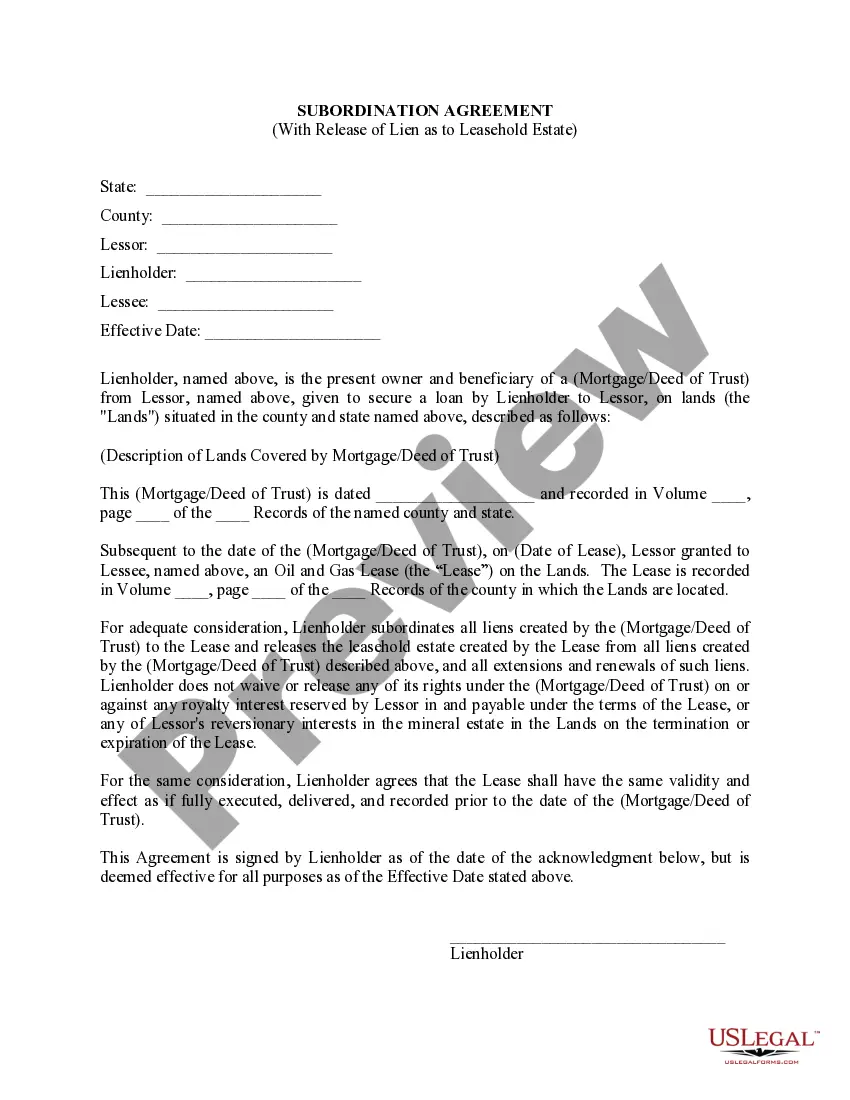

Mississippi Subordination Agreement For Heloc

Description

How to fill out Mississippi Lease Subordination Agreement?

What is the most dependable service to obtain the Mississippi Subordination Agreement For Heloc and other current versions of legal documents.

US Legal Forms is the answer! It boasts the most extensive array of legal paperwork for any purpose.

If you do not yet have an account with our resource, here are the steps to follow to create one.

- Every template is meticulously crafted and validated for conformity with federal and local regulations.

- They are organized by region and state of use, making it effortless to find what you require.

- Experienced users of the platform simply need to Log In to the system, verify if their subscription is active, and click the Download button adjacent to the Mississippi Subordination Agreement For Heloc to obtain it.

- Once saved, the document remains accessible for future reference within the My documents section of your profile.

Form popularity

FAQ

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

What is a subordination agreement? It's a contract between your first mortgage lender and your home equity lender. It allows your home equity lender to agree to remain in the second lien position on a property behind a new first lien mortgage.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

Nothing requires the heloc lender to agree to subordinate its position; it is solely the lender's choice. if the heloc lender is unwilling to subordinate, the only way to refinance would be to close out the heloc.