Rule 8 05 Financial Statement Mississippi Withholding Tax

State:

Mississippi

Control #:

MS-61758

Format:

Word

Instant download

Description

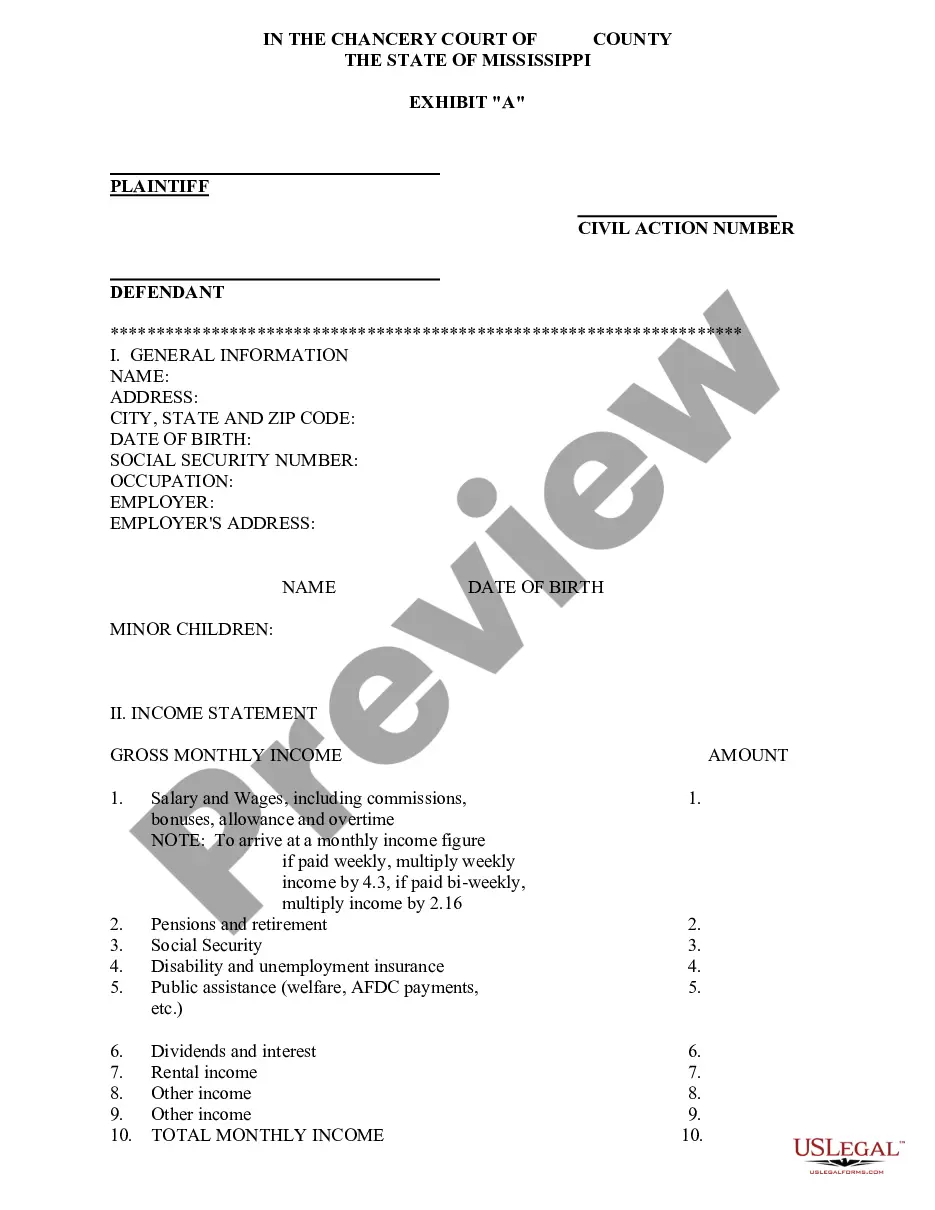

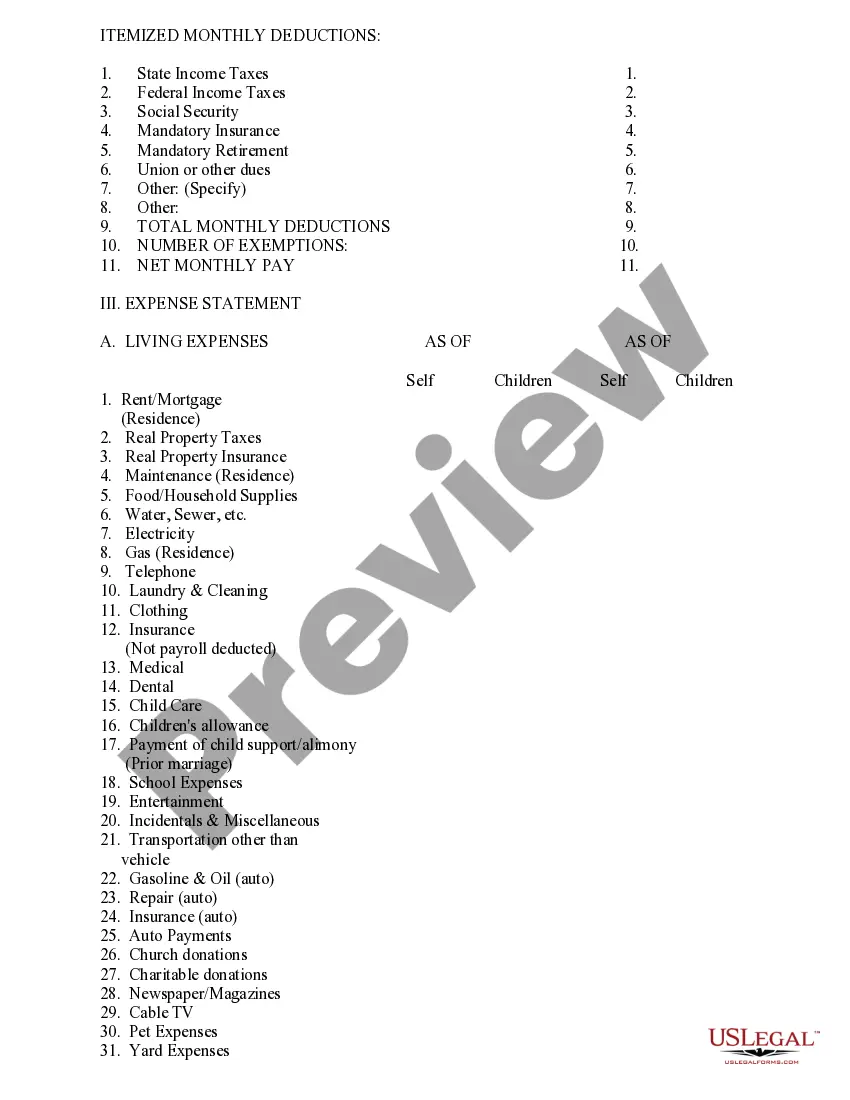

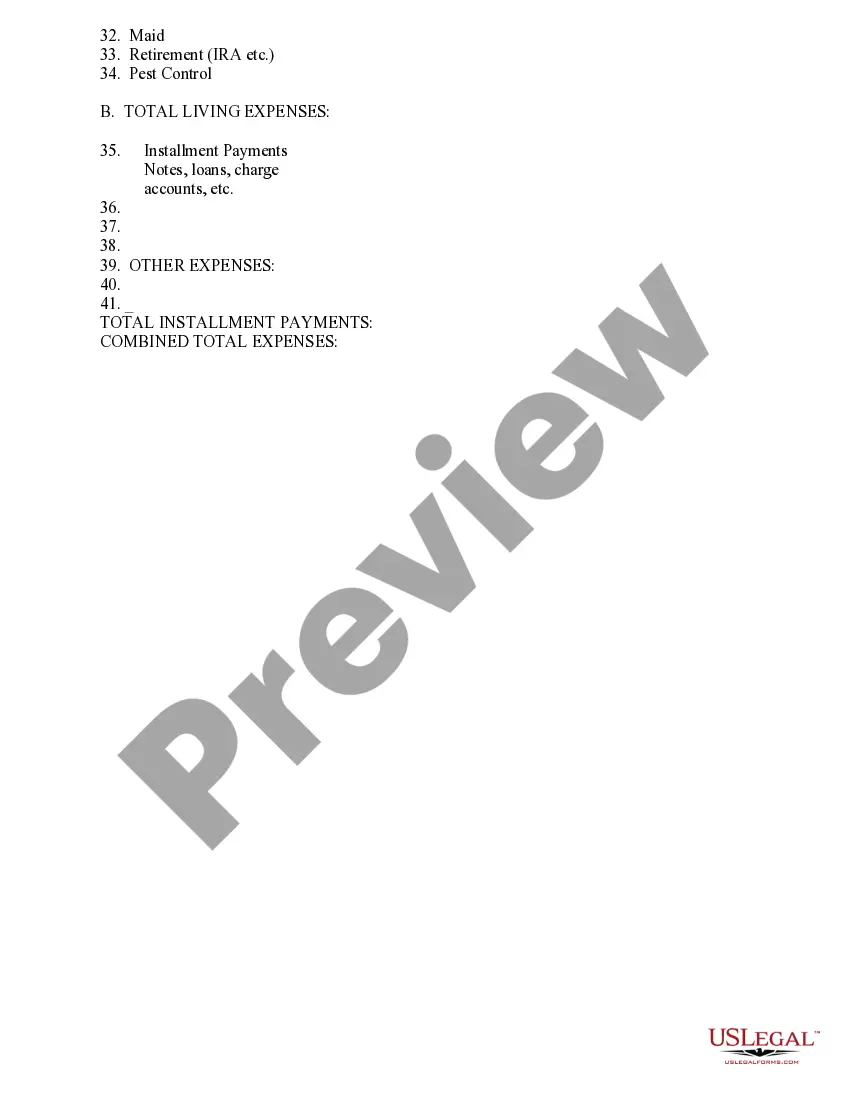

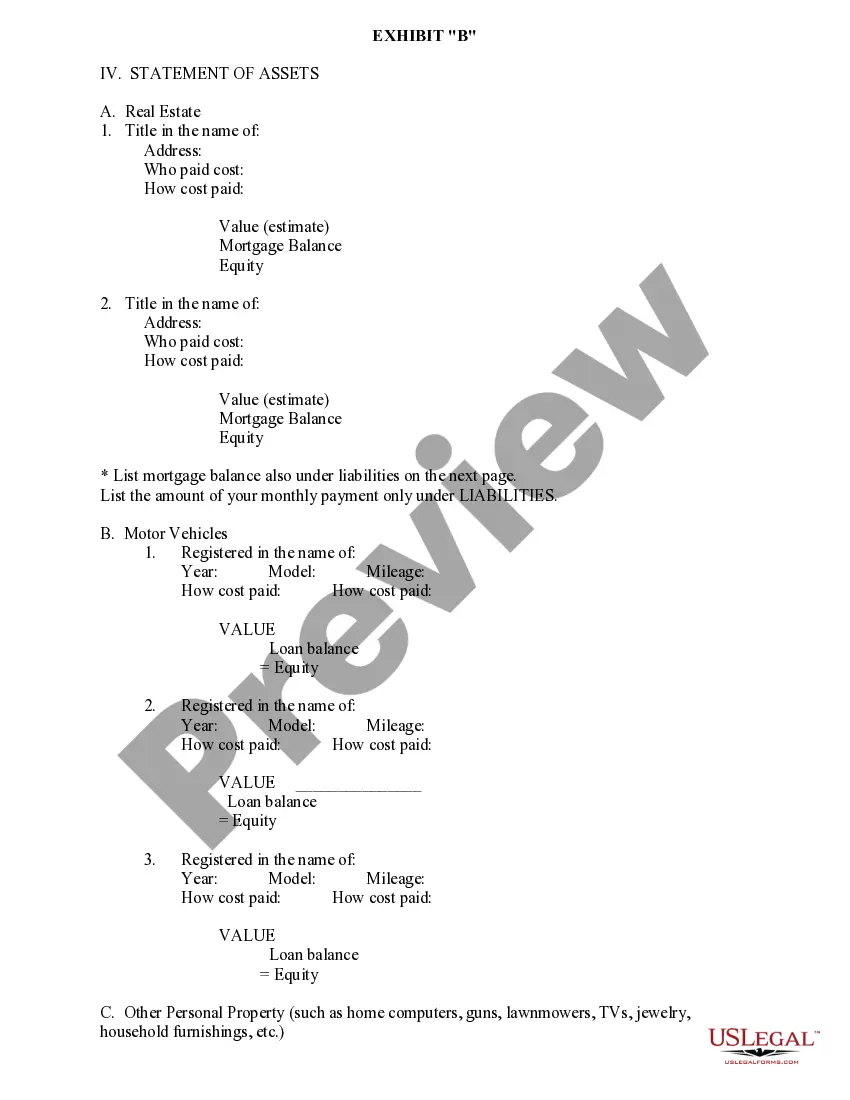

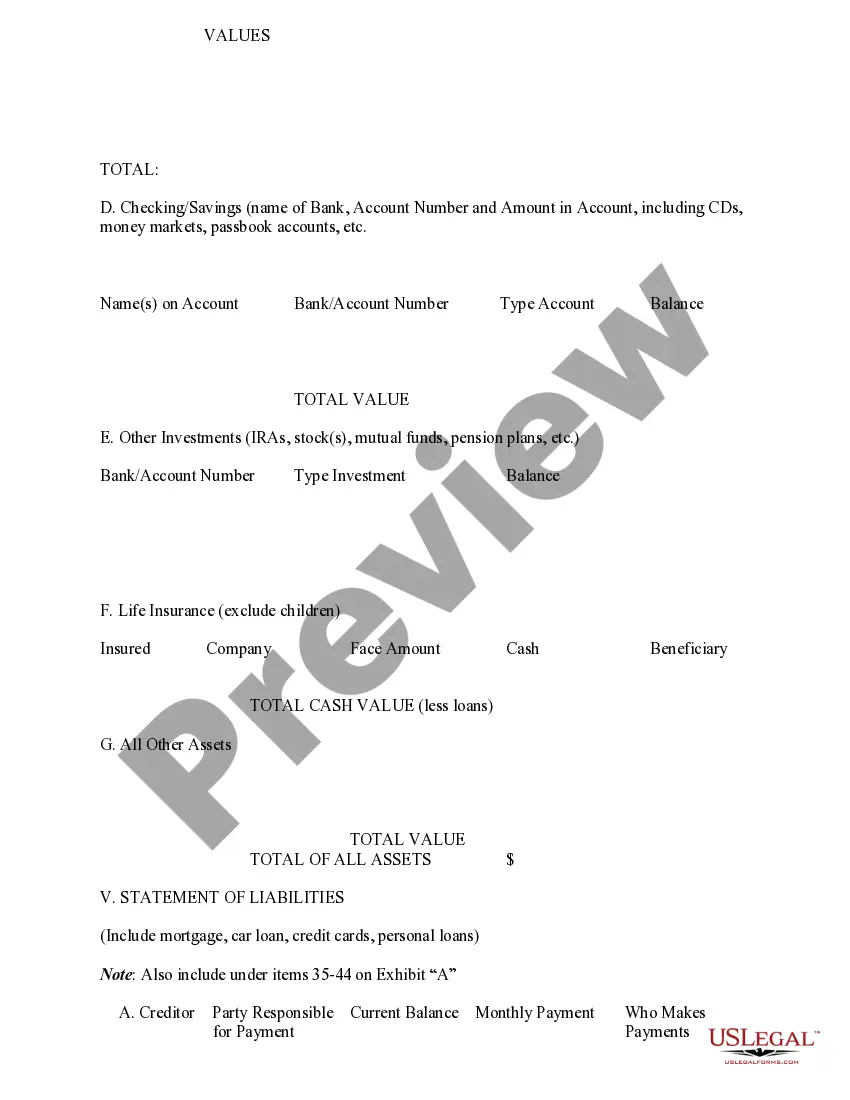

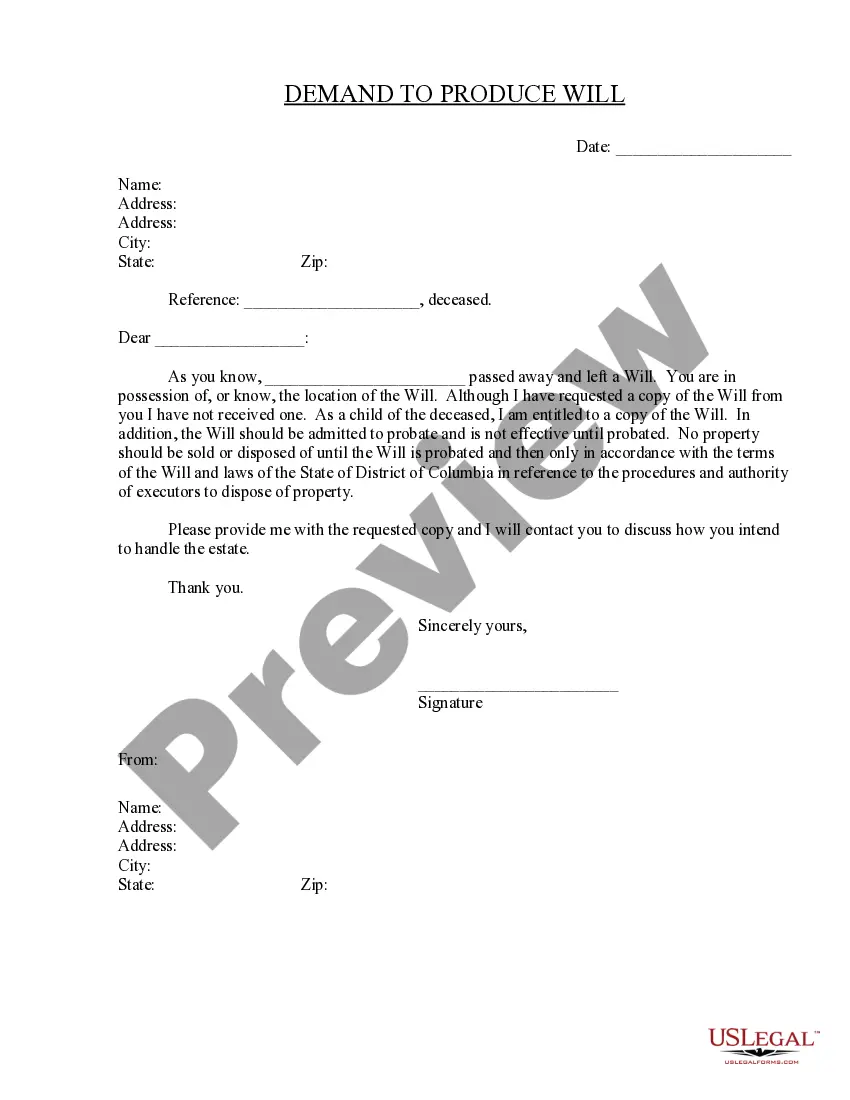

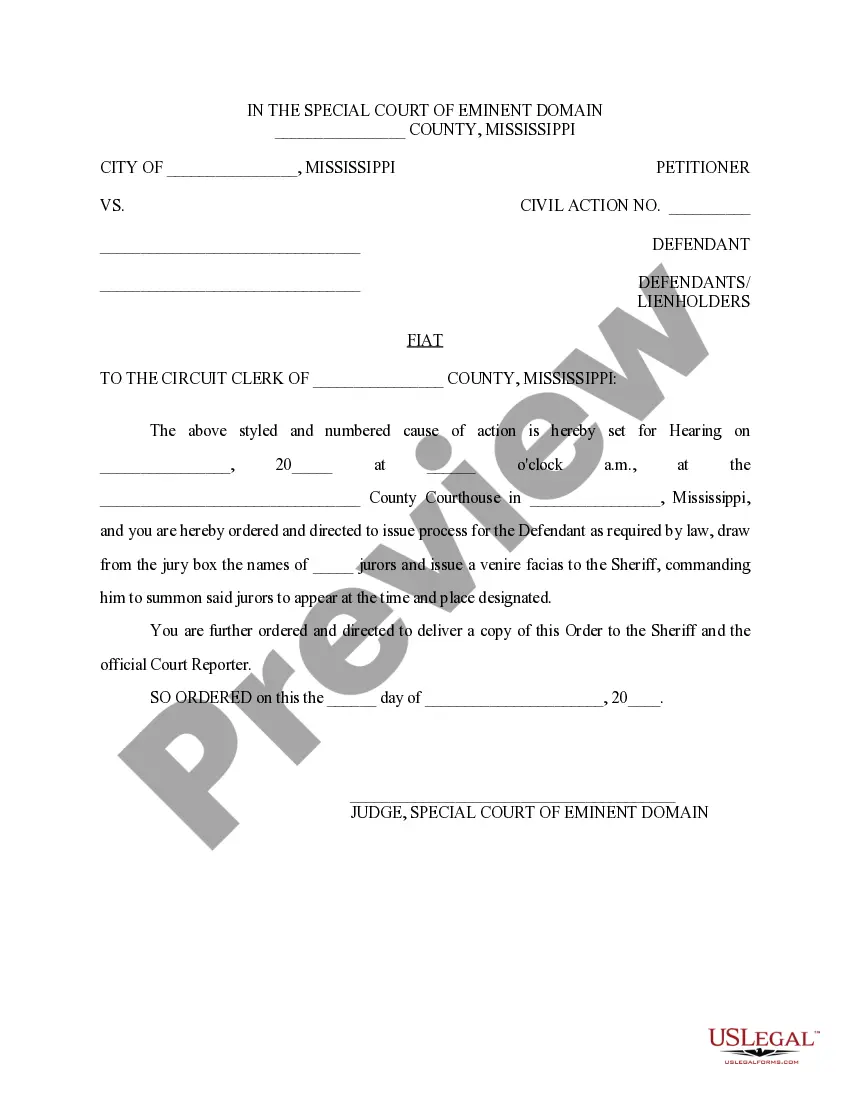

The Rule 8 05 financial statement for Mississippi withholding tax is a vital legal document