Cancel Deed Trust With A Mortgage

Description

How to fill out Cancel Deed Trust With A Mortgage?

There’s no longer a reason to waste time searching for legal documents to fulfill your local state requirements. US Legal Forms has compiled all of them in one location and made them easier to access.

Our website provides over 85,000 templates for various business and personal legal situations organized by state and type of use. All forms are expertly drafted and verified for authenticity, ensuring you can acquire a current Cancel Deed Trust With A Mortgage.

If you are already acquainted with our service and possess an account, please ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all saved documents whenever necessary by accessing the My documents section in your profile.

Print your form to fill it out by hand or upload the sample if you prefer working in an online editor. Preparing official documents in compliance with federal and state laws is quick and easy with our platform. Try US Legal Forms today to keep your paperwork organized!

- If this is your first time using our service, completing the process will require a few additional steps.

- Here’s how new users can locate the Cancel Deed Trust With A Mortgage in our catalog.

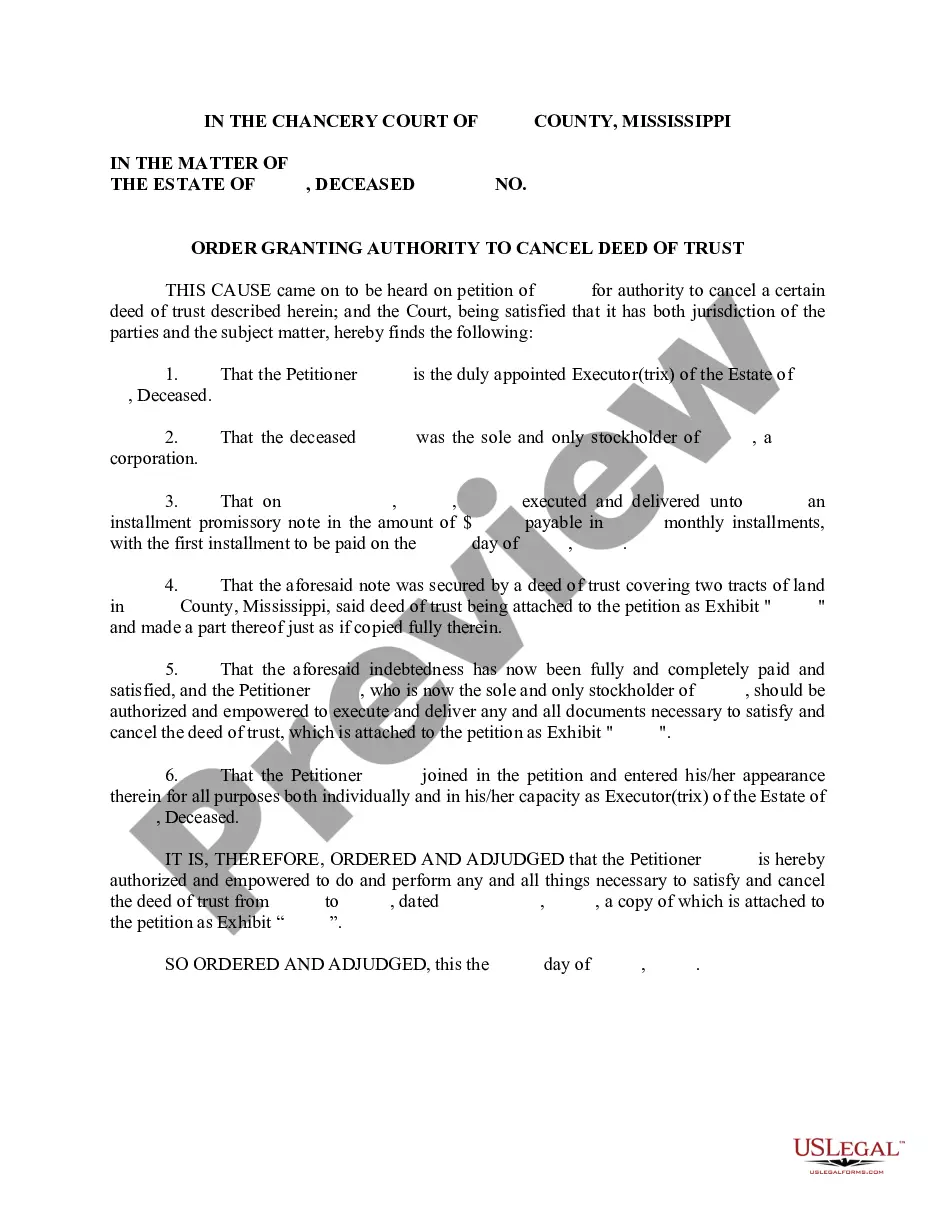

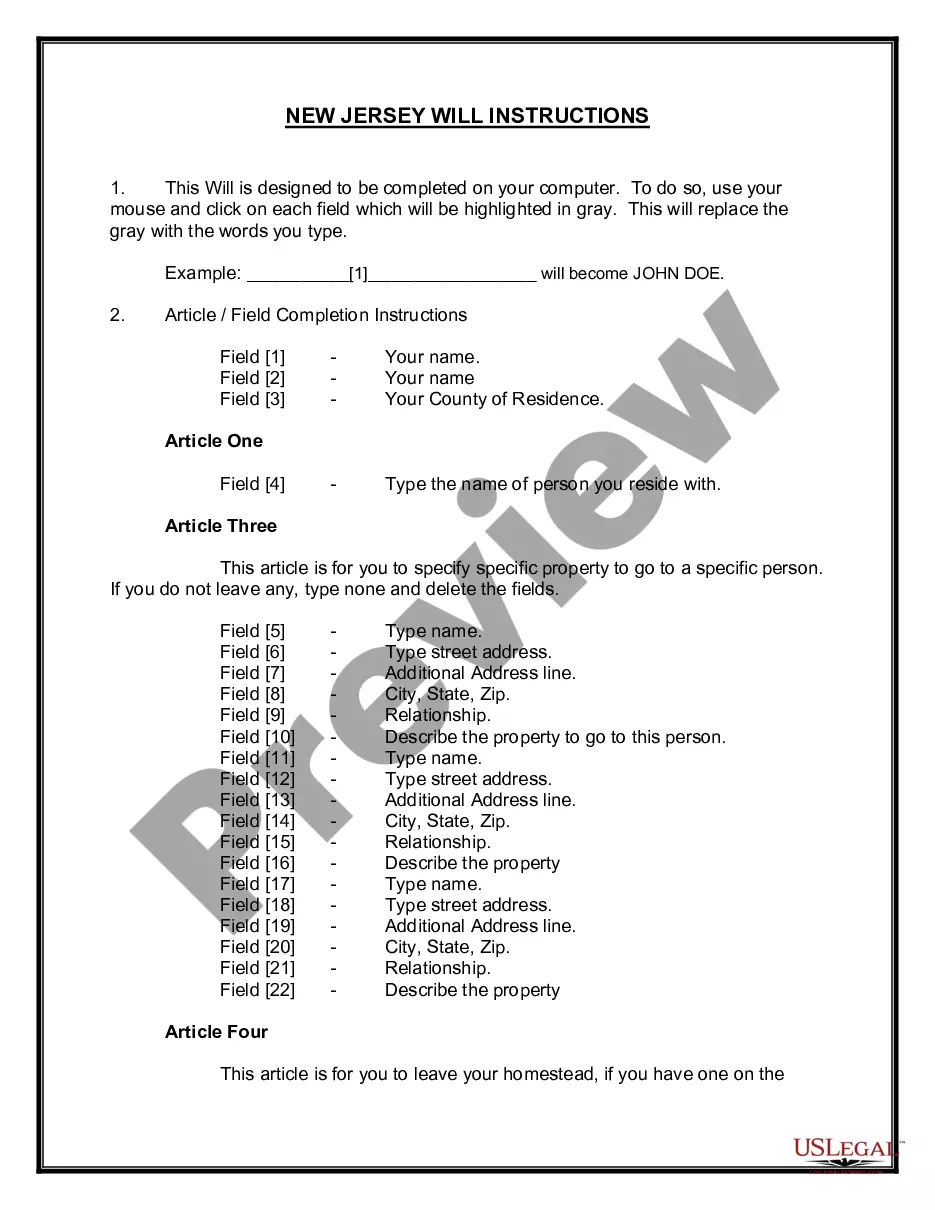

- Carefully review the page content to ensure it contains the example you need.

- To do this, use the form description and preview options, if available.

- Utilize the Search bar above to find another example if the previous one was not suitable.

- Click Buy Now next to the name of the template when you identify the correct one.

- Choose the desired subscription plan and create an account or sign in.

- Complete payment for your subscription using a credit card or through PayPal to proceed.

- Select the file format for your Cancel Deed Trust With A Mortgage and download it to your device.

Form popularity

FAQ

The choice between a deed of trust and a mortgage largely depends on your circumstances. Deeds of trust can often provide a quicker foreclosure process, while mortgages might offer more borrower protections. Evaluating these factors can be crucial if you aim to cancel a deed trust with a mortgage.

The most significant difference lies in the parties involved. A mortgage is a direct agreement between a borrower and lender, whereas a deed of trust involves a third party, the trustee. This difference can impact how one might approach efforts to cancel a deed trust with a mortgage.

