Ms Employee Salaries

Description

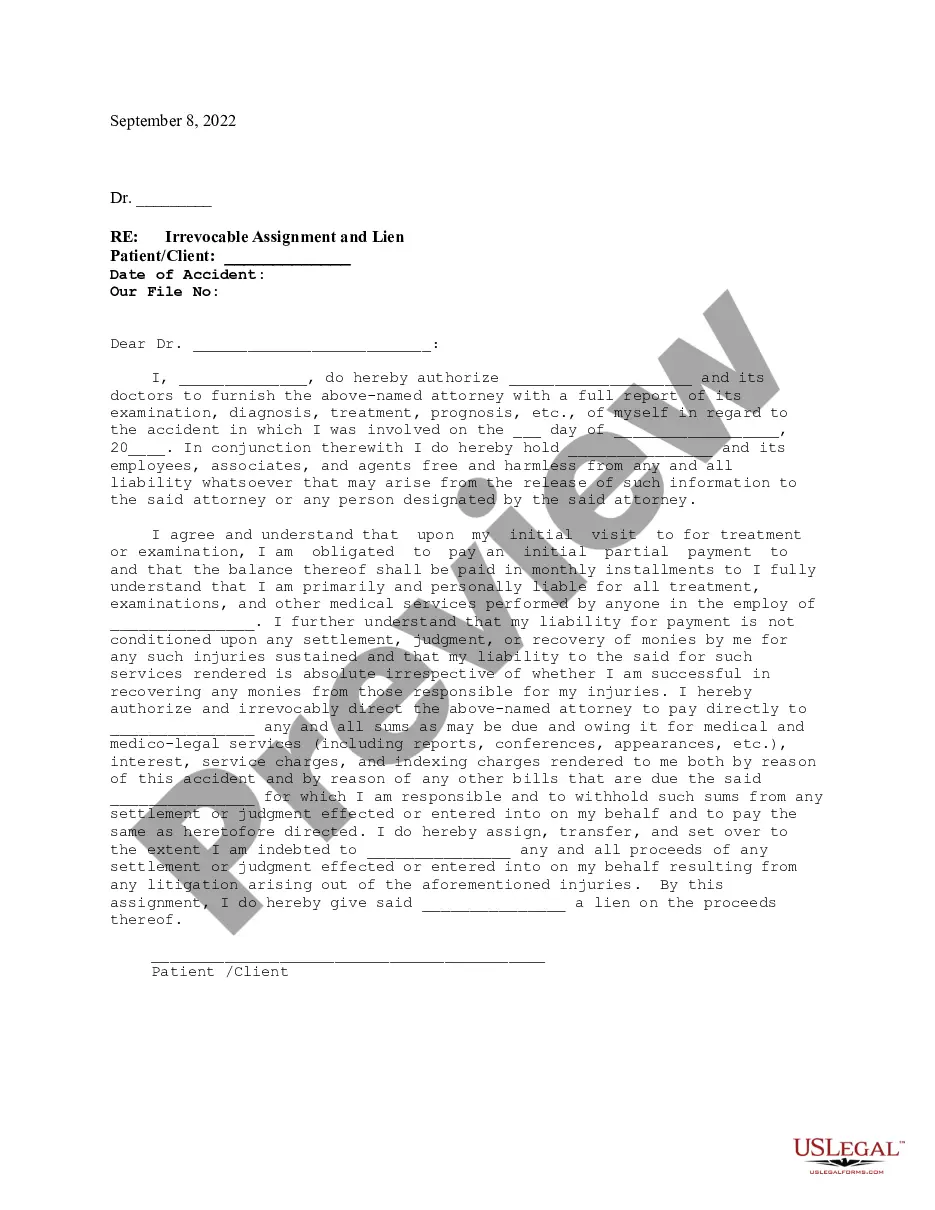

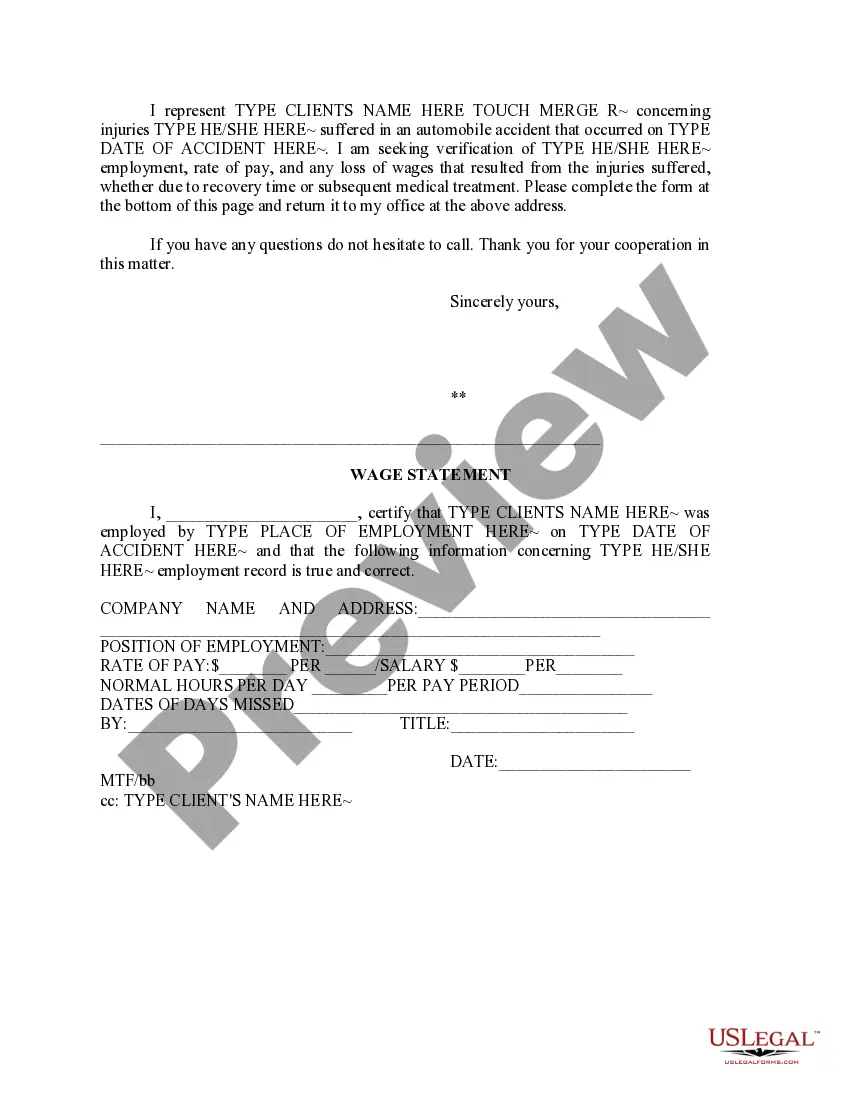

How to fill out Mississippi Letter Regarding Wage Statement?

Creating legal documents from the ground up can occasionally feel overwhelming.

Certain situations may require extensive research and considerable financial resources.

If you are looking for an easier and more economical method to produce Ms Employee Salaries or any other documents without unnecessary complications, US Legal Forms is readily available for you.

Our online repository of more than 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can quickly obtain forms specific to your state and county, expertly assembled by our legal professionals.

Ensure that the template you select meets the standards of your state and county. Choose the appropriate subscription option for acquiring the Ms Employee Salaries. Download the document, then complete, sign, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make completing forms a straightforward and efficient process!

- Use our platform whenever you need a dependable service that allows you to effortlessly find and download the Ms Employee Salaries.

- If you are familiar with our services and have created an account with us before, simply Log In to your account, select the template, and download it immediately or retrieve it later under the My documents section.

- Don’t have an account? That's fine. Setting it up takes minimal time, and you can browse the catalog.

- However, before proceeding to download Ms Employee Salaries, please adhere to these suggestions.

- Review the document preview and descriptions to ensure you are selecting the correct document.

