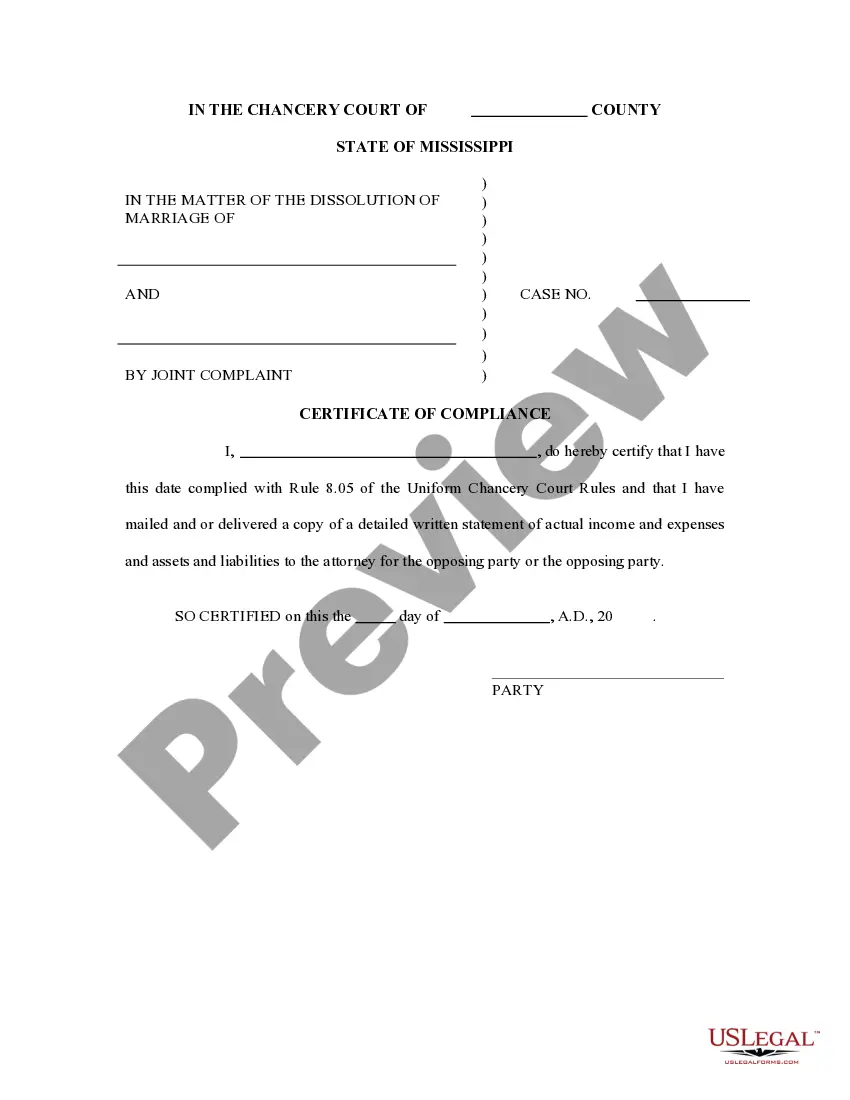

Certificate Of Compliance Sample With Mandatory Financial Disclosures

Description

How to fill out Certificate Of Compliance Sample With Mandatory Financial Disclosures?

Bureaucracy demands exactness and correctness.

If you don't regularly manage the completion of paperwork like the Certificate Of Compliance Sample With Mandatory Financial Disclosures, it may result in some misunderstandings.

Selecting the appropriate sample from the outset will ensure that your document submission will proceed smoothly and avoid any hassles of resubmitting a file or starting the same task from the beginning.

If you are not a registered user, finding the necessary sample would require a few extra steps: Use the search bar to find the template. Ensure the Certificate Of Compliance Sample With Mandatory Financial Disclosures you’ve found is suitable for your state or region. Open the preview or browse the description containing the specifics on the template's application. When the result aligns with your search, click the Buy Now button. Choose the right option from the offered pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal account. Obtain the form in the file format of your choice. Securing the correct and current samples for your paperwork takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and simplify your work with forms.

- Acquire the suitable sample for your paperwork through US Legal Forms.

- US Legal Forms constitutes the largest online forms directory that hosts over 85 thousand samples across various fields.

- You can easily find the latest and most pertinent version of the Certificate Of Compliance Sample With Mandatory Financial Disclosures by simply searching on the platform.

- Locate, store, and save templates in your profile or refer to the description to confirm that you have the right one available.

- With an account at US Legal Forms, you can effortlessly gather, keep in one place, and navigate through the templates you store for quick access.

- When on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where the record of your documents is maintained.

- Review the descriptions of the forms and save those that you need at any time.

Form popularity

FAQ

Mandatory disclosure includes information that must be provided by law, while voluntary disclosure encompasses additional details sellers might choose to share. Understanding the difference can help buyers gain a comprehensive view of the property. To facilitate this process, a Certificate of compliance sample with mandatory financial disclosures can guide sellers in meeting mandatory requirements while highlighting other relevant information.

A required disclosure is any information that the law mandates sellers share with buyers before completing a transaction. This can include details about the property’s condition, history, and any financial obligations. A thorough Certificate of compliance sample with mandatory financial disclosures helps ensure that all required disclosures are clearly documented and understood.

Mandatory disclosure refers to the legal requirement for sellers to provide specific information to prospective buyers. This includes financial disclosures, property conditions, and any potential issues that may affect the property's value. Utilizing a Certificate of compliance sample with mandatory financial disclosures ensures that sellers meet these obligations effectively.

The mandatory disclosure form serves to inform potential buyers about important aspects of the property. It ensures transparency by detailing any existing concerns or obligations related to the property. Thus, a well-prepared Certificate of compliance sample with mandatory financial disclosures can facilitate smoother transactions and foster trust between parties.

The mandatory disclosure list in Florida includes essential documents that sellers must provide to buyers. This list often contains the seller's financial disclosures, governing documents, and information regarding any past claims or disputes. Having a Certificate of compliance sample with mandatory financial disclosures can help both buyers and sellers understand their rights and responsibilities during a real estate transaction.

In Colorado, mandatory financial disclosures include aspects such as balance sheets, income statements, and notes to financial statements. These disclosures provide a comprehensive view of a company's financial standing and are required for compliance with state laws. A useful resource for understanding these requirements is a certificate of compliance sample with mandatory financial disclosures, available on platforms like UsLegalForms.

Rule 16.2 mandates certain disclosures that companies in Colorado must adhere to, ensuring that investors receive all necessary financial information. This rule emphasizes the importance of transparency in reporting, allowing for informed decision-making. Reviewing a certificate of compliance sample with mandatory financial disclosures can streamline the process of adhering to Rule 16.2.

A financial disclosure requirement refers to a legal and regulatory obligation for companies to provide essential financial information. This requirement ensures that stakeholders have access to pertinent data regarding a company's financial health and performance. A certificate of compliance sample with mandatory financial disclosures can assist organizations in understanding and fulfilling these critical requirements.

Colorado has specific disclosure laws that govern businesses regarding financial and operational transparency. These laws require companies to provide accurate information to stakeholders and regulatory bodies, which promotes trust and accountability. To navigate these regulations, you can refer to a certificate of compliance sample with mandatory financial disclosures for guidance on what must be disclosed.