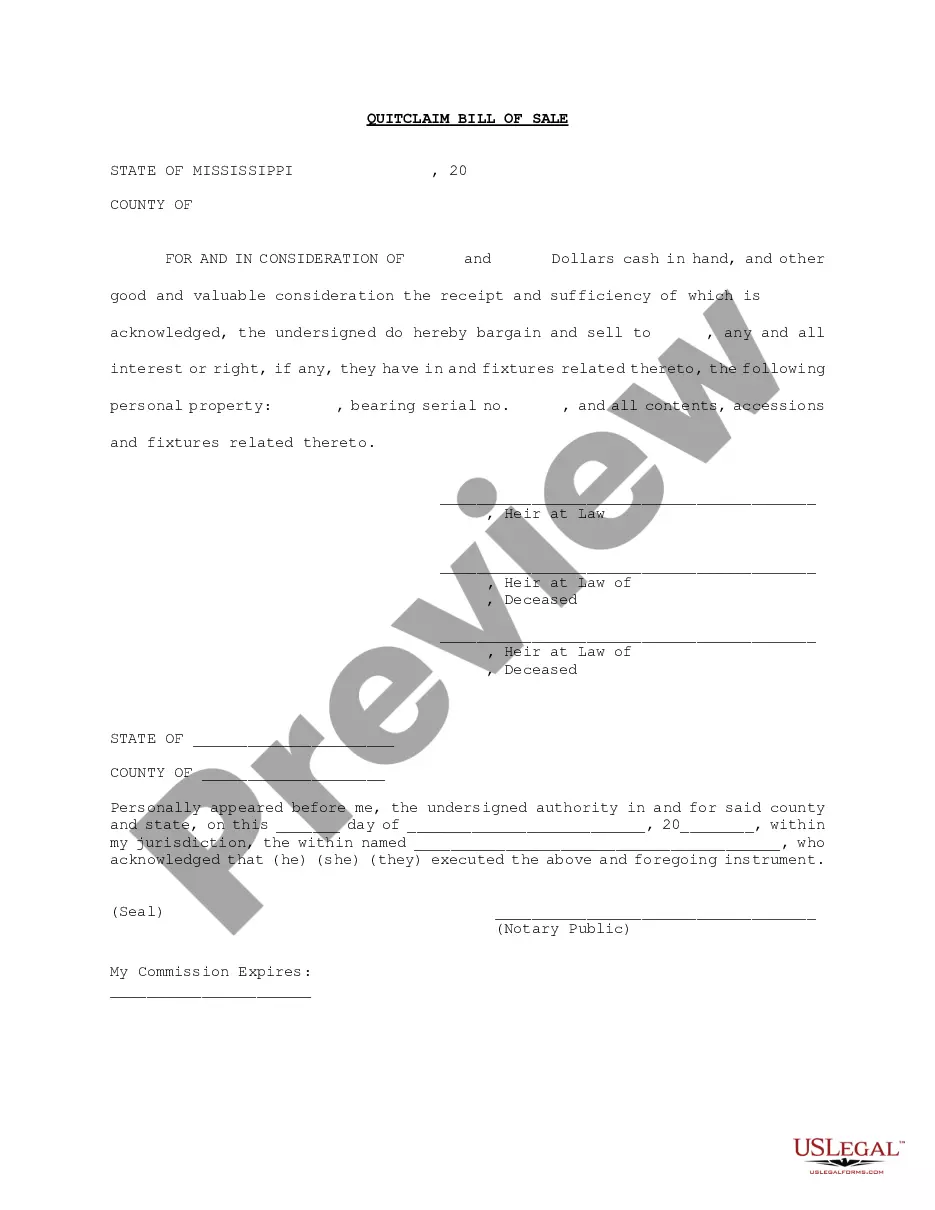

Bill Of Sale For Mobile Home In Mississippi Form

Description

How to fill out Mississippi Quitclaim Bill Of Sale Of Mobile Home?

Adequately composed official documents constitute one of the crucial safeguards for steering clear of complications and lawsuits, though obtaining them without legal counsel may require time.

Whether you need to swiftly locate an updated Bill Of Sale For Mobile Home In Mississippi Form or other documents related to employment, family, or business events, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Furthermore, you can access the Bill Of Sale For Mobile Home In Mississippi Form at any time later, as all the paperwork previously obtained on the platform is retained within the My documents section of your profile. Conserve time and resources on preparing official documents. Experience US Legal Forms today!

- Ensure that the form is appropriate for your needs and location by reviewing the description and preview.

- Search for an alternate example (if necessary) using the Search bar in the page header.

- Click Buy Now when you find the suitable template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Bill Of Sale For Mobile Home In Mississippi Form.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Purchased Used from IndividualTitle (1999 or higher model)Notarized Bill of Sale.Copy of Current Tax Receipt (IF purchased from MS Resident)Copy of Deed with Mobile Home description on deed or... If Mobile Home is not listed, a Notarized Bill of Sale.Photo identification for all parties.

Until July 1, 1999, Mississippi law did not mandate that mobile homes be titled.

Mississippi Code Annotated. To register a mobile home as real property, the mobile homeowner must own the land upon which the mobile home is placed. You must have written approval from the appropriate Zoning Department before you can move a mobile home on a property other than an approved mobile home park.

Aside from calling us here at National Cash Offer to help you sell your mobile home without a title, it is NOT impossible to sell your mobile home without a title. Although without the title, you can't legally transfer ownership of the property the owner will just be the sole owner of the mobile home.

The cost of registering a mobile home includes both the annual registration fee and tax. The annual registration fee is either $2 or $36 depending on the type of Roll. The taxes due are also determined by the Mobile Home Roll which is based on the Mississippi Department of Revenue's Mobile Home Schedule.