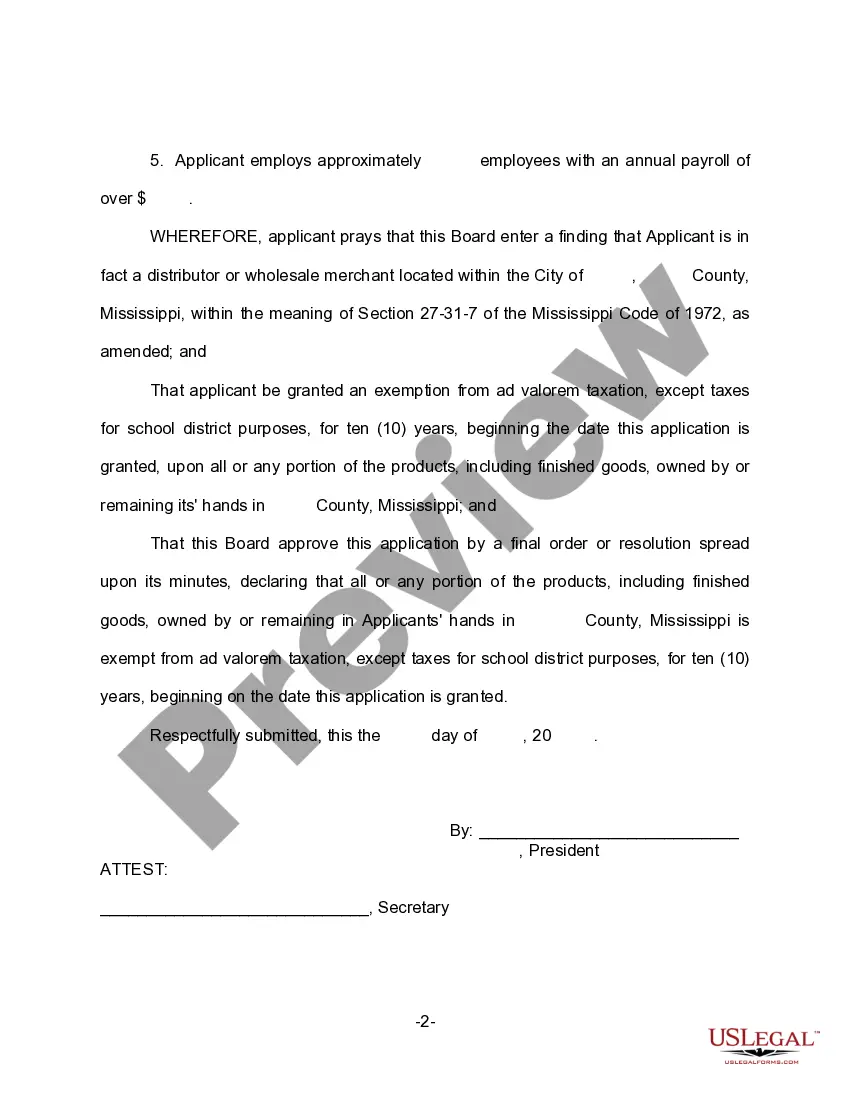

Mississippi Exemption Application For Tax Year 2017

Description

How to fill out Mississippi Application For Exemption From Ad Valorem Taxes For Certain Manufactured Products Held For Sale Or Shipment To Other Than Final Consumer For A Period Of 10 Years?

The Mississippi Exemption Application For Tax Year 2017 you see on this page is a reusable formal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Mississippi Exemption Application For Tax Year 2017 will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to confirm it suits your requirements. If it does not, make use of the search option to find the correct one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your Mississippi Exemption Application For Tax Year 2017 (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a valid.

- Download your paperwork one more time. Utilize the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Employees may change their Mississippi and Federal withholding tax rates by completing a new Mississippi Form 89-350 ?and Federal Form W-4.

Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1. (b) Married individuals are allowed a joint exemption of $12,000. If the spouse is not employed, enter $12,000 on Line 2(a).

Form 80-160 is for Mississippi credit for tax paid to another state. If you completed your nonresident state first, TurboTax will calculate the figures for you. If you have not completed your other state tax return(s), go back and complete them first.

Apply online at the DOR's Taxpayer Access Point portal to receive a Withholding Account Number immediately after completing the registration. Find an existing Withholding Account Number: on Form 89-105, Employer's Withholding Tax Return.

The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. What are exemptions?