Sales Tax Formula

Description

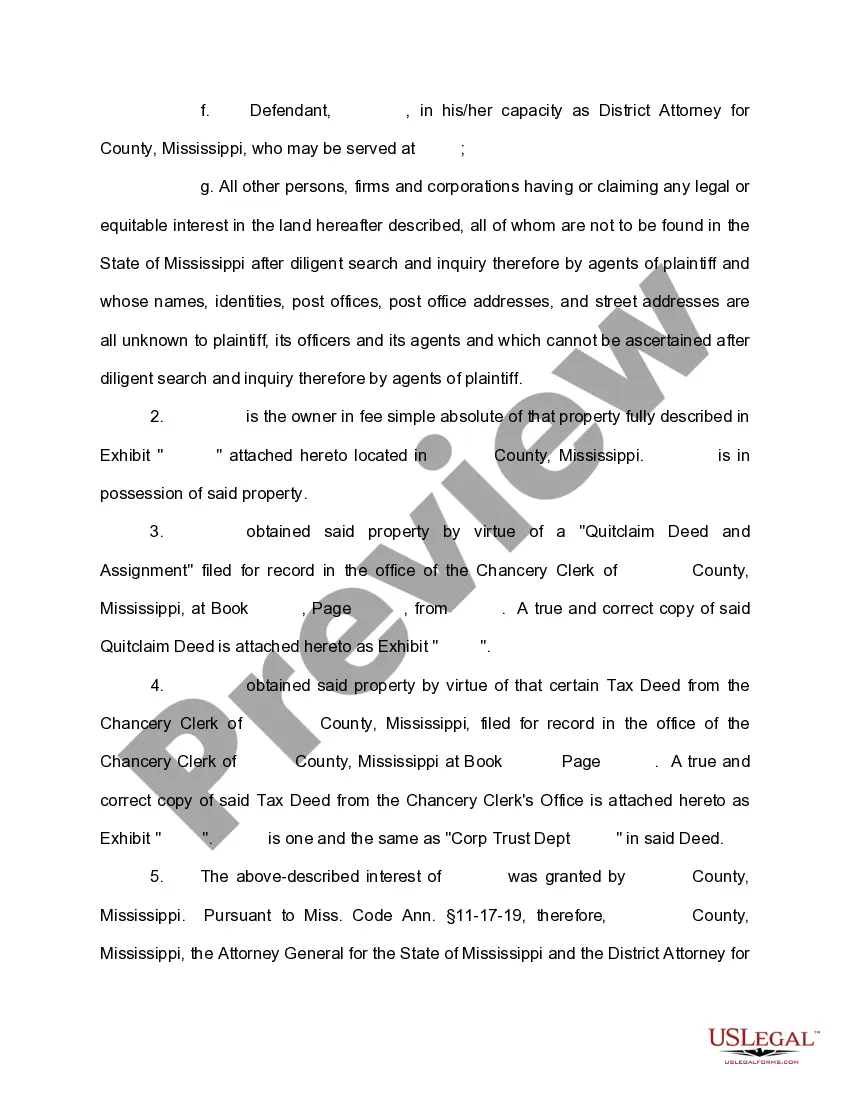

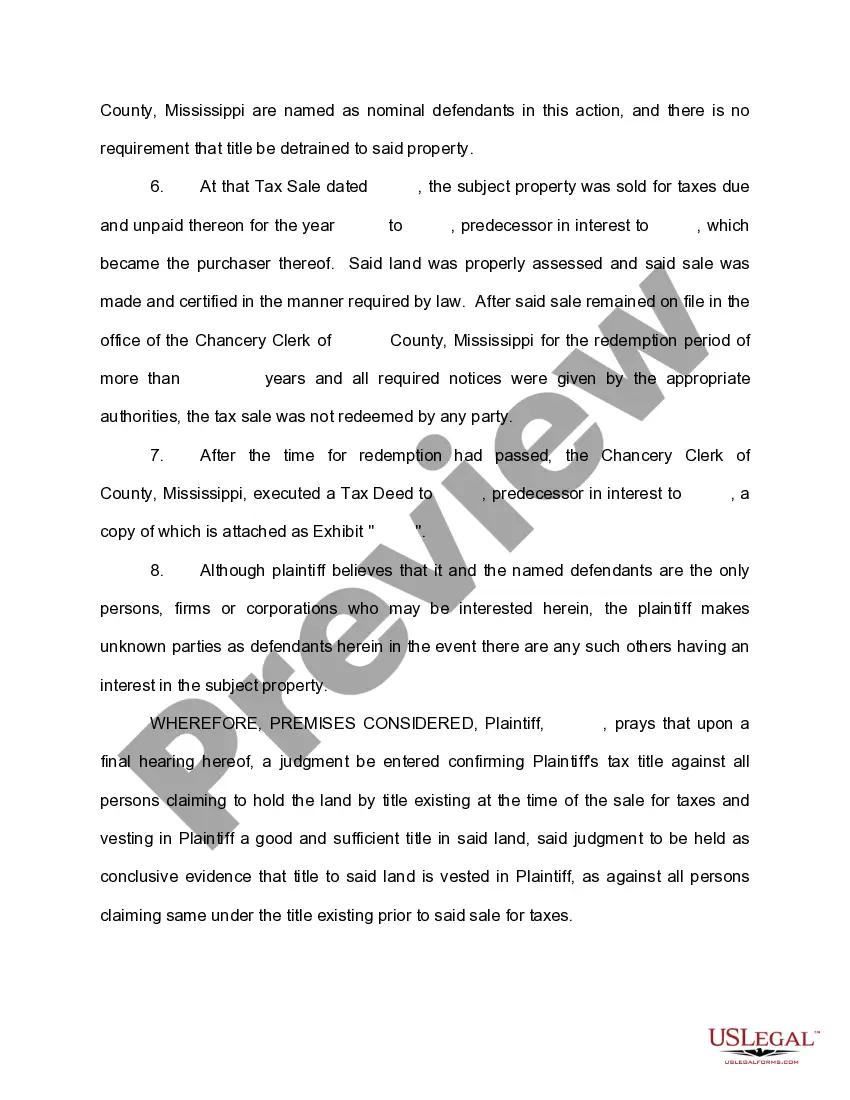

How to fill out Mississippi Complaint?

Locating a reliable source for the latest and pertinent legal samples is half the battle of navigating bureaucracy.

Choosing the appropriate legal documents requires precision and careful attention, which is why it is crucial to obtain Sales Tax Formula samples solely from reputable sources, such as US Legal Forms. An incorrect template will squander your time and delay the situation you are facing. With US Legal Forms, you have minimal concerns. You can access and verify all details regarding the document’s application and significance for your situation and within your state or county.

Eliminate the hassle associated with your legal documentation. Discover the extensive US Legal Forms library where you can find legal samples, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to locate your sample.

- Access the form’s details to confirm it meets the criteria of your state and county.

- View the form preview, if available, to ensure the template is indeed the one you seek.

- Return to the search to find the appropriate document if the Sales Tax Formula does not align with your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered customer, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing plan that fits your needs.

- Proceed to the registration to complete your transaction.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Sales Tax Formula.

- Once you have the form on your device, you can modify it using the editor or print it out and fill it in manually.

Form popularity

FAQ

You can multiply the dollar amount by 1. X, where X represents the sales tax after dividing by 100. For example, if something is $20 and the sales tax is 7% you would multiply $20 times 1.07 and you would pay $21.40. Or add 7 cents for every dollar.

6% would be 0.06, all you do is move the decimal two spaces to the left. For example 6% sales tax on an item would be calculated by multiplying the total cost by the decimal form of the percentage. Say the total cost was $30.00, it would be calculated as 30 x 0.06 = 1.8 then add the quotient to the original cost.

Adding the 6% sales tax rate to this, the total price is 106% of the purchase price. Converting 100% into a decimal gives us 1, so 106% is 1.06. Now, just multiply by the purchase price to get the total price.

How to Calculate Sales Tax Find list price and tax percentage. Divide tax percentage by 100 to get tax rate as a decimal. Multiply list price by decimal tax rate to get tax amount. Add tax amount to list price to get total price.

Know the retail price and the sales tax percentage. Divide the sales tax percentage by 100 to get a decimal. Multiply the retail price by the decimal to calculate the sales tax amount.