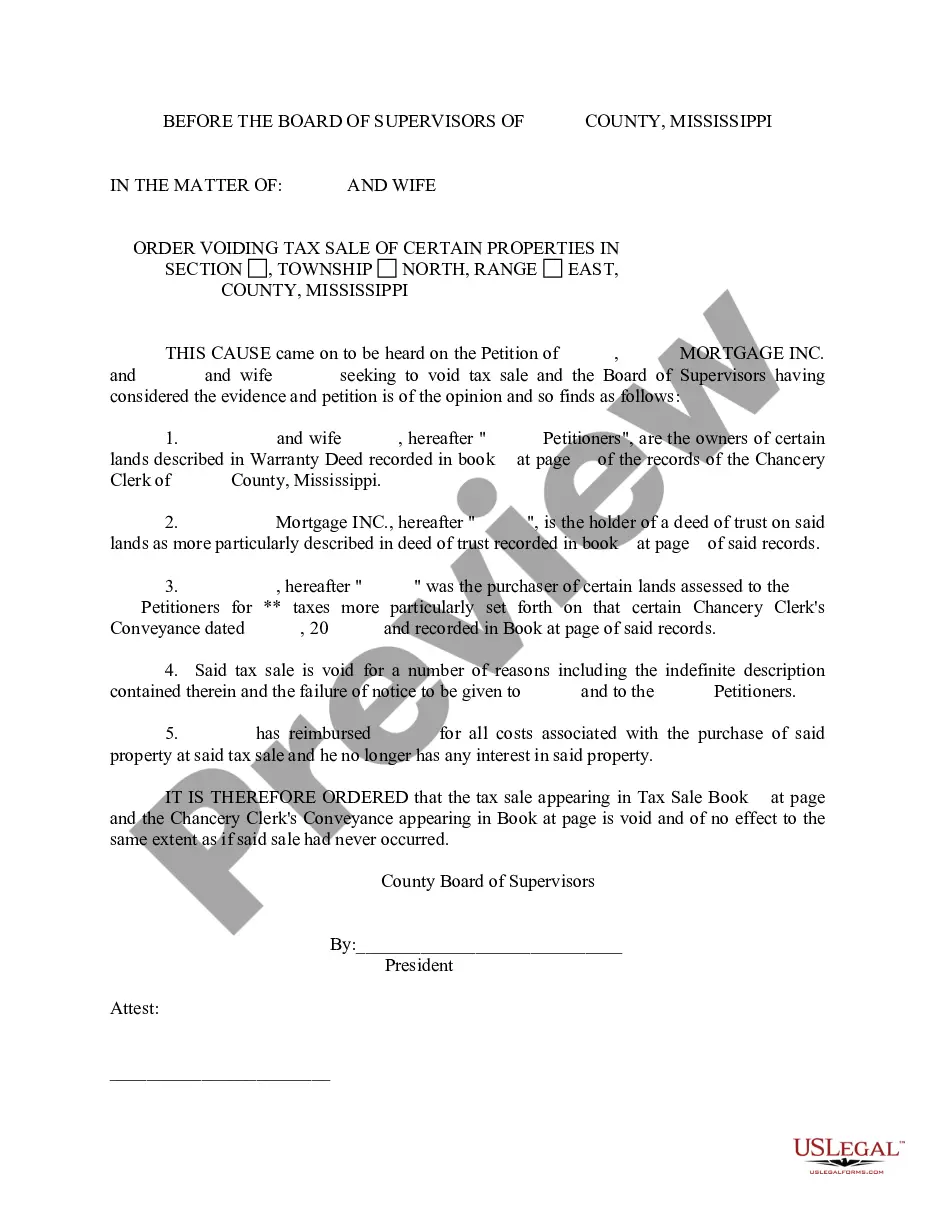

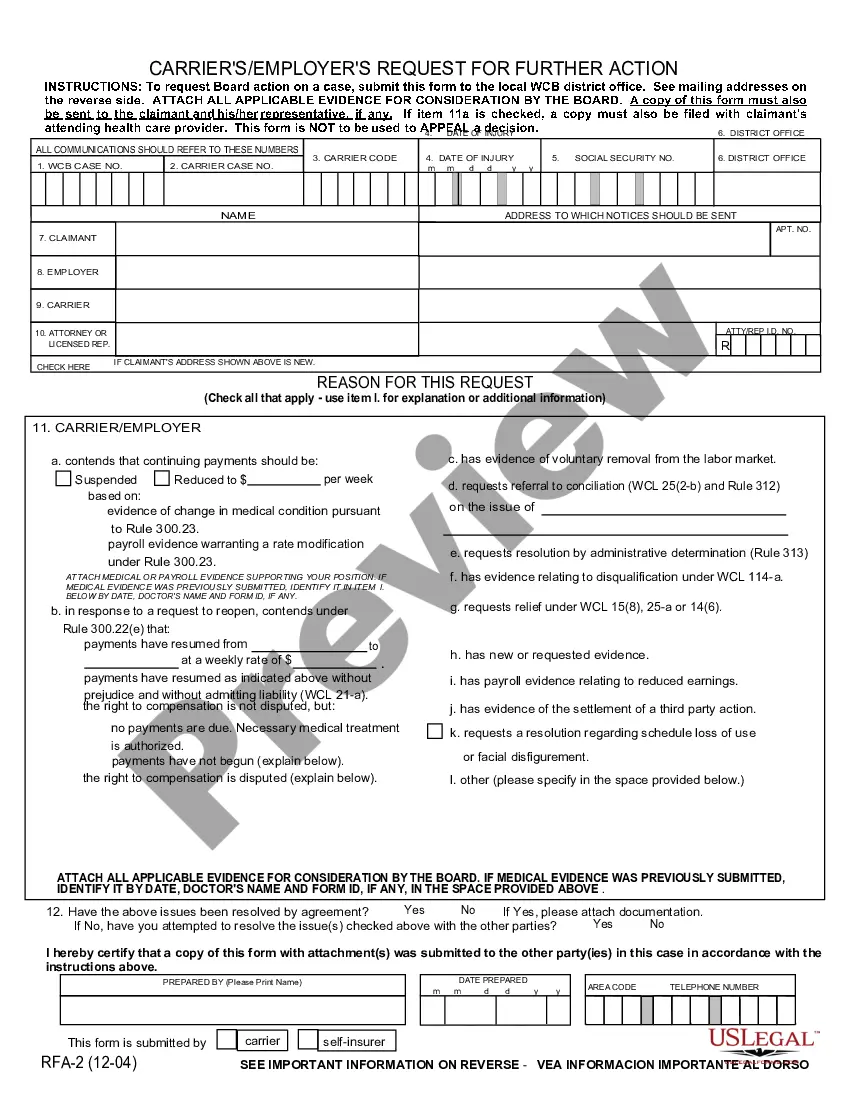

Ms tax properties are a specific type of tax property investment that offers certain tax advantages to investors. These properties can be classified into different types based on the specific tax benefits they provide. Let's explore a few of these types of Ms tax properties below: 1. Ms Tax-Free Municipal Bonds: Ms tax-free municipal bonds are debt securities issued by state and local governments. These bonds are exempt from federal income tax and often from state and local taxes as well. By investing in these bonds, individuals can earn tax-free interest income, making them an attractive option for investors seeking tax savings. Example: An investor purchases tax-free municipal bonds issued by a city government. The interest income earned on these bonds is exempt from federal, state, and local taxes, providing the investor with tax advantages. 2. Ms Low-Income Housing Tax Credits: Ms low-income housing tax credits are allocated to real estate developers who build or rehabilitate affordable housing for low-income individuals and families. These tax credits are used to offset the developer's federal income tax liability and are typically spread over a ten-year period. Investors can directly invest in these projects and receive tax benefits through their partnership with the developers. Example: An investor contributes funds to a low-income housing development project and receives a corresponding allocation of low-income housing tax credits. These tax credits can be used to offset the investor's federal income tax liability over ten years, resulting in tax savings. 