Warranty Deed Attorney Near Me

Description

