Sample Subpoena For Tax Returns With Irs

Description

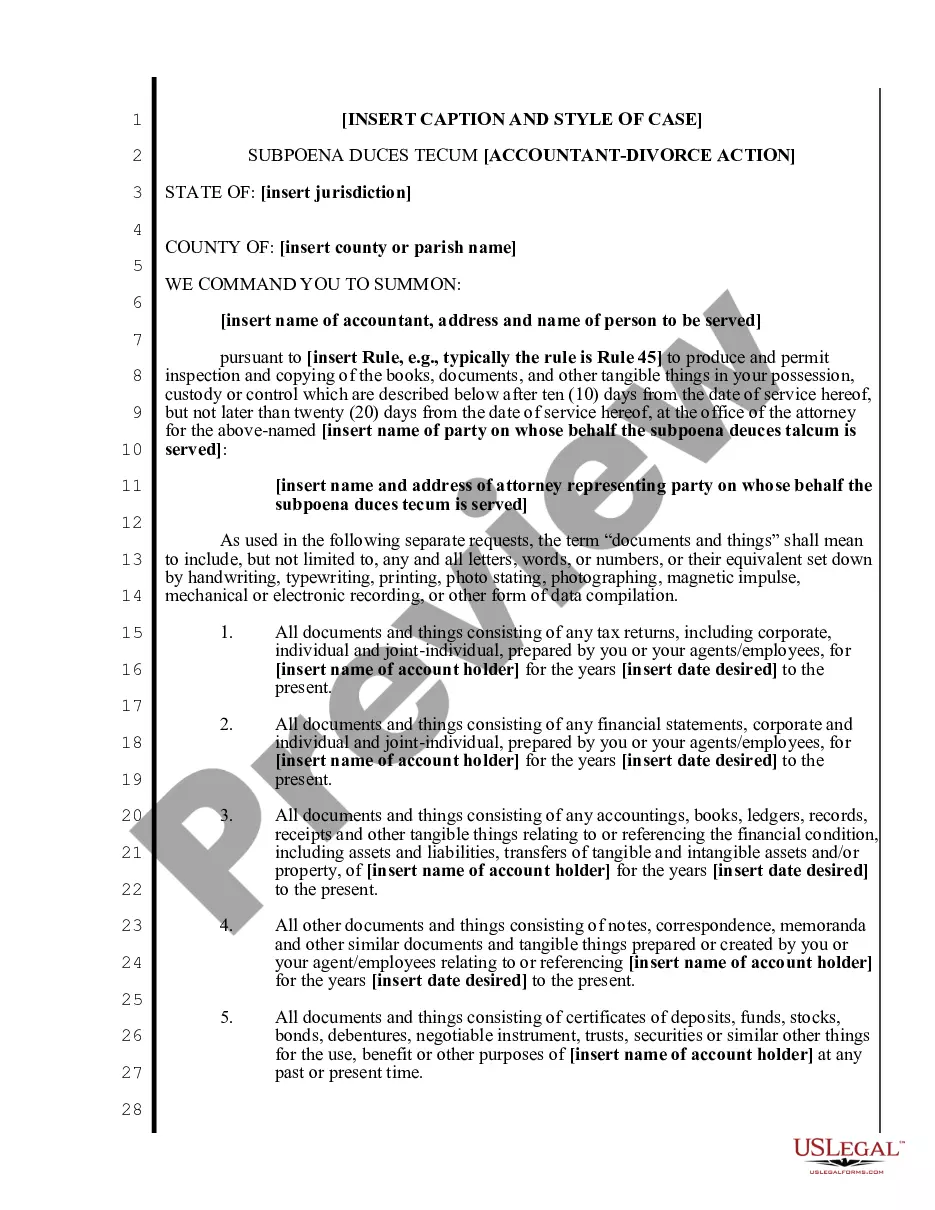

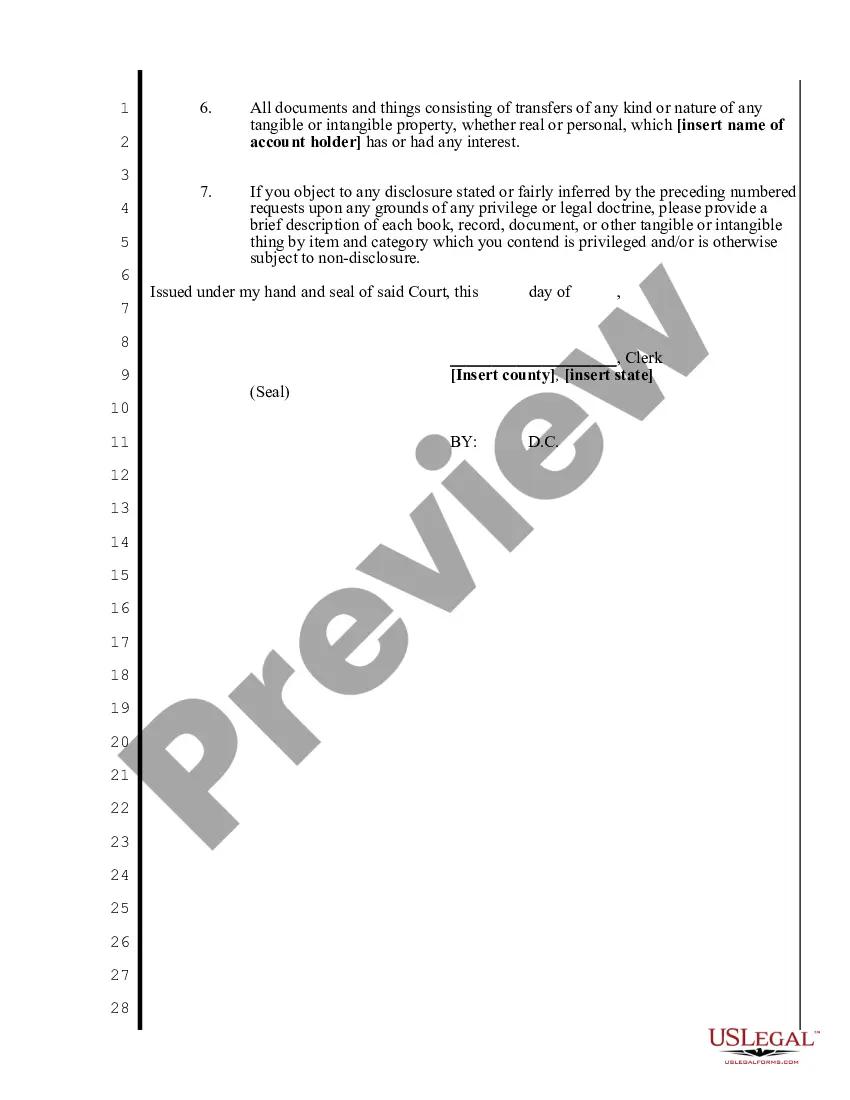

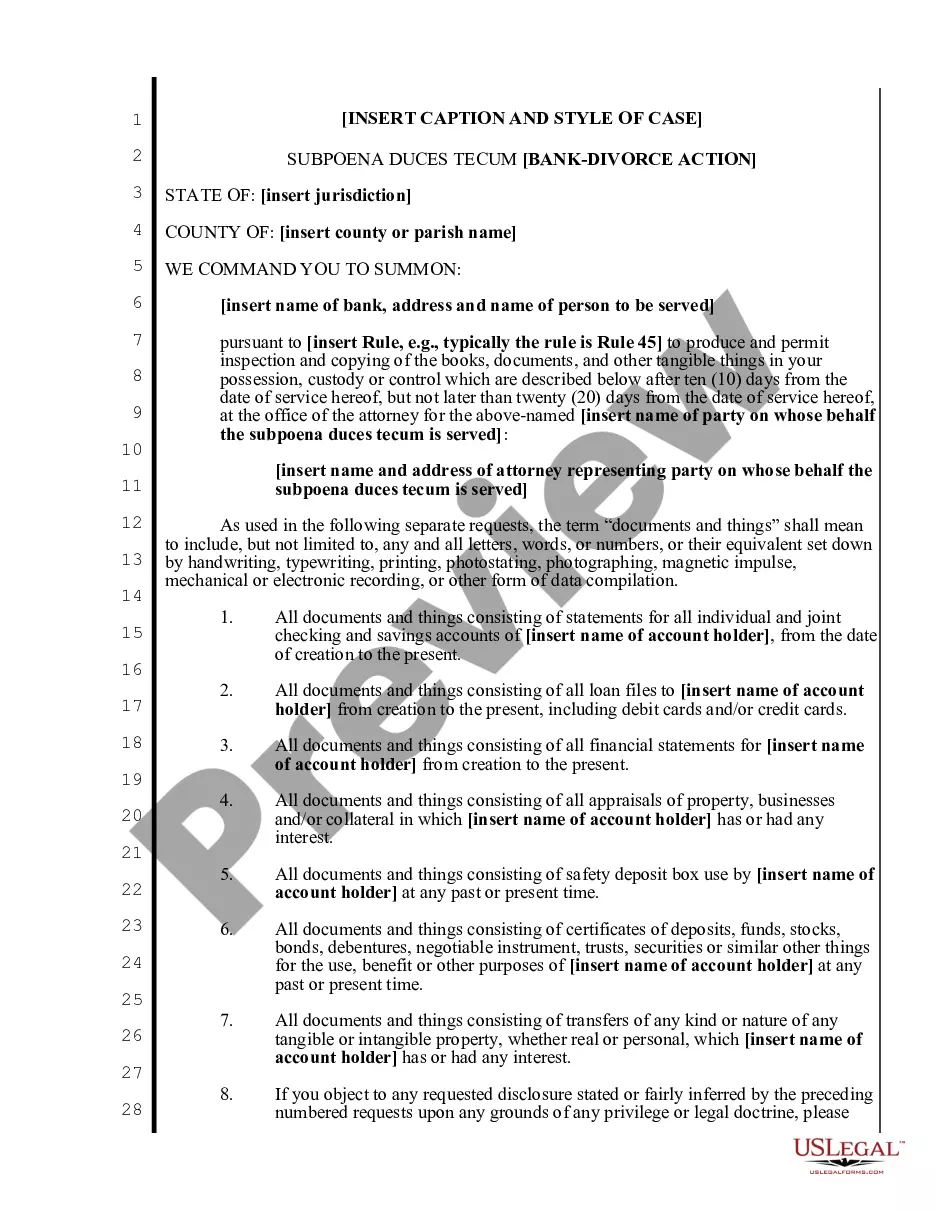

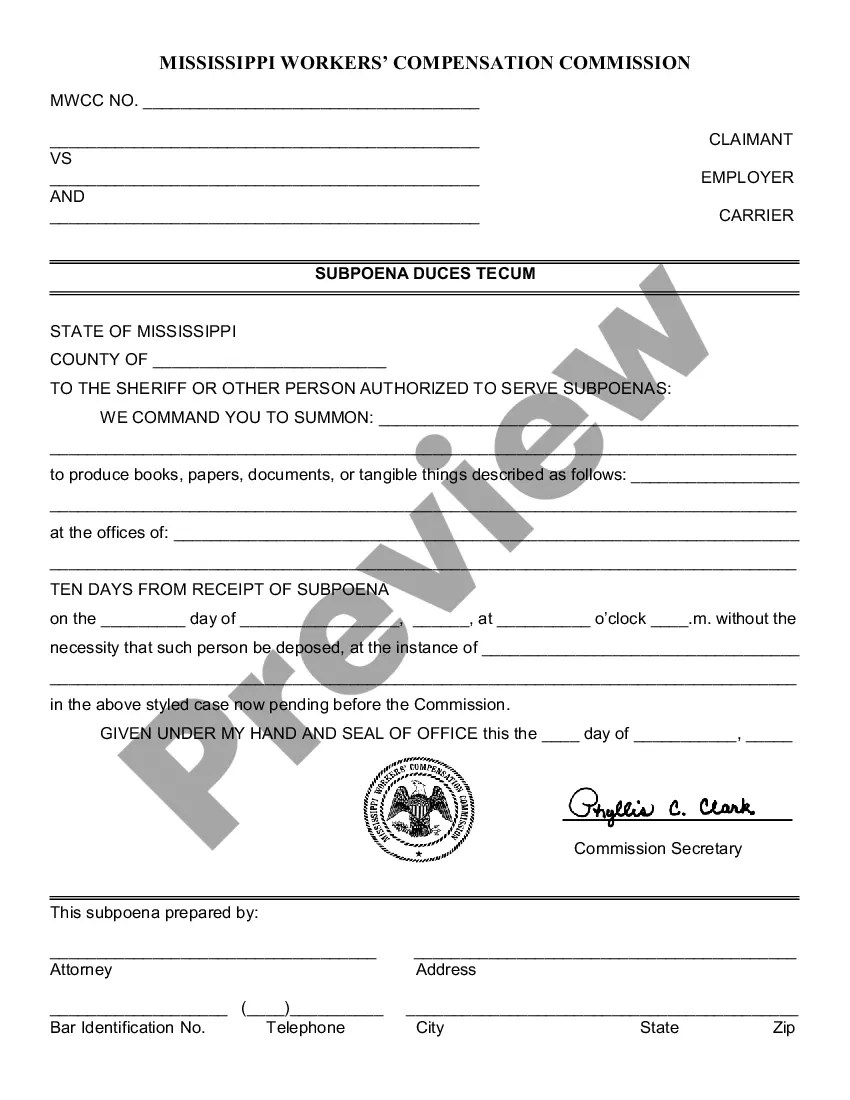

How to fill out Mississippi Subpoena Duces Tecum - Accountant - Divorce Action?

Identifying a reliable location to acquire the most up-to-date and pertinent legal examples is a significant part of navigating bureaucracy. Securing the appropriate legal documents necessitates exactness and carefulness, which is why it's essential to obtain samples of Sample Subpoena For Tax Returns With Irs solely from trustworthy sources, such as US Legal Forms. An incorrect template could squander your time and delay your current situation.

With US Legal Forms, you have minimal concerns. You can access and review all the specifics regarding the document's applicability and significance for your case and in your state or locality.

