Agent Real Estate

Description

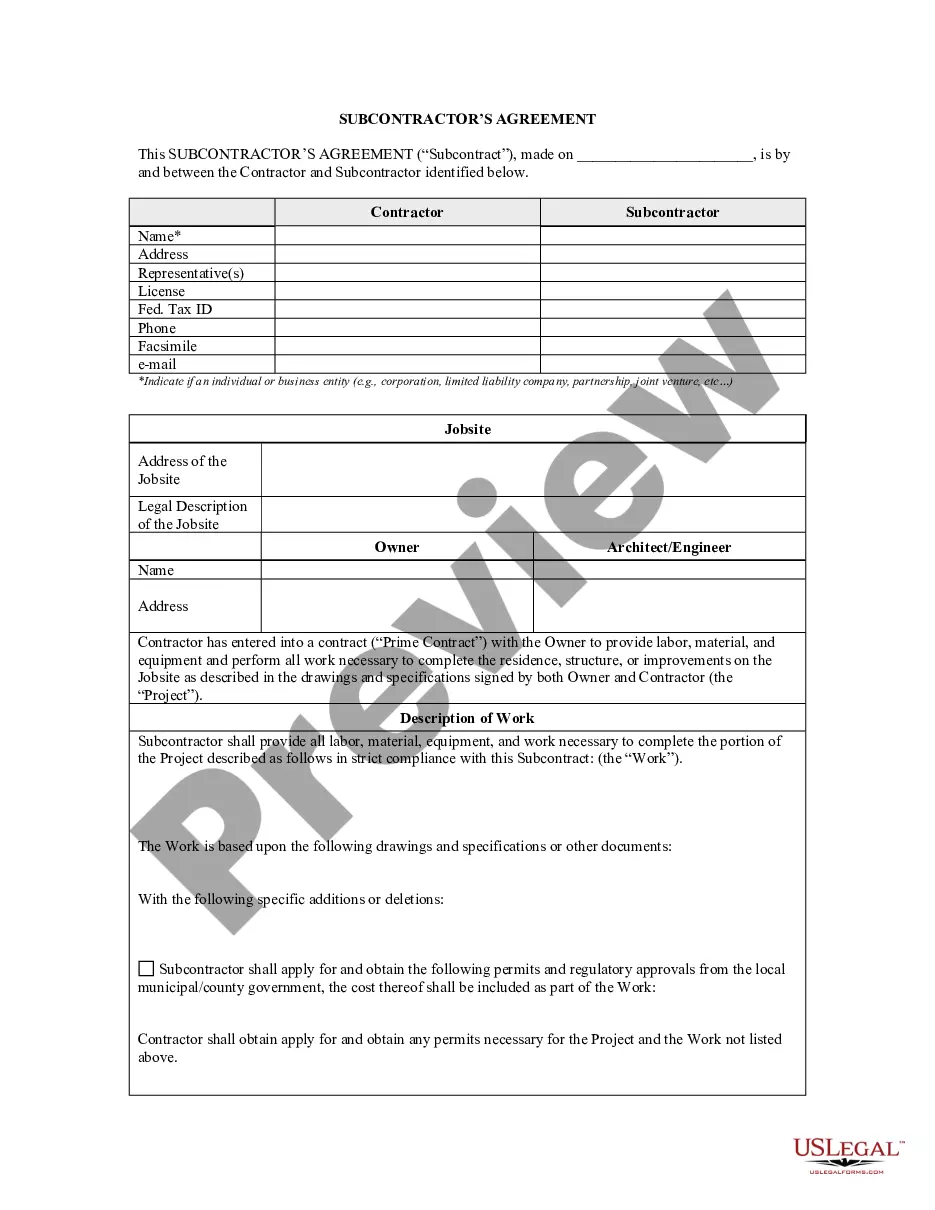

How to fill out Mississippi Reciprocal Easement And Operation Agreement?

- Log in to your account on US Legal Forms. If you’re a new user, create an account to begin.

- Explore the extensive library of over 85,000 forms. Use the search feature to find the specific document that meets your agent real estate needs.

- Review the form’s preview and description carefully to ensure it aligns with your locality's requirements.

- Once satisfied, click on the 'Buy Now' button to select a subscription plan suitable for your needs.

- Complete the purchase process by entering your payment details, either via credit card or PayPal.

- Download the form and save it to your device for immediate use, or revisit your profile anytime under 'My Forms'.

In conclusion, US Legal Forms stands out by providing an extensive library of forms that empower both individuals and attorneys to craft precise legal documents. With their added benefits of expert assistance and a robust collection, obtaining agent real estate forms has never been simpler.

Start streamlining your legal document process today by visiting US Legal Forms!

Form popularity

FAQ

Promoting yourself as an agent real estate can involve creating a strong online presence through social media and a professional website. Share valuable content that showcases your expertise, engage with clients and prospects consistently, and build a network through local events. Tools like US Legal Forms can assist by providing marketing templates and resources to enhance your promotional efforts.

When introducing yourself to an agent real estate, maintain a friendly yet professional tone. Begin with your name, followed by your role or purpose for the introduction, whether you are a client, a fellow agent, or a collaborator. A clear and confident introduction helps build rapport and sets the stage for a constructive conversation.

An effective sample introduction can be: 'Hello, my name is Your Name. I am an agent real estate with Your Company and specialize in specific areas or types of properties. With over X years of experience, I focus on providing expert guidance to help you navigate the real estate market successfully.' This format conveys professionalism and establishes your credibility.

When writing to an agent real estate, begin with a clear subject line that summarizes your request or inquiry. In the body, introduce yourself and state your purpose for contacting them, whether it's to request a showing, ask a question, or provide feedback. Keep your message concise and respectful, and ensure you include your contact information for a prompt response.

To introduce yourself as an agent real estate, start with your name and your role. Clearly state your expertise in the real estate market and provide a brief background about your experience. This introduction should also highlight the areas you specialize in, making it easier for potential clients to understand how you can assist them.

To achieve $100,000 in your first year as an agent real estate, focus on building a strong network and leveraging marketing strategies to reach potential clients. Invest time in learning about your market and developing negotiation skills. Additionally, consider utilizing tools and resources available on platforms like uslegalforms, which can streamline transactions and help you stay organized. Consistency and dedication are key to achieving this income goal.

If you are managing an estate with income-generating property, applying for an EIN may be helpful for the estate's tax purposes. An estate acts like a separate entity when it comes to taxes, which means it might require its own EIN. This application can streamline financial management for the estate. Always consider consulting a tax professional to ensure compliance with regulations.

Realtors acting as sole proprietors generally do not need an EIN, but having one can be advantageous. An EIN helps with tax filings and can simplify your bookkeeping. If you start an LLC or hire employees, you will likely need an EIN. It's a useful tool for enhancing your business's professional presence.

While it is not always mandatory for an agent real estate to have an EIN, it is beneficial. If you engage employees, operate an LLC, or prefer to keep your personal and business finances separate, obtaining an EIN is recommended. It simplifies the tax filing process and can enhance your business reputation. Evaluate your business structure to determine your needs.

Starting an LLC as an agent real estate can offer personal liability protection and potential tax benefits. An LLC separates your business assets from personal assets, which can safeguard your personal wealth. Moreover, it can enhance your professional image and credibility in the real estate market. It's important to evaluate your specific situation and consider consulting with a business advisor.