Sample Response To Form Interrogatories

Description

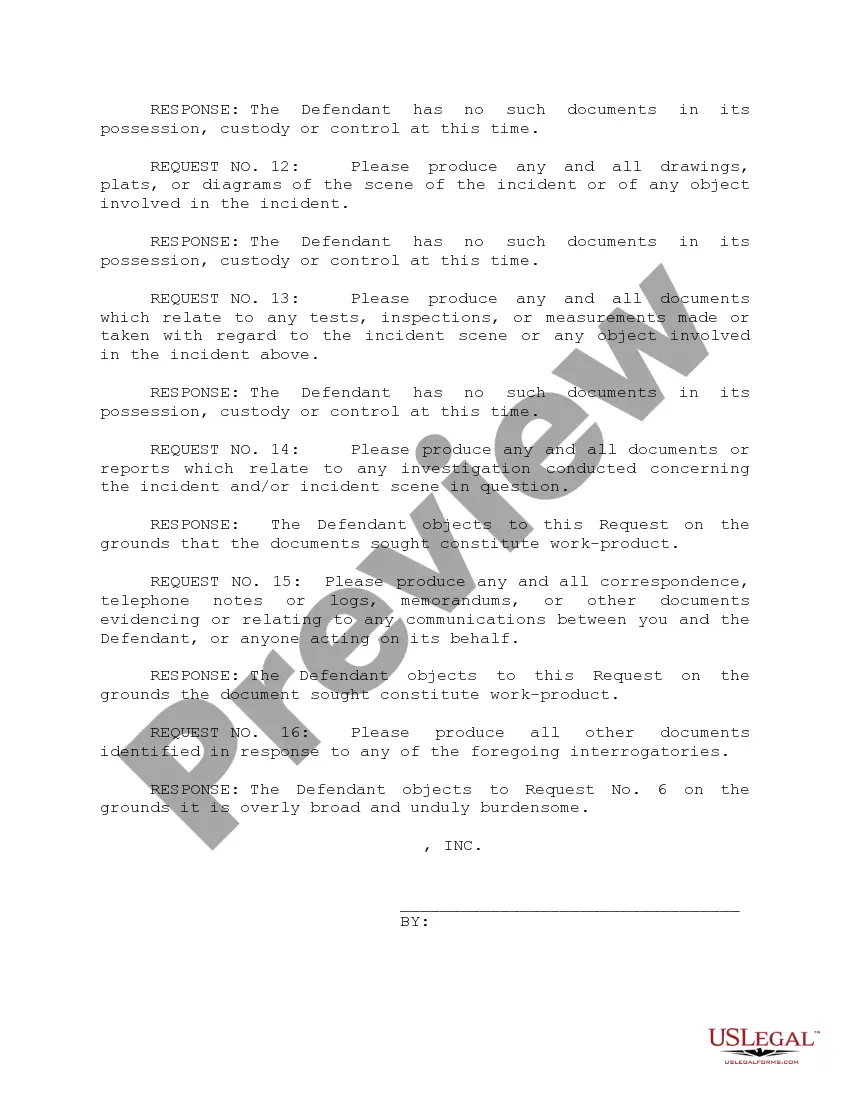

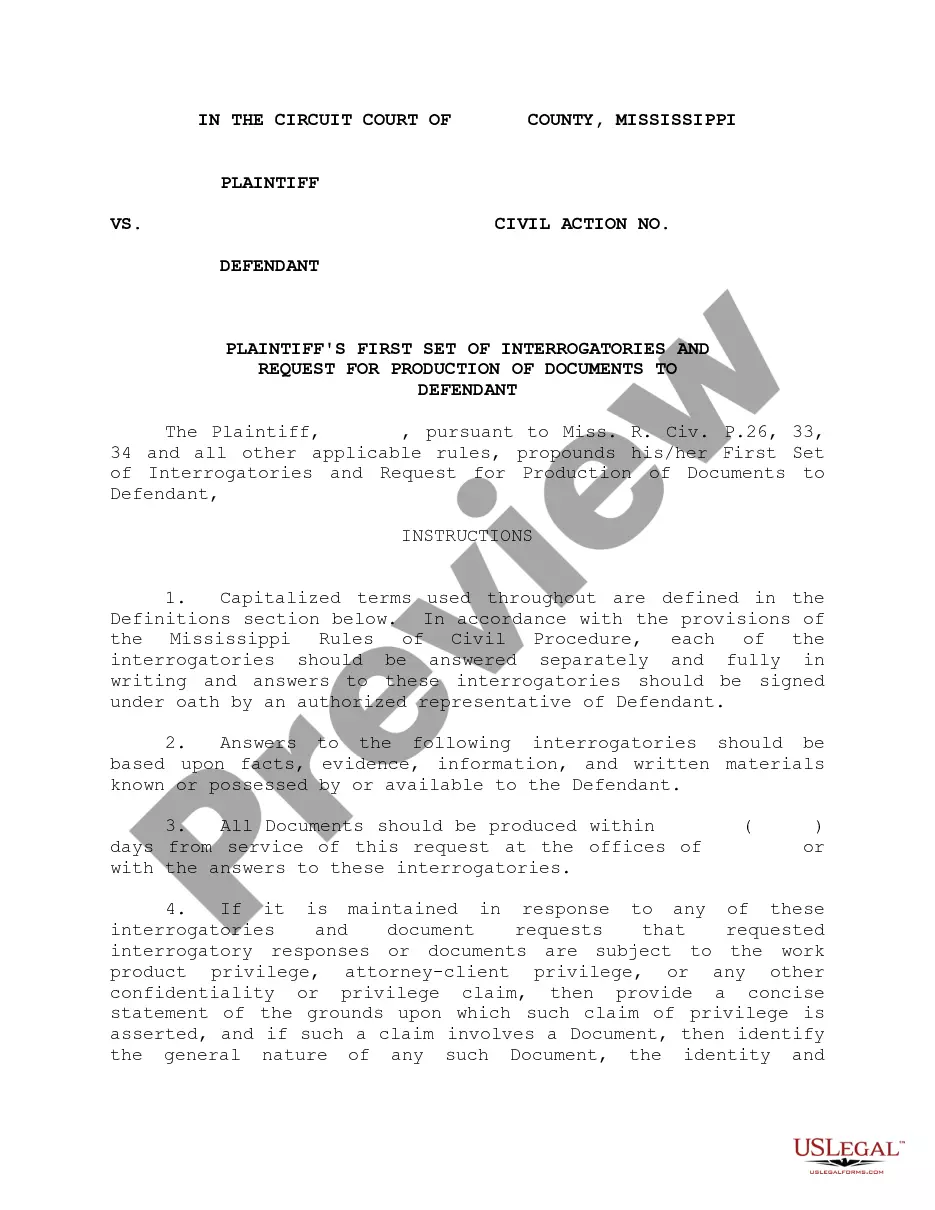

How to fill out Mississippi Defendant's Answers To Plaintiff's First Set Of Interrogatories And Requests For Production Of Documents?

It’s apparent that you cannot become a legal expert instantly, nor can you comprehend how to swiftly prepare a Sample Response To Form Interrogatories without possessing a specialized skill set.

Drafting legal documents is a lengthy undertaking necessitating specific education and expertise. Thus, why not entrust the crafting of the Sample Response To Form Interrogatories to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can access a range of materials from court documents to templates for office correspondence. We understand the significance of compliance and adherence to federal and state regulations. Therefore, on our website, all templates are location-specific and current.

You can regain access to your documents from the My documents tab at any time. If you’re an existing customer, you can easily Log In, and find and download the template from the same section.

Regardless of the purpose of your forms—be it financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the form you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if the Sample Response To Form Interrogatories is what you are looking for.

- Restart your search if you require another template.

- Sign up for a free account and choose a subscription plan to acquire the template.

- Select Buy now. Once your payment is complete, you will receive the Sample Response To Form Interrogatories, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

It's common to encounter questions you may not know the answer to when dealing with form interrogatories. In such cases, it's best to state that you do not have that information readily available. You can also consider consulting legal resources or professionals for assistance, as they can help you formulate an appropriate response. Utilizing a sample response to form interrogatories can also provide insight on how to handle these situations.

