Appeal Court For

Description

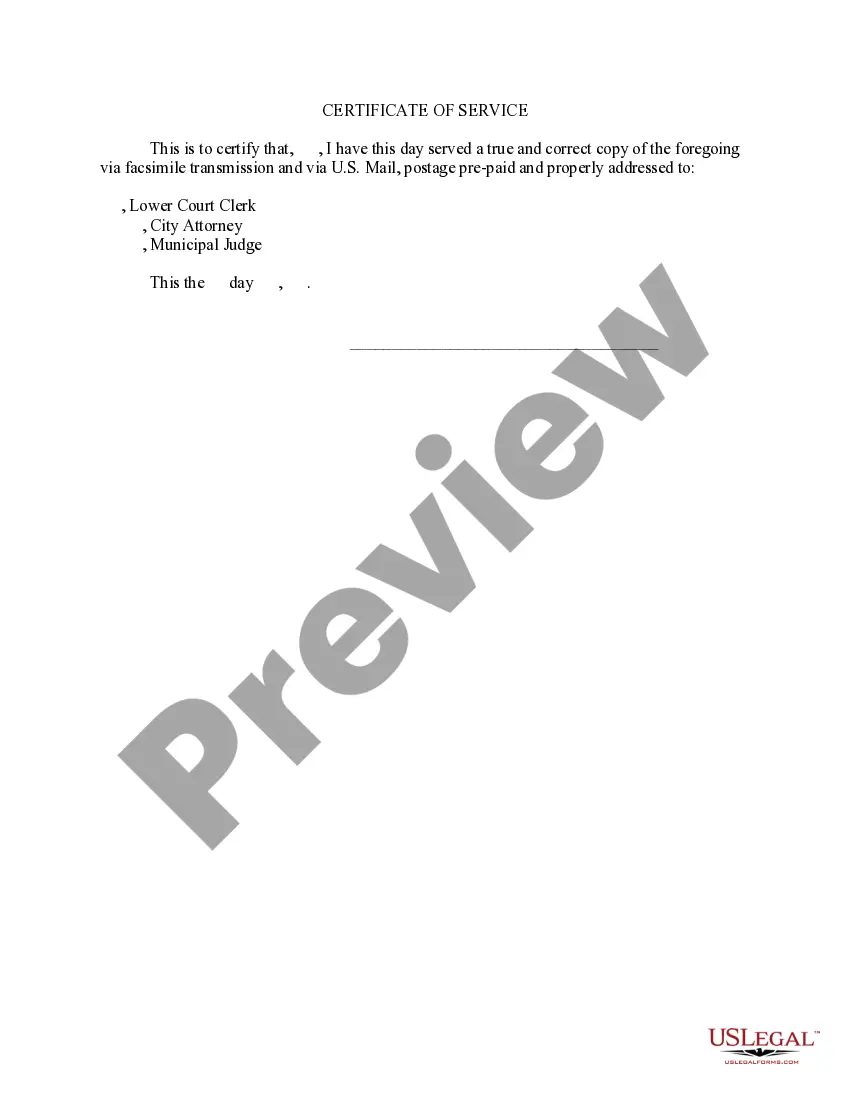

How to fill out Mississippi Notice Of Appeal From Municipal Court To County Court?

It's well known that one cannot instantly become a legal authority, nor can you swiftly learn how to efficiently prepare Appeal Court For without having a specialized background.

Drafting legal documents is a lengthy endeavor that necessitates specific training and abilities. So why not entrust the preparation of the Appeal Court For to the professionals.

With US Legal Forms, one of the largest collections of legal templates, you can discover everything from court documents to templates for internal business communications. We acknowledge the significance of compliance and adherence to federal and state regulations.

Click Buy now. Once the purchase is finalized, you can access the Appeal Court For, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

You can regain access to your documents from the My documents section at any time. If you’re a current customer, simply Log In, and find and download the template from the same section.

Regardless of the intent behind your forms—be it financial, legal, or personal—our platform has everything you need. Give US Legal Forms a try now!

- Here’s how to start using our platform and acquire the document you require in just minutes.

- Locate the document you need with the search bar at the top of the website.

- Preview it (if this feature is available) and read the accompanying description to determine if Appeal Court For is what you seek.

- If you need another form, initiate your search again.

- Create a free account and select a subscription plan to purchase the form.

Form popularity

FAQ

You can get an LLC in Rhode Island in 3-4 business days if you file online (or 2 weeks if you file by mail).

Generally, members of LLCs filing Partnership Returns pay self-employment tax on their share of partnership earnings. If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return.

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes.

The State of Rhode Island does not legally require businesses to adopt an operating agreement.

Rhode Island LLC Formation Filing Fee: $150 The primary cost when starting a Rhode Island LLC is the $150 fee ($152.50 online) to register your business with the Rhode Island Department of State' Business Division.

LLCs in Rhode Island are taxed as pass-through entities by default. Rather than paying taxes at the entity level, LLCs pass profits and losses on to their members, who then pay taxes at the individual level. In Rhode Island, LLC members are subject to both federal and state personal income tax.

Rhode Island LLC Formation Filing Fee: $150 The primary cost when starting a Rhode Island LLC is the $150 fee ($152.50 online) to register your business with the Rhode Island Department of State' Business Division.

For a C Corporation, the rate of seven percent (7%) of net income apportioned to Rhode Island; or a minimum of $400.00, whichever amount shall yield the greatest tax.

RHODE ISLAND DIVISION OF TAXATION - PAGE 2 OF 2 In general, for an LLC treated as a corporation for federal tax purposes, for tax years beginning on or after January 1, 2015, the tax is 7% of net income, or the minimum tax, whichever amount is greater.

Regardless of how your LLC is structured or how much income you make, you'll need to pay a minimum of $400 to the Rhode Island Division of Taxation. Partnerships, disregarded entities, and S corporations pay the minimum business corporation tax of $400. Regular corporations pay $400 or more, depending on their profits.