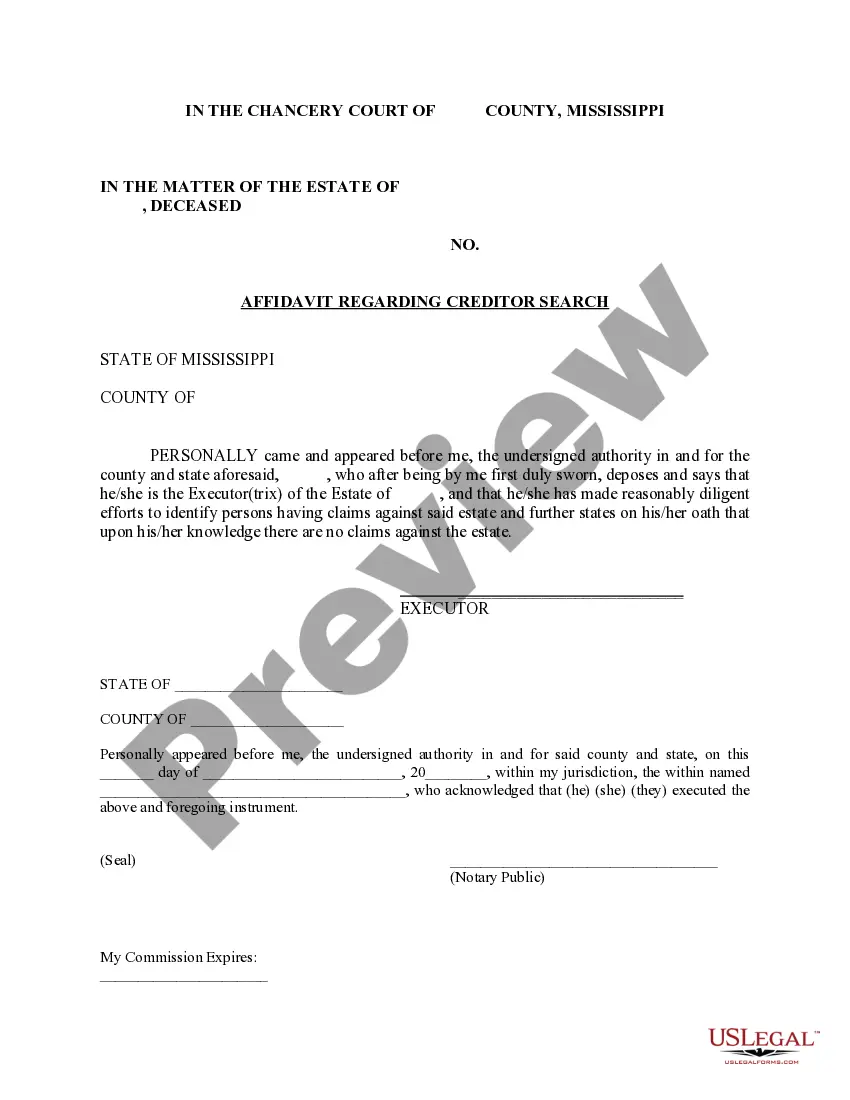

Creditor Search Form

Description

How to fill out Creditor Search Form?

Whether you handle documents frequently or need to send a legal document from time to time, it is essential to have a valuable resource that contains all the related and current samples.

The first step with a Creditor Search Form is to ensure it is the latest version, as this determines its eligibility for submission.

If you wish to simplify your search for the most recent document samples, look for them on US Legal Forms.

Use the search menu to locate the form you need. Review the Creditor Search Form preview and summary to confirm it is the one you're interested in. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Input your credit card details or PayPal account information to finalize the transaction. Select the file format for download and verify it. Say goodbye to the confusion of managing legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal forms featuring nearly every document sample you might need.

- Look for the templates you need, assess their relevance immediately, and learn more about their usage.

- With US Legal Forms, you have access to over 85,000 document templates across various fields.

- Obtain the Creditor Search Form samples in just a few clicks and store them anytime in your account.

- Having a US Legal Forms account will provide you with all the samples you need with added convenience and less hassle.

- Simply click Log In in the website header and navigate to the My documents section for easy access to all the forms you require, saving you time in locating the right template or checking its applicability.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

Forgetting to list a creditor can create challenges during bankruptcy proceedings, as those debts may not be discharged. Additionally, the omitted creditor may still pursue collection actions against you. To avoid this, using a creditor search form allows for thorough preparation and helps identify all creditors. US Legal Forms can assist in reviewing your filings to ensure all information is complete and accurate.

If a creditor is not listed in a Chapter 11 filing, they will generally be barred from participating in the bankruptcy process. This could affect your ability to discharge debts owed to that creditor in the future. Therefore, using a creditor search form is crucial for ensuring all debts are accounted for. US Legal Forms offers tools that help you create comprehensive bankruptcy filings that include all necessary creditor information.

Creditors can and do object to Chapter 7 bankruptcy filings, particularly if they suspect fraud or misuse of the bankruptcy process. They may file a complaint to challenge the discharge of their debts. Understanding your creditor list through a creditor search form can prepare you for such objections. US Legal Forms provides valuable resources that guide you through the complexities of Chapter 7 and how to respond to creditor challenges.

Filling out a proof of claim involves providing essential information about the debt you are owed. Typically, this includes the creditor's name, the amount owed, and any supporting documentation. A creditor search form can help identify all relevant creditors, ensuring you submit claims for each one correctly. Resources like US Legal Forms offer templates to simplify the process and ensure accuracy.

To obtain a list of all your creditors, start by reviewing your financial statements and credit reports. A creditor search form can streamline this process, allowing you to gather necessary details quickly. Additionally, you can contact individual creditors directly to ensure you have a complete overview of your obligations. Using services like US Legal Forms can help you create the right documents to assist in the creditor search.

If a creditor is not listed in Chapter 7 bankruptcy filings, they may not be able to collect on that debt following the bankruptcy discharge. It’s crucial to ensure all creditors are included when submitting your bankruptcy documents, and using a creditor search form can help in this complete identification process. Unlisted creditors may retain the right to pursue collection actions, which could complicate your financial situation. Therefore, thoroughness in the list of creditors is key to achieving your debt relief goals.

To make a list of creditors, begin by listing all of your debts and then identifying the creditors associated with them. Utilizing a creditor search form can assist you in structuring this information efficiently. Be sure to include key details like contact information and amounts owed to create a comprehensive resource. An organized creditor list is vital for managing your financial obligations and planning repayment.

You can get a list of all debts owed by accessing your credit report, which provides a detailed account of your financial obligations. Using a creditor search form can enhance this process by structuring your information and making it easier to track debts. Furthermore, contacting each creditor may uncover any additional debts not listed on your report. This thorough approach will give you a complete picture of your financial situation.

To obtain a list of creditors, you can start by reviewing your financial statements and account records. Additionally, using a creditor search form can expedite the process, helping you gather all relevant information about your debts. You may also consider reaching out to your creditors directly for a comprehensive list. This proactive approach ensures you have an accurate understanding of your obligations.

The list of creditors template is a document designed to organize and present all your creditors in a clear format. Using a creditor search form can help you identify and list creditors effectively. This template simplifies the process of gathering necessary information, making it easier to communicate with each creditor. Ultimately, it serves as an essential tool for managing your financial obligations.