Av Contractor Mississippi For Sale

Description

How to fill out Mississippi Resolution Of Board Of Aldermen Granting Exemption From AV Taxes - 27-31-101?

Bureaucracy demands exactness and correctness.

If you don't engage in completing documents like Av Contractor Mississippi For Sale every day, it may lead to some confusion.

Selecting the appropriate sample from the beginning will ensure that your document submission proceeds smoothly and avert any troubles of resubmitting or duplicating the same task from the beginning.

Locating the correct and current samples for your documents takes just a few minutes with an account at US Legal Forms. Sidestep bureaucracy issues and simplify your work with paperwork.

- Discover the sample using the search feature.

- Verify that the Av Contractor Mississippi For Sale you found is applicable to your state or area.

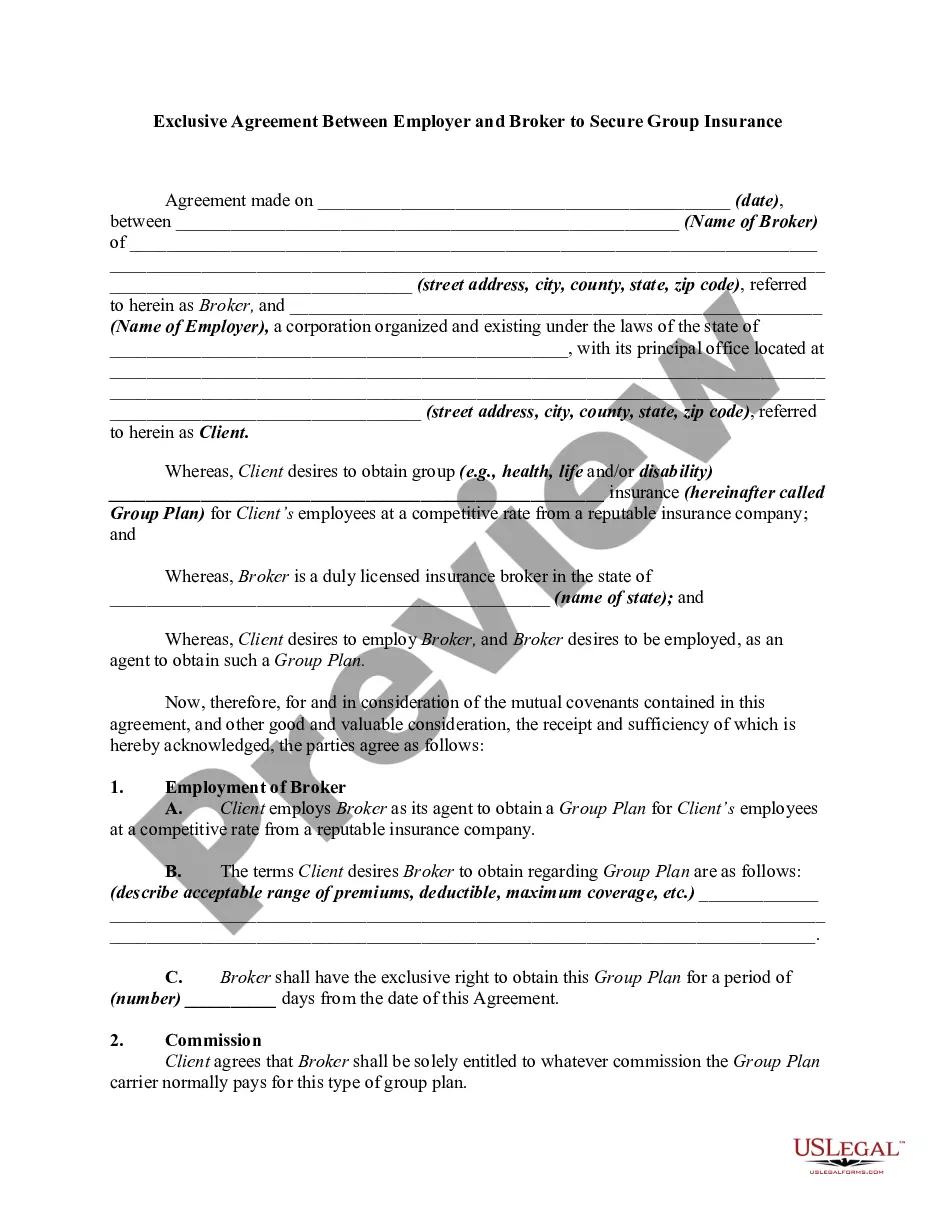

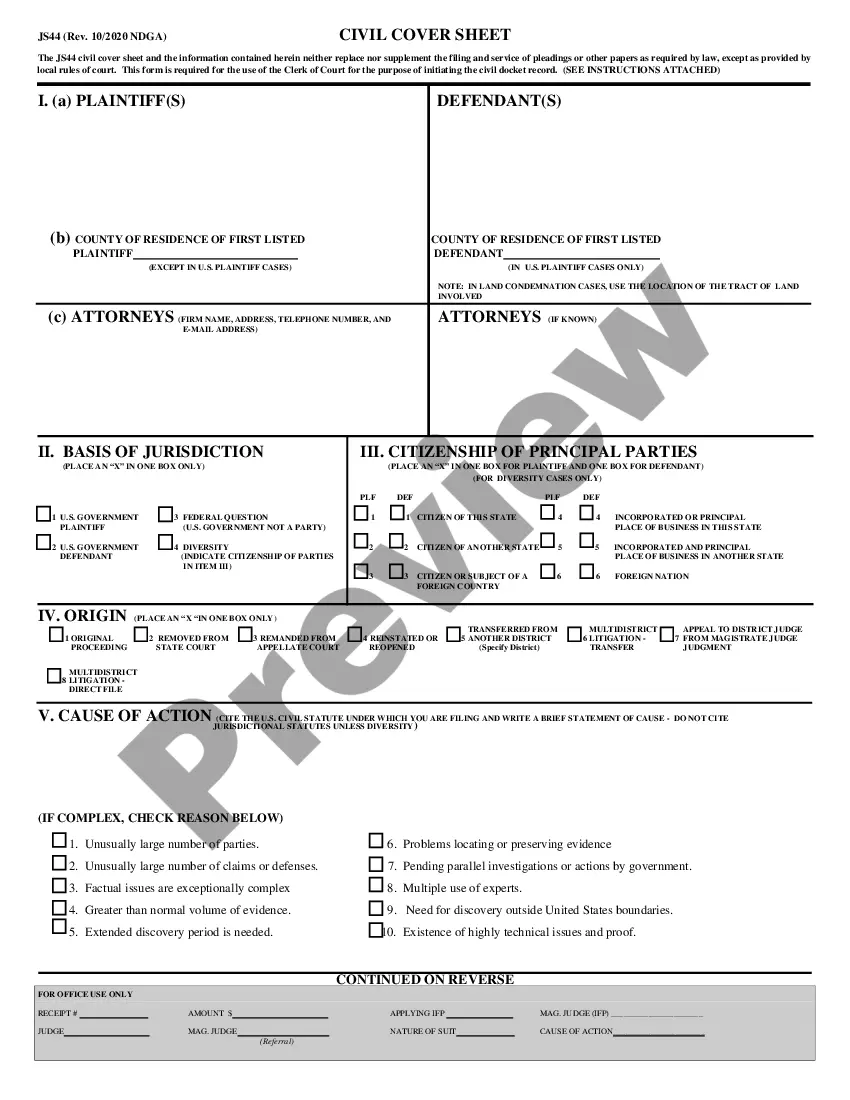

- View the preview or examine the details that include the information on using the sample.

- When the outcome aligns with your inquiry, click the Buy Now button.

- Select the suitable option from the offered subscription packages.

- Sign in to your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Download the form in the format of your preference.

Form popularity

FAQ

The 3 main steps to obtaining a license in Mississippi are to:Submit an application to the Mississippi State Board of Contractors.Pass the Law and Business Management exam.Pass a Technical (trade) exam specific to the type of work you perform.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

The Sales Tax Law levies a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation received exceeds $10,000.00. Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract . You may apply for a MPC on TAP.

The Act grants lien rights not only to contractors, but also to all subcontractors, sub-subcontractors, and materialmen providing work to any improvement of real estate, as well as architects, engineers, and surveyors.