The cost to register for an Arkansas sales tax permit is $50 for in-state businesses; there is no application fee for remote sellers.

File Your Business Taxes Businesses that operate within Arkansas are required to register for one or more tax-specific identification numbers, licenses or permits, including income tax withholding, sales and use tax (seller's permit), and unemployment insurance tax.

Businesses that sell or lease goods or taxable services in Arkansas will require a state sales tax permit. This permit, sometimes colloquially referred to as a seller's permit registers businesses to collect sales and use tax on any tangible products or taxable services they are selling or leasing.

You will need to determine which permit is the best choice for your business. How Much Does a Sales Tax Permit in Arkansas Cost? There is no fee when applying for the remote seller permit in Arkansas. There will be a $50 fee to apply for the in-state permit with the state of Arkansas.

Here's an overview of the key steps you'll need to take to start your own business in Arkansas. Choose a Business Idea. ... Decide on a Legal Structure. ... Choose a Name. ... Create Your Business Entity. ... Apply for Arkansas Licenses and Permits. ... Pick a Business Location and Check Zoning. ... File and Report Taxes. ... Obtain Insurance.

Tax-exempt customers Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

ARKANSAS SALES TAX NEXUS: You will have to comply with the state of Arkansas's individual sales tax laws and apply for a seller's permit if: The business's primary location (online store, storefront, office etc.) where it conducts operations is located within Arkansas.

The Arkansas Department of Finance and Administration will issue a sales and use tax permit number to your business. It is not the same number as the Employer Identification Number). To apply for a permit, submit an application along with a $50 nonrefundable fee.