Once you have the form on your device, you can edit it with the editor or print it and complete it manually. Eliminate the hassle that comes with your legal paperwork. Explore the extensive US Legal Forms library, where you can discover legal samples, verify their relevance to your circumstances, and download them instantly.

- Utilize the catalog browsing or search option to locate your sample.

- Examine the form's description to determine if it meets the requirements of your state and area.

- View the form preview, if available, to confirm the form is indeed the one you seek.

- Return to the search to locate the appropriate template if the Sample Subpoena For Tax Returns With Irs does not fulfill your needs.

- If you are confident about the form's applicability, download it.

- As an authorized user, click Log in to verify and access your selected forms in My documents.

- If you don't have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that fits your requirements.

- Continue to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Sample Subpoena For Tax Returns With Irs.

Form popularity

FAQ

Determining if the IRS is investigating you can be challenging. Look out for unusual correspondence from them, especially notices asking for information or clarification on your tax returns. Additionally, if you receive a sample subpoena for tax returns with IRS, this is a clear indicator that they are scrutinizing your financial matters. You should consult a tax expert if you have concerns about your status.

The U.S. Supreme Court, in a unanimous opinion in Polselli v. Internal Revenue Service, ruled that the IRS was not required under the Internal Revenue Code to provide notice when seeking the records of innocent third parties.

Tax Returns Can Be Used To Help Project Likely Future Earnings (Or Losses) When it comes to proving loss of the ability to earn wages in the future, expert witnesses are sometimes required to properly prove the claim.

If you refuse or don't provide them by the IRS deadline, the IRS can summons the records directly from your bank or financial institution. You can contest the summons (called ?quashing? the summons) if you can show that the summons isn't for a legitimate purpose or that the information is irrelevant to the purpose.

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

Under California law, plaintiffs enjoy what is referred to as a ?tax return privilege.? The various statutes making it a misdemeanor for taxing authorities to disclose confidential tax return information (see e.g. Rev. & Tax. C. §§ 19542, 7056) impliedly creates this privilege.