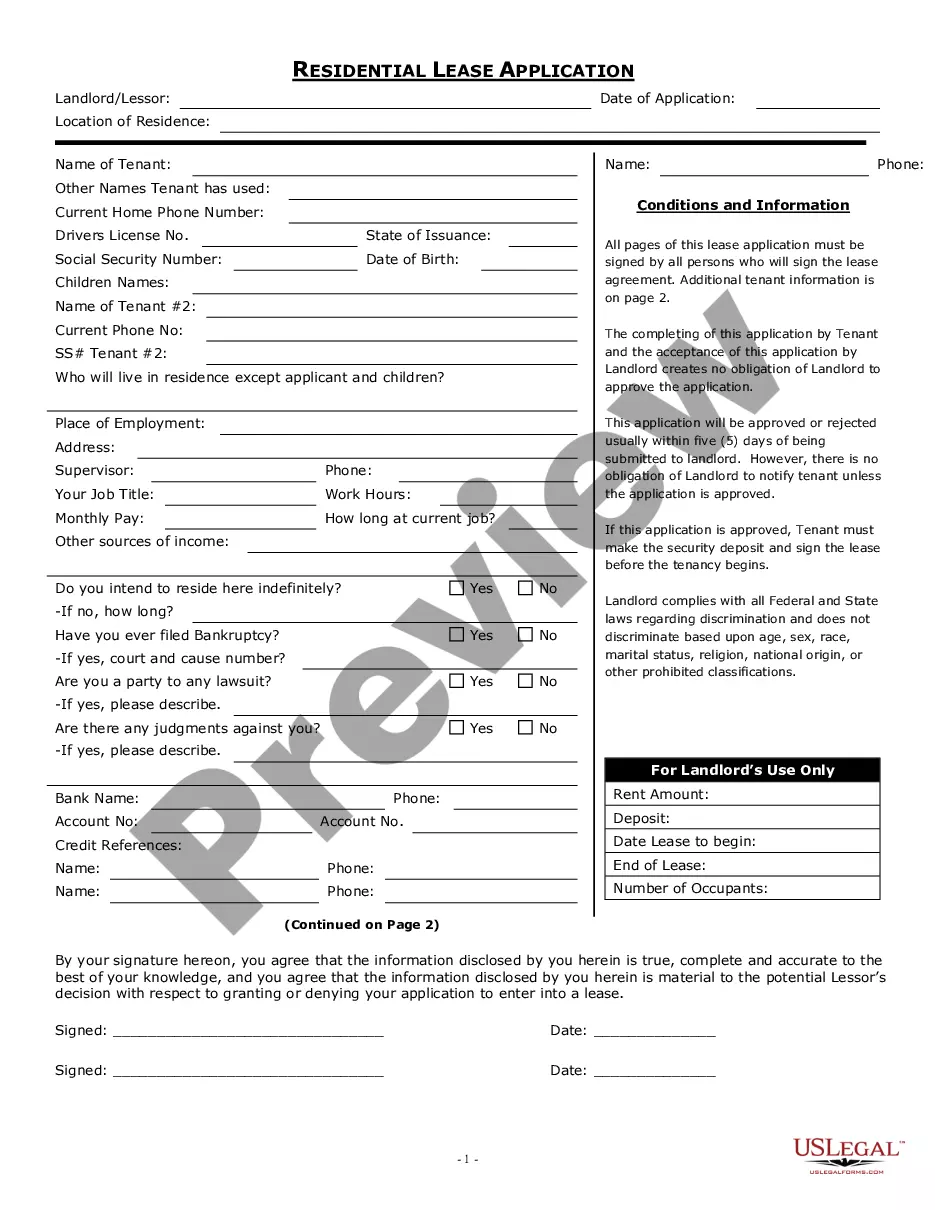

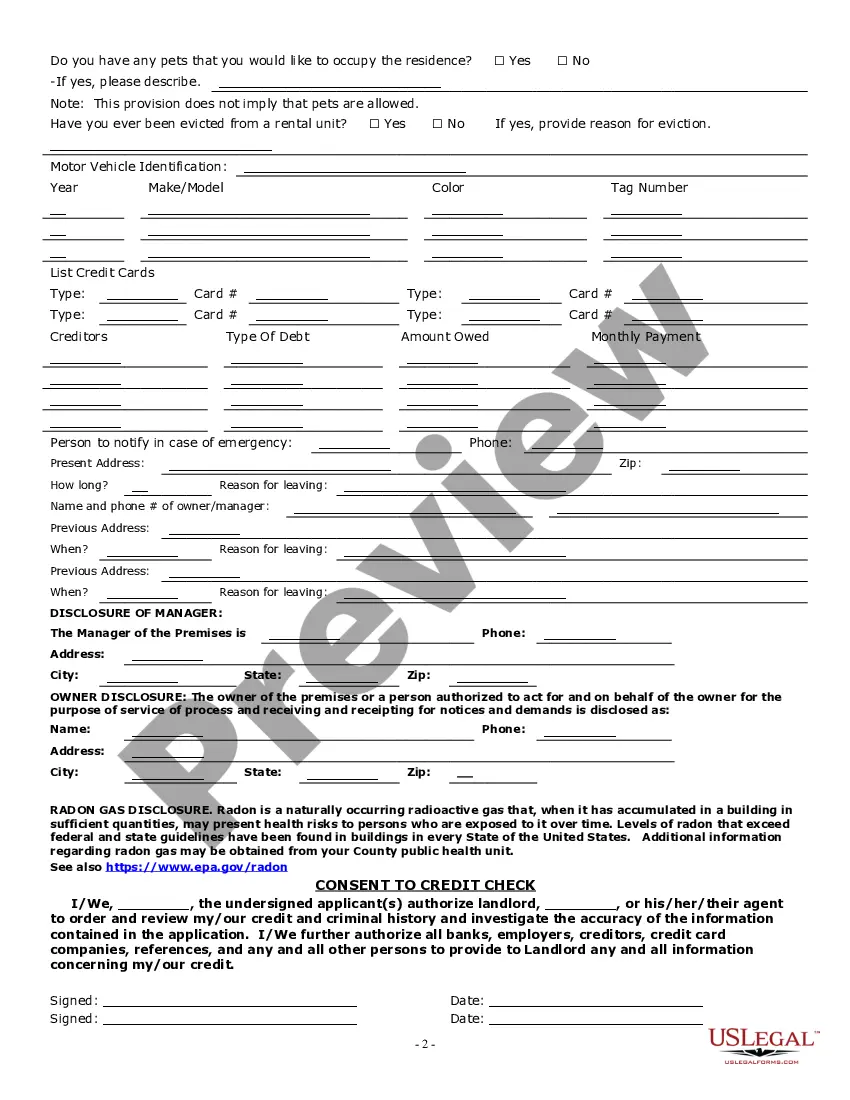

Mississippi Rental Application With Credit Check

Description

How to fill out Mississippi Rental Application With Credit Check?

There's no longer a need to spend hours searching for legal documents to comply with your local state requirements.

US Legal Forms has gathered all of them in one place and made their access simpler.

Our site provides over 85k templates for any business and personal legal situations categorized by state and usage area.

Using the Search field above to look for another template if the previous one did not meet your needs. Click Buy Now beside the template title once you find the right one. Select the preferred subscription plan and create an account or sign in. Pay for your subscription with a credit card or through PayPal to proceed. Choose the file format for your Mississippi Rental Application With Credit Check and download it to your device. Print your form to fill it out by hand or upload the sample if you wish to use an online editor. Preparing legal documents in accordance with federal and state laws and regulations is fast and simple with our library. Experience US Legal Forms today to keep your paperwork organized!

- All forms are properly drafted and validated for authenticity, ensuring you receive a current Mississippi Rental Application With Credit Check.

- If you are already accustomed to our platform and possess an account, make sure your subscription is active before downloading any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents anytime by accessing the My documents section in your profile.

- If you are new to our platform, the process requires a few additional steps to complete.

- Here's how new users can find the Mississippi Rental Application With Credit Check in our catalog.

- Carefully review the page content to confirm it includes the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

On your Mississippi rental application with credit check, credit references should include your account information with relevant banks and lenders. This could involve listing both personal and business accounts, if applicable. It's best to provide clear and precise details so landlords can easily verify your credit history. Using uslegalforms to assist with your application can guide you in providing the necessary and accurate information.

When considering what to put for credit reference on a Mississippi rental application with credit check, you should list the names, addresses, and contact information for your financial institutions. Include details from banks, credit unions, or lenders where you have accounts. This information helps landlords assess your financial stability. Be accurate and ensure that your references are willing to confirm your credit history.