Form popularity

FAQ

An L6 employee at Microsoft typically earns a competitive salary reflective of their expertise and contributions. These Ms employee salaries can vary based on location and specific job functions, but they usually come with bonuses and stock options. Such compensation is designed to reward skills and performance, ensuring employees feel valued in a thriving corporate environment.

Mississippi Median Household Income You will be taxed 3% on any earnings between $4,000 and $5,000, 4% on the next $5,000 (up to $10,000) and 5% on income over $10,000. Income below $4,000 is not taxed at the state level.

Every employer engaged in business, licensed to do business, or transacts business in Mississippi or who pays wages to a Mississippi resident (regardless of where the services are performed), or pays wages to a non-resident (persons domiciled outside of Mississippi ) for services performed in Mississippi must register ...

Mississippi has a progressive state income tax system with rates that range from 3.0% to 5.0%. The state also assesses a 1% tax on all taxable income, which is deductible on federal returns.

Withholding Formula (Effective Pay Period 03, 2019) If the Amount of Taxable Income Is:The Amount of Mississippi Tax Withholding Should Be:Over $5,000 but not over $10,000$90.00 plus 4.00% of excess over $5,000Over $10,000$290.00 plus 5.00% of excess over $10,0002 more rows ?

Step-by-Step Guide to Running Payroll in Mississippi Step 1: Set up your business as an employer. ... Step 2: Register your business with the State of Mississippi. ... Step 3: Create your payroll process. ... Step 4: Have employees fill out relevant forms. ... Step 5: Review and approve time sheets.