Sample Subpoena To Accountant For Bank Records

Description

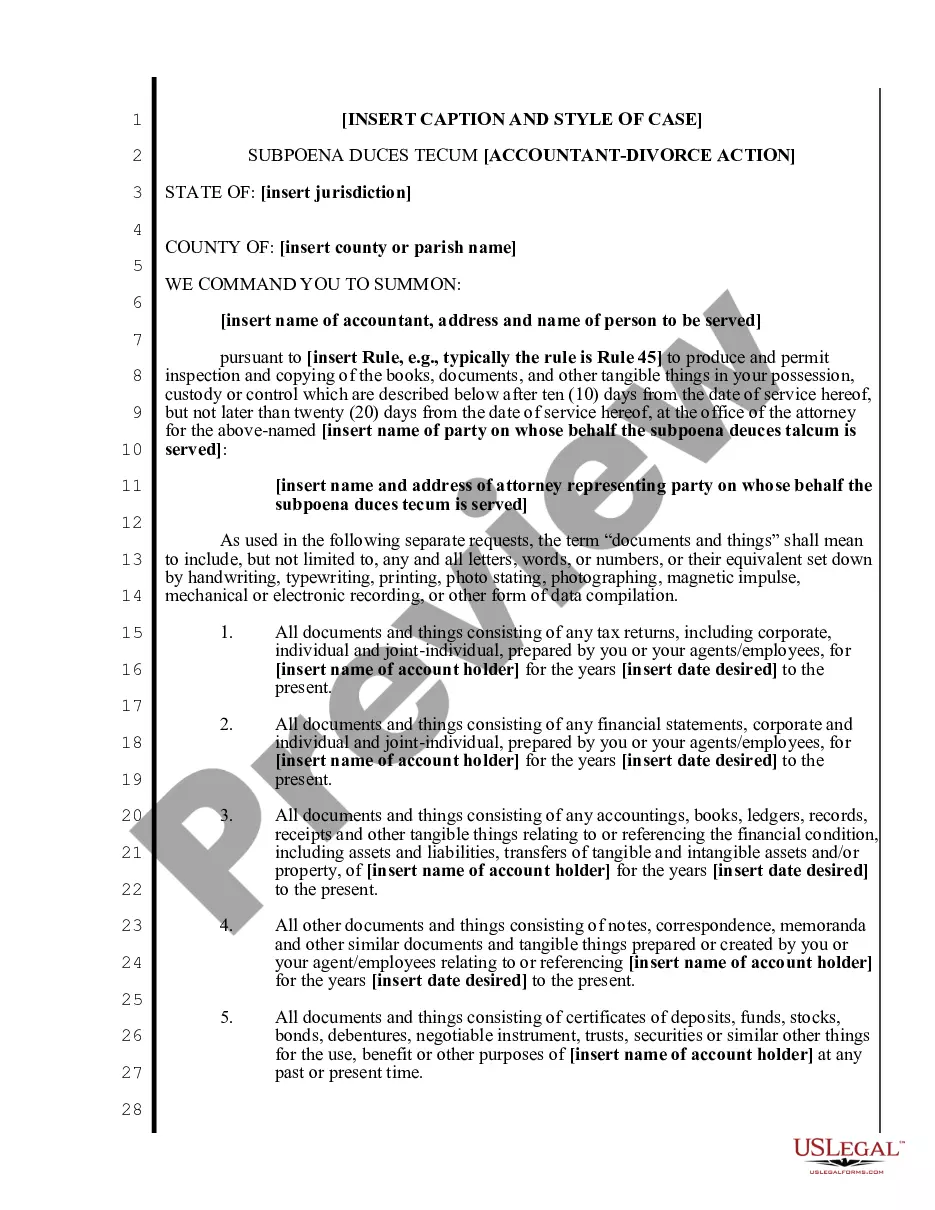

How to fill out Mississippi Subpoena Duces Tecum - Accountant - Divorce Action?

Locating a reliable source for the latest and suitable legal templates constitutes a significant part of navigating bureaucratic processes.

Accurate legal document requirements necessitate precision and careful attention, which is why it is crucial to source samples of Sample Subpoena To Accountant For Bank Records exclusively from reputable providers, such as US Legal Forms. A flawed template could squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns.

Eliminate the stress associated with your legal paperwork. Explore the vast collection of US Legal Forms to locate legal templates, evaluate their pertinence to your circumstances, and download them instantly.

- Utilize the directory navigation or search function to locate your template.

- Examine the form's details to ensure it meets the standards of your state and locality.

- Review the form preview, if accessible, to confirm that the template matches your needs.

- Return to the search function and seek the appropriate template if the Sample Subpoena To Accountant For Bank Records does not meet your requirements.

- If you are confident about the relevance of the form, download it.

- When you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing plan that aligns with your requirements.

- Proceed with registration to complete your purchase.

- Finalizing your purchase involves selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Sample Subpoena To Accountant For Bank Records.

- Once you have the form on your device, you can modify it with the editor or print it out and complete it by hand.

Form popularity

FAQ

Yes, your accountant can testify against you if called upon in a legal proceeding. However, this often depends on the nature of the proceedings and any waivers of confidentiality. When navigating a situation involving a sample subpoena to accountant for bank records, it’s essential to be aware of these potential outcomes.

Typically, you may not be notified if your bank records are subpoenaed. Subpoenas are often issued without prior notice to maintain the integrity of investigations. When dealing with a sample subpoena to accountant for bank records, understand that this lack of notification can sometimes complicate matters.

Yes, taking legal action against an accountant is possible if you believe they have acted unlawfully or unethically. This could involve malpractice claims or other legal remedies. Using a sample subpoena to accountant for bank records might play a role in collecting evidence for your case.

Yes, accountants can be held accountable for their actions. If they breach their professional duty or engage in misconduct, they may face legal consequences. Therefore, understanding how to navigate a sample subpoena to accountant for bank records can help clarify any such situations where accountability comes into play.

Yes, a closed bank account can still be subpoenaed. Authorities may seek past records to gather information for legal matters or investigations. When preparing any documentation, including a sample subpoena to accountant for bank records, it’s crucial to include the necessary details to ensure compliance.

Yes, accountants are generally required to maintain confidentiality regarding your financial information. This duty means they cannot disclose your details without your consent, except in specific situations outlined by law. When utilizing a sample subpoena to accountant for bank records, you might need to consider the legal implications that could waive this confidentiality.

A subpoena for bank records is commonly referred to as a subpoena duces tecum. This is a formal request for documents necessary for a legal case, including bank statements and transaction histories. Utilizing a sample subpoena to accountant for bank records can make this process smoother and more effective. By following the correct legal steps, you can obtain essential financial information needed for your case.

A bank subpoena is a legal order that instructs a bank to provide certain financial records. This document is vital for attorneys seeking proof of transactions or account balances relevant to their cases. By issuing a sample subpoena to accountant for bank records, you can gather critical evidence needed for your arguments. Remember, this must be carried out according to proper legal protocols to ensure compliance.

When you need bank statements from a witness, it is often referred to as obtaining a subpoena duces tecum. This legal tool allows you to acquire documents, including financial records, from a person who has knowledge relevant to a case. Using a sample subpoena to accountant for bank records ensures you can request the specific information necessary for your legal proceedings. This process can significantly aid in establishing a clear financial picture.

Yes, bank accounts can be subpoenaed as part of a legal investigation. When you issue a sample subpoena to accountant for bank records, you compel the accountant to provide documents related to specified accounts. This process supports the pursuit of financial evidence necessary for legal matters. However, there are regulations governing how and when this can be done.