Installment Note Form For Corporation

Description

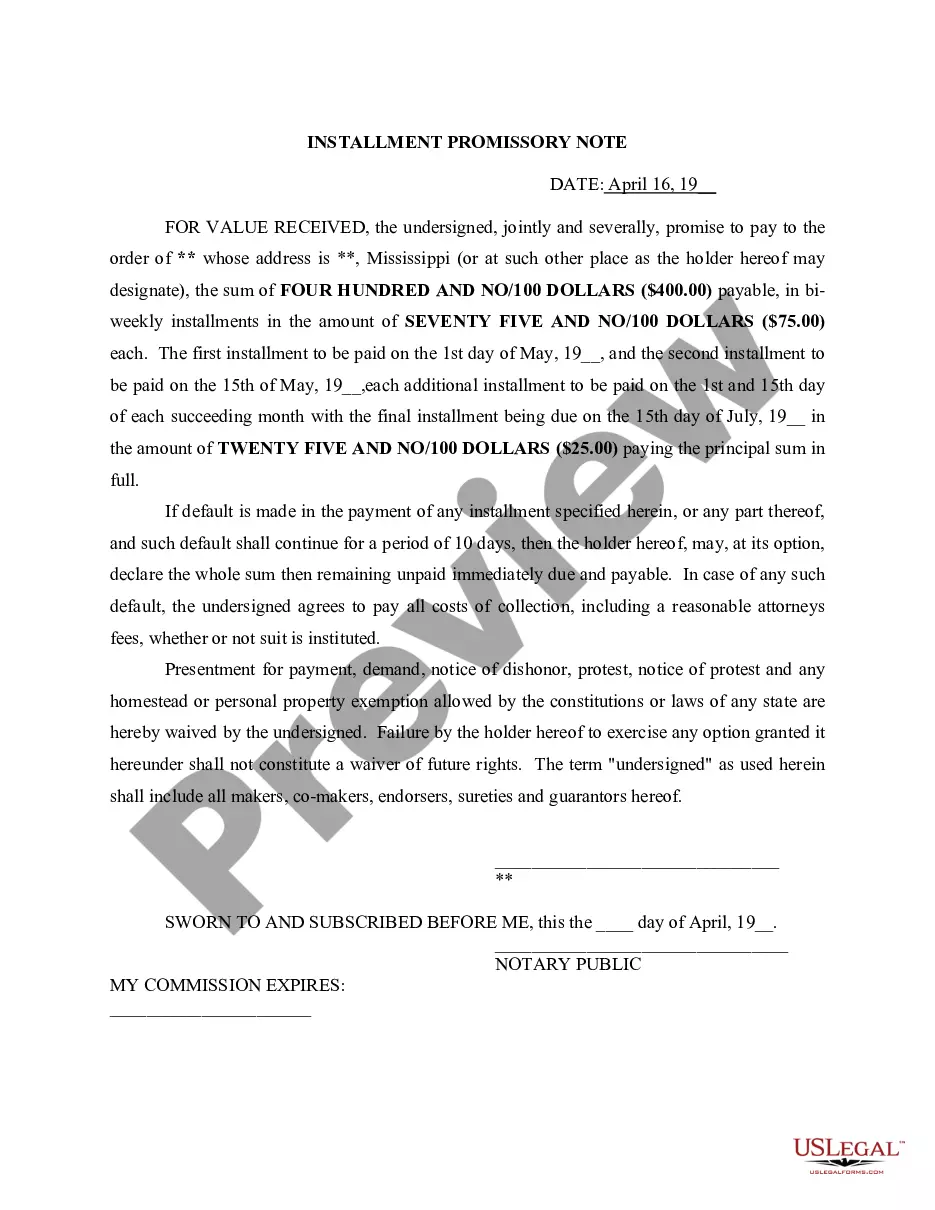

How to fill out Mississippi Installment Promissory Note?

Maneuvering through the red tape of traditional paperwork and templates can be challenging, particularly for those who are not engaged in it professionally.

Moreover, selecting the appropriate template for an Installment Note Form For Corporation will take considerable time, as it must be accurate and precise to the final detail.

However, you will significantly reduce the time spent obtaining a suitable template from a reliable source.

Acquire the correct form in a few straightforward steps: Enter the document title in the search field, identify the relevant Installment Note Form For Corporation from the results list, review the details of the sample or open its preview. If the template meets your needs, click Buy Now. Then, select your subscription plan, use your email to create a secure password for your US Legal Forms account, choose a payment method (credit card or PayPal), and save the template document in your preferred format on your device. US Legal Forms can save you time and effort in verifying if the form you found online meets your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the correct forms online.

- US Legal Forms serves as a singular location to obtain the latest form samples, consult their usage, and download these samples for completion.

- It boasts a repository of over 85k forms applicable in diverse fields.

- When searching for an Installment Note Form For Corporation, you can be confident in its authenticity since all forms are verified.

- Having an account with US Legal Forms guarantees that you have all necessary samples at your fingertips.

- You can store them in your history or add them to the My documents collection.

- Access your saved forms from any device by clicking Log In on the library site.

- If you do not yet have an account, you can always search for the needed template.

Form popularity

FAQ

Yes, you can change your IRS installment agreement online through the IRS website. It offers a convenient way to manage your installment agreements and submit any required forms, such as the Form 9465. This functionality ensures that you can adapt your payment plans efficiently as your financial situation changes.

Yes, you can add a new balance to your IRS installment agreement if your financial situation changes. This often requires submitting a new Form 9465, along with your current financial information. Adjustments can help you navigate your tax obligations more effectively.

To reinstate an IRS installment agreement, you need to contact the IRS and provide necessary information regarding your financial situation. You may have to submit a new Form 9465 if your original agreement was canceled. This reinstatement can help you manage tax debts while avoiding penalties.

The installment method in accounting is a way to recognize revenue and profits from sales over time as payments are received. This method is particularly useful when the collection of the revenue is uncertain. Utilizing an installment note form for a corporation can help document this process effectively.

To amend your installment agreement, you typically need to contact the IRS directly or submit a new Form 9465. It's important to provide your financial details to illustrate the need for changes. By properly amending your agreement, you can create a more manageable payment plan.

Yes, you can modify an IRS installment agreement. To do this, you need to submit Form 9465, also known as the Installment Agreement Request. Adjusting your payment terms may help you better manage your finances while ensuring you comply with tax obligations.

To request an installment agreement after filing your taxes, you can use the online application on the IRS website or submit Form 9465 by mail. Ensure you have your tax information ready, as this will facilitate a smooth process. For corporations, completing the installment note form for corporation can provide clarity and shape your agreement effectively.

To obtain a copy of your installment agreement, you can contact the IRS directly or access your account through the IRS website. It may also be beneficial to check any correspondence received after setting up the agreement. If you need assistance with documentation, using the installment note form for corporation can help simplify the process.

Yes, nonresidents can request an installment agreement with the IRS, provided they meet certain conditions. They must file the necessary tax returns and be compliant with all tax obligations. For detailed guidance, nonresidents may consider using the installment note form for corporation to ensure their agreement aligns with U.S. tax laws.

The 6252 form, officially known as 'Installment Sale Income,' is used to report income from sales on an installment basis. This form helps corporations calculate and report profit over time from such sales, ensuring the tax implications are managed properly. Utilizing the installment note form for corporation can assist in structuring these transactions effectively.