that assists users in accurately disclosing their financial situation during court proceedings. This form requires detailed information concerning the individual's general information, income statement, expense statement, statement of assets, and statement of liabilities. Key features of this form include line items for monthly income sources, itemized monthly deductions, a comprehensive breakdown of living expenses, and assets, facilitating a full financial overview. Users can fill out their gross monthly income by providing figures for various income types and calculate their net monthly pay. Additionally, the form requires items related to total living expenses and liabilities to ensure full transparency in financial disclosures. Target users such as attorneys, partners, and legal assistants will find this form indispensable for preparing financial statements for clients, aiding in negotiations or litigation that involve financial matters. Proper filling and editing instructions emphasize accuracy and completeness, which are crucial for submissions to the court. Overall, this financial statement serves as an essential tool for individuals navigating legal processes that require financial clarity.

Free preview

How to fill out Mississippi Financial Statement Required By Rule 8.05?

The Rule 8 05 Financial Statement Mississippi Withholding Tax displayed on this page is a reusable official template crafted by expert attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal event. It’s the quickest, simplest, and most dependable method to acquire the documentation you require, as the service ensures the utmost level of data protection and anti-malware security.

Subscribe to US Legal Forms to have validated legal templates for all of life’s situations readily available.

- Explore the document you need and assess it.

- Examine the sample you searched and preview it or verify the form description to ensure it meets your needs. If it does not, utilize the search feature to locate the suitable one. Click Buy Now once you have identified the template you seek.

- Register and Log In.

- Select the pricing plan that fits you and establish an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Select the format you desire for your Rule 8 05 Financial Statement Mississippi Withholding Tax (PDF, Word, RTF) and download the document onto your device.

- Complete and endorse the document.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Re-download your paperwork as needed.

- Use the same document again at any time. Access the My documents tab in your profile to re-download any previously saved forms.