Wyoming primarily uses deeds of trust instead of traditional mortgages. This means that lenders have the right to initiate a foreclosure through a trustee in the event of default. If you are considering how to cancel a deed trust with a mortgage in Wyoming, it's crucial to understand these state-specific laws.

Yes, you can come out of a trust deed through several methods. One common way is by refinancing your mortgage, which can allow you to cancel the deed trust with a mortgage. If you are facing difficulties, consider seeking assistance or consulting an expert for guidance.

Yes, a deed of trust is legally binding in the UK. It establishes the rights and obligations between parties regarding property ownership and management. If you wish to adjust or cancel a deed of trust, legal guidance can ensure that the process is handled correctly, safeguarding your interests.

Yes, you can cancel your trust deed if it is set up as revocable. To do this, you normally need to create a revocation document that all involved parties should sign. It's vital to keep a copy for your records and consider seeking help from professionals to ensure proper compliance with legal standards.

In India, revoking a trust typically involves executing a deed of revocation, which must be signed by the trustee and preferably all beneficiaries. This legal document must clearly express your intention to revoke the trust. Legal assistance is highly recommended to navigate the specific legal requirements and ensure proper execution.

A trust deed can be changed if the terms of the trust allow for amendments. This usually requires a formal record of the changes, which all parties must agree to and sign. Legal advice may be beneficial to ensure that all requirements are met and that the amendments are legally binding.

Canceling or revoking a declaration of trust typically involves drafting a revocation document that states your intention to revoke the trust. Ensure that this document is signed by all parties involved and keep copies for your records. Consider using a service like uslegalforms to access templates and guidance specifically tailored for your situation.

To remove a deed of trust, you must prepare and execute a deed of release, which is a legal document. This deed should detail the parties involved and must be signed by all parties. Ensure that you file the deed of release with the appropriate authorities to finalize the removal; using an online service like uslegalforms can help simplify these steps.