Sales Tax With Massachusetts

Description

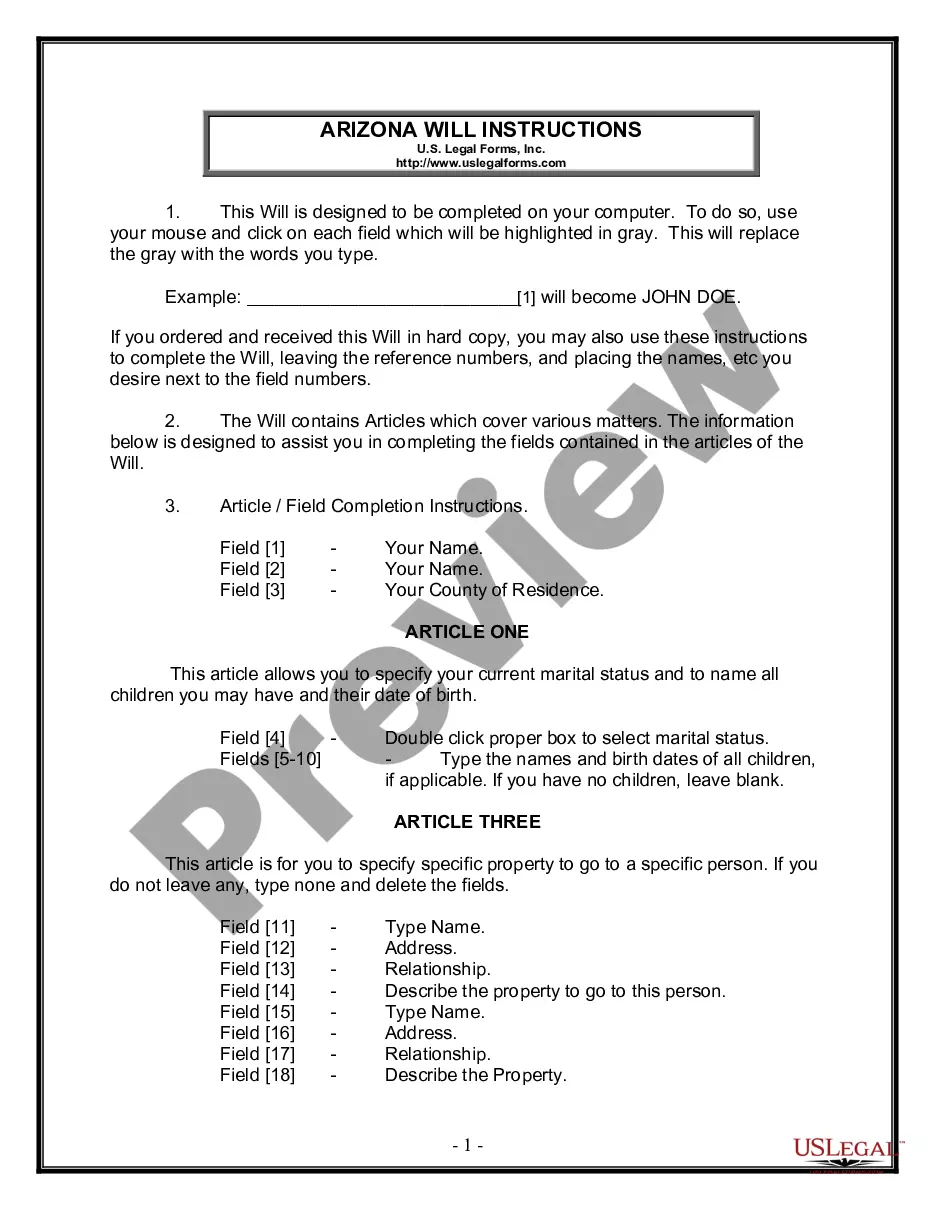

How to fill out Mississippi Complaint?

It’s no secret that you can’t become a legal expert immediately, nor can you grasp how to quickly draft Sales Tax With Massachusetts without having a specialized set of skills. Creating legal documents is a long venture requiring a certain education and skills. So why not leave the creation of the Sales Tax With Massachusetts to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Sales Tax With Massachusetts is what you’re searching for.

- Start your search again if you need a different template.

- Register for a free account and choose a subscription plan to purchase the template.

- Pick Buy now. Once the payment is through, you can get the Sales Tax With Massachusetts, fill it out, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

How to register for sales tax in Massachusetts Remote sellers can register for sales tax in Massachusetts via MassTaxConnect, an online tax portal. ... When asked what account type you'd like to register, simply select Sales Tax and click Next. ... You must file a sales tax return either monthly, quarterly, or yearly. ... ?Yearly.

If you have sales tax nexus in Massachusetts, you're required to register with the Massachusetts DOR and to charge, collect, and remit the appropriate tax to the state.

The minimum combined 2023 sales tax rate for Boston, Massachusetts is 6.25%. This is the total of state, county and city sales tax rates. The Massachusetts sales tax rate is currently 6.25%.

Sales tax. The Massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property (including gas, electricity, and steam) and telecommunications services1 sold or rented in Massachusetts.

To register your business with MassTaxConnect, you will need your: Social Security number if registering as a sole proprietor with no employees. EIN/FEIN - Required for all businesses including sole proprietors with employees. Start date of your business. Legal and mailing addresses.