For a Mississippi rental application with credit check, your credit reference should ideally be someone with whom you have had a financial relationship. This could be your bank, credit card company, or any financial institution that knows your creditworthiness. Providing a reliable credit reference demonstrates your financial responsibility. Be sure to inform this person ahead of time to ensure they are prepared to respond if contacted.

When filling out a Mississippi rental application with credit check, consider including professional references who can vouch for your reliability. Good options include current or former employers, colleagues, or landlords. Choose individuals who can speak positively about your behavior and responsibilities. Including these references enhances your credibility and increases your chances of approval.

If your credit score is too low to rent, don't lose hope. Engage in proactive discussions with potential landlords about your financial situation, emphasizing steady income and a good rental history. You can leverage platforms like uslegalforms to navigate the Mississippi rental application with credit check process effectively, helping you present your case convincingly.

When addressing poor credit with a landlord, honesty and transparency are key. Consider preparing a brief explanation, detailing the reasons for your credit issues and highlighting your current reliable income. Sharing any positive rental experiences can reinforce your credibility. Your Mississippi rental application with credit check can still succeed despite past struggles.

To secure an apartment in Mississippi, you'll typically need a completed rental application and proof of income. Landlords often require a credit check to evaluate your financial responsibility. Other common requirements include rental history, references, and suitability checks, which collectively inform the decision on your Mississippi rental application with credit check.

Renting with bad credit can be challenging but not impossible. Start by being upfront with potential landlords on your Mississippi rental application with credit check. Offer provisions like a co-signer or a higher deposit. Additionally, having stable income or recent positive rental experiences can help mitigate concerns about your credit.

Yes, you can still secure a rental even with a 500 credit score. Many landlords look at more than just your credit score when reviewing a Mississippi rental application with credit check. They may consider your income, rental history, and references. You could also provide a larger security deposit to increase your chances.

Yes, Zillow typically conducts a hard credit check for its rental applications. This is important for landlords to assess your financial responsibility. Keep in mind that a hard check can temporarily lower your credit score. If you're worried about this, you can explore your options through a Mississippi rental application with credit check to find landlords who may offer more lenient acceptance criteria.