Complaint To Confirm Title Mississippi Withholding

Description

How to fill out Complaint To Confirm Title Mississippi Withholding?

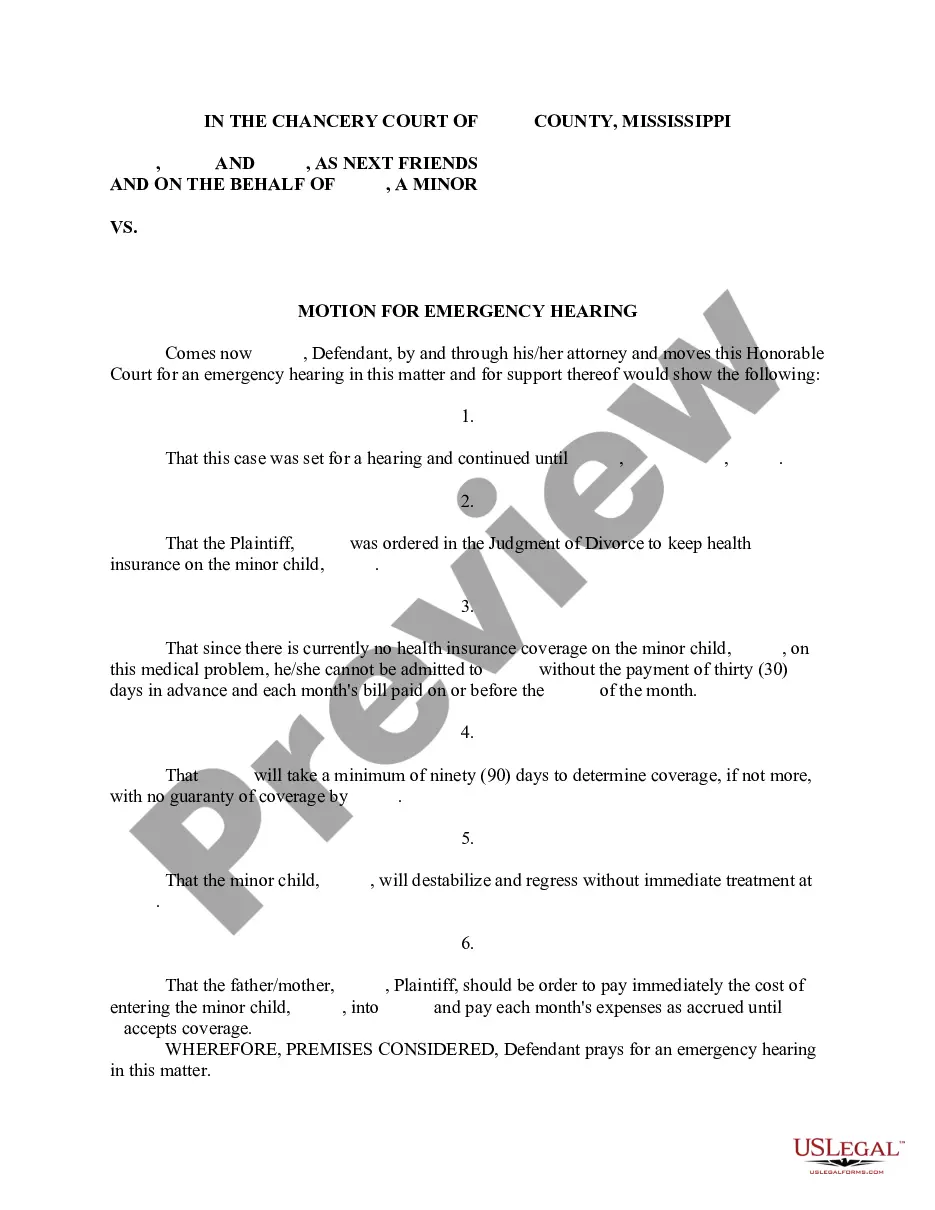

When you need to complete a Complaint To Confirm Title Mississippi Withholding in line with your local state's laws and regulations, there can be numerous options available.