3. Ms Energy Tax Credits: Ms energy tax credits are incentives provided to individuals or businesses for implementing energy-efficient improvements or utilizing renewable energy sources. These credits can reduce an individual's or business's tax liability by allowing them to claim a credit for qualified energy-related expenses. Example: A homeowner installs solar panels on their property. As a result, they become eligible for an energy tax credit, which allows them to claim a percentage of their installation costs as a credit against their federal income taxes, reducing their tax liability. 4. Ms Opportunity Zones: Ms opportunity zones are designated areas in economically distressed communities that offer tax benefits to investors who invest in qualifying businesses or real estate projects within these zones. By investing their capital gains in opportunity zone funds, taxpayers can potentially defer and reduce their capital gains tax liabilities. Example: An investor sells a stock and realizes a significant capital gain. They decide to reinvest their capital gains into an opportunity zone fund within the designated zone. By doing so, they can defer paying tax on the capital gains until 2026, potentially reduce the tax liability, and even eliminate capital gains tax on future appreciation of the investment. In conclusion, Ms tax properties encompass a variety of investment opportunities that provide tax advantages to investors. These include tax-free municipal bonds, low-income housing tax credits, energy tax credits, and opportunity zones. Investing in these types of properties allows individuals and businesses to reduce or defer their tax liabilities while also supporting socially impactful projects or ventures.

