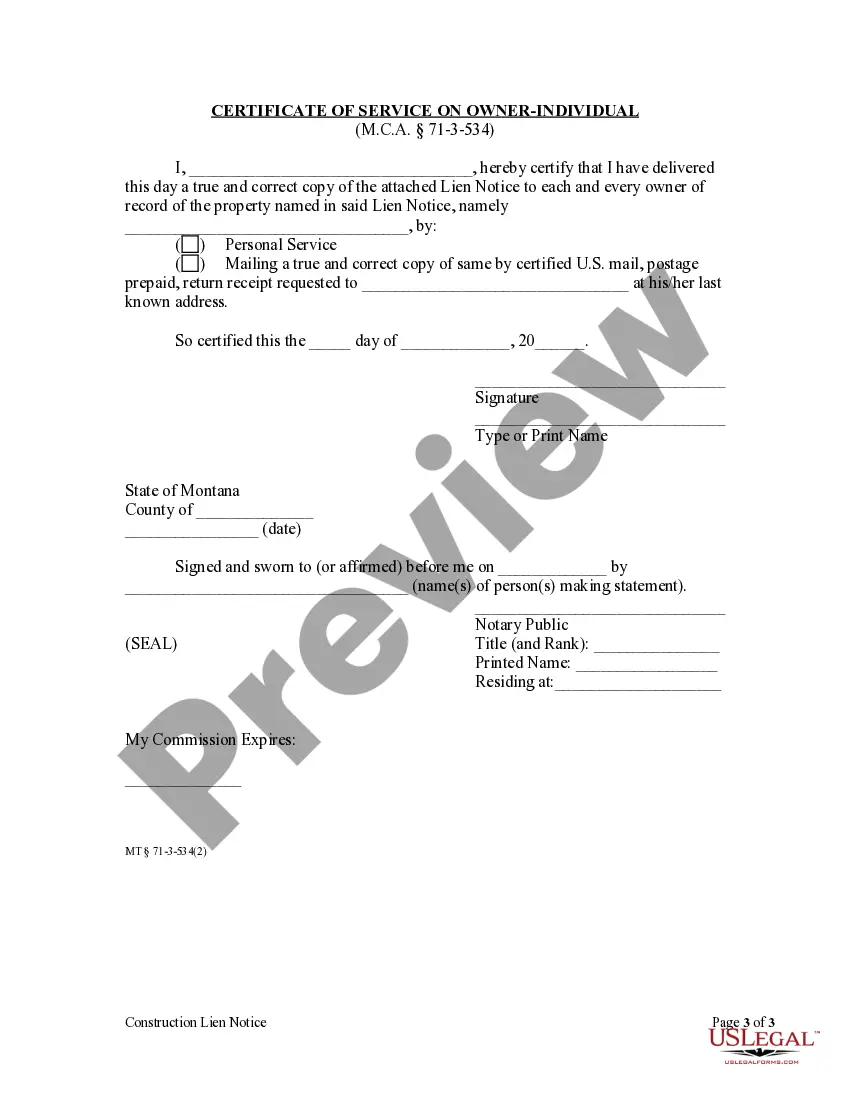

How to fill out Montana Construction Lien Notice - Individual?

- Log into your account if you are a returning user and ensure your subscription is active. Use the Download button to obtain your form.

- For first-time users, start by checking the Preview mode and form description for the 53583-3 template to confirm it meets your requirements and local jurisdiction.

- If necessary, utilize the Search tab to locate additional templates that might better fit your needs.

- Once you find the appropriate form, click on the Buy Now button and select your preferred subscription plan. You will need to create an account for full access.

- Proceed to payment by entering your credit card information or opting for PayPal to complete your subscription purchase.

- Finally, download the 53583-3 form and save it on your device, allowing you to access it later from the My Forms section in your profile.

By following these straightforward steps, you can quickly obtain the forms you need with confidence, knowing they are legally sound and tailored to your specifications.

Take action now and streamline your legal documentation process with US Legal Forms. Visit the site and get your 53583-3 form today!

Form popularity

FAQ

Step 3 on the W-4 form significantly impacts your tax withholding and, consequently, your overall tax burden. Claiming more dependents will lower your taxable income, resulting in reduced tax withheld from your paycheck. However, ensure that your claims are accurate; otherwise, you could end up owing taxes come April. If you need clarity on the W-4 process, US Legal Forms offers useful resources to navigate these decisions.

To fill out section 3 of the W-4 form, calculate your expected dependent exemptions based on your family size and situation. This section is critical as it helps determine how much federal income tax will be withheld from your paycheck. Make sure to read the line-by-line instructions to avoid common mistakes. For assistance, you might want to explore templates on US Legal Forms which can make this task easier.

To fill out a DPT 3 form correctly, begin by entering your personal information, including your name and address. Then, follow the provided instructions to fill in specific details such as income and exemption claims. Each section is crucial for accurate tax filing, so take your time to verify your entries. If you need any help, using the resources from US Legal Forms might simplify the process.

Box 3 on the W-4 form is where you report the number of dependents you are claiming. This number helps your employer calculate the correct amount of federal tax to withhold from your earnings. It's important to ensure that you provide accurate dependents' information to avoid underpaying or overpaying your taxes. US Legal Forms can assist you in understanding these tax documents better.

To complete Step 3 of the employee withholding certificate, you'll need to determine the number of dependents you can claim. This includes children and other eligible individuals who rely on you for support. Make sure to follow the instructions provided for accuracy, as this impacts how much tax is withheld from your paycheck. For a smooth process, consider using US Legal Forms, which offers resources to guide you through this.

To file a Qualified Subchapter S Trust (QSST) election, submit Form 2553 with the IRS, indicating your status as a trust. You can streamline this process by using online services such as uslegalforms, which provide the necessary forms and guidance for correct completion. Meeting the filing deadline is crucial, so consider using these resources for timely submission.

To file a GST 3B Nil return, log into the GST portal, select the option for Nil return filing, and provide the necessary details. Confirm that your business has no sales or purchases during the period you are reporting. Uslegalforms can assist you with this simple process, ensuring proper submission and compliance.

GSTR 3B is a self-declared summary return, required for reporting sales, purchases, and applicable taxes under the GST regime. For example, if your business recorded $10,000 in sales and $1,000 in Input Tax Credit, you would report these figures on your GSTR 3B. Leveraging uslegalforms can help you easily compile and submit this information accurately.

To file GSTR 3B, begin with data collection for sales, purchases, and tax credits. Next, access the GST portal, fill in your details, and ensure the accuracy of the information entered. Finally, submit the form and keep a copy for your records. Uslegalforms provides templates and guidance to streamline this process and ensure compliance with GSTR regulations.

Filing GSTR 3B involves several steps: first, gather your transaction data, then log into the GST portal, and select the GSTR 3B option. Next, input your details accurately in the designated fields, review for errors, and submit the form. Utilizing tools from uslegalforms can help guide you through each step, enhancing accuracy and compliance.