There's no necessity to review every document to validate it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable service that can assist you in acquiring a reusable and current template on any topic.

Utilizing US Legal Forms makes acquiring appropriately drafted legal documents effortless. Moreover, Premium users can also benefit from the comprehensive integrated solutions for online document editing and signing. Try it out today!

- US Legal Forms is the largest online catalog with a compilation of over 85k ready-to-use documents for business and individual legal situations.

- All templates are verified to align with each state's laws and regulations.

- Consequently, when downloading Complaint To Confirm Title Mississippi Withholding from our platform, you can be confident that you possess a valid and current document.

- Acquiring the required sample from our platform is incredibly straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and maintain access to the Complaint To Confirm Title Mississippi Withholding at any time.

- If it's your first time using our library, please follow the steps below.

- Review the suggested page and verify it for alignment with your criteria.

Form popularity

FAQ

To fill out the Mississippi employee's withholding exemption certificate, you need to provide your name, address, Social Security number, and the reason for the exemption. Make sure to read the instructions carefully to avoid errors. If you require assistance or face complications, consider utilizing platforms like uslegalforms to guide you through the process, particularly if it relates to a complaint to confirm title Mississippi withholding.

Yes, many employers allow you to change your withholding online through their payroll systems or employee portals. Check with your employer for specific instructions and processes. If you encounter challenges or have questions, don’t hesitate to file a complaint to confirm title Mississippi withholding for further assistance.

You can check the status of your Mississippi state tax by visiting the state's tax website or contacting their customer service. Provide necessary details such as your Social Security number and relevant tax information. Being informed about your tax status is crucial, especially if you face issues related to a complaint to confirm title Mississippi withholding.

Yes, you can opt out of withholding by submitting a new Mississippi employee's withholding exemption certificate to your employer. This certificate allows you to claim zero withholding if you meet the criteria. If you're considering this option, ensure you fully understand the consequences, especially regarding a complaint to confirm title Mississippi withholding.

To cancel your tax withholding, you must submit a new Mississippi employee's withholding exemption certificate to your employer. This document allows you to adjust your withholding rates as needed. If you have questions or concerns, consider filing a complaint to confirm title Mississippi withholding for clarity on your tax situation.

To look up a tax lien in Mississippi, you can start by visiting the Mississippi Secretary of State's website, where they provide public records of liens. Additionally, contacting your county tax assessor's office can yield specific information about any outstanding liens related to property you are interested in. If you encounter issues or need to contest a lien, filing a Complaint to confirm title Mississippi withholding can help clarify ownership. Remember, utilizing services like US Legal Forms can streamline this process by providing you with the necessary documents and guidance.

Finding tax lien properties in Mississippi involves checking public records at the county tax assessor's office and exploring online databases. You may also want to use platforms like US Legal Forms to obtain tailored documents that help manage your search and formalize a complaint to confirm title Mississippi withholding effectively. By combining local resources with reliable online solutions, you can navigate the process smoothly and increase your chances of success.

Yes, you can search IRS tax liens through various online databases and local government resources. This process is beneficial when you need to evaluate any claims against a property, especially when considering a complaint to confirm title Mississippi withholding. Utilizing dedicated platforms and services may help streamline your search for tax lien information, making it easier to uncover any relevant records.

For assistance with Mississippi state taxes, you can contact the MS Department of Revenue through their official channels. They provide comprehensive support for all tax-related inquiries, including issues concerning the Complaint to confirm title mississippi withholding. Make sure to have your details ready when you reach out for a smoother experience.

To check for liens on a property in Mississippi, you can search through the county tax office or the online records available through the Mississippi Secretary of State's website. This is crucial if you are dealing with property issues and need to resolve concerns related to the Complaint to confirm title mississippi withholding.