Ms Tax Properties With Examples

Description

How to fill out Ms Tax Properties With Examples?

Legal document managing might be overpowering, even for the most experienced experts. When you are searching for a Ms Tax Properties With Examples and don’t get the time to devote looking for the right and updated version, the operations can be stressful. A strong web form library can be a gamechanger for anyone who wants to manage these situations efficiently. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from personal to organization papers, all in one location.

- Use innovative tools to finish and manage your Ms Tax Properties With Examples

- Gain access to a resource base of articles, guides and handbooks and resources connected to your situation and needs

Save effort and time looking for the papers you will need, and utilize US Legal Forms’ advanced search and Preview feature to locate Ms Tax Properties With Examples and acquire it. If you have a membership, log in in your US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to find out the papers you previously downloaded and to manage your folders as you see fit.

Should it be the first time with US Legal Forms, make an account and get unlimited access to all advantages of the library. Listed below are the steps to take after accessing the form you want:

- Confirm this is the correct form by previewing it and reading through its information.

- Be sure that the sample is recognized in your state or county.

- Select Buy Now when you are ready.

- Select a monthly subscription plan.

- Find the formatting you want, and Download, complete, sign, print out and deliver your papers.

Benefit from the US Legal Forms web library, supported with 25 years of experience and reliability. Change your day-to-day papers administration in to a smooth and intuitive process right now.

Form popularity

FAQ

In Tennessee, if you don't meet the witness requirements for your will, your will is not valid. This can mean that all the work you've put into this document can become meaningless in the long run.

There are two basic ways to change a will: (1) by writing a new Will; or (2) by amending a current Will with a codicil. Creating a new Will has become the preferred way to change an estate plan. However, creating a new Will without regard to the old one makes the Will vulnerable to court challenges.

Any and all Matters of Probate under consideration in the state of Tennessee are public record and are available for review in the Office of the County Clerk in the County of filing. Please visit the Tennessee Department of Revenue website for more information and forms regarding Tennessee Inheritance Tax.

Once the executor receives authority to manage the estate, they have 60 days to file an inventory of the estate with the probate court. Creditors then have up to 12 months to enter their claims on the record. An interested party may object to the creditor's claim and request a jury trial or hearing within 30 days.

Tennessee law does not give a deadline for submitting a will to probate after someone dies. However, if a will is not submitted to probate, the court will treat the decedent's estate as if a will never existed. The decedent's property gets distributed ing to Tennessee's laws of intestate succession.

Wills after 1861 are found in the microfilmed county records; there is no published index to wills in Tennessee dated after 1861. There is a fee to search for a will or probate record on microfilm. The Library and Archives will search a five year range in ONE specified county for a probate record.

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.

Wills after 1861 are found in the microfilmed county records; there is no published index to wills in Tennessee dated after 1861. There is a fee to search for a will or probate record on microfilm. The Library and Archives will search a five year range in ONE specified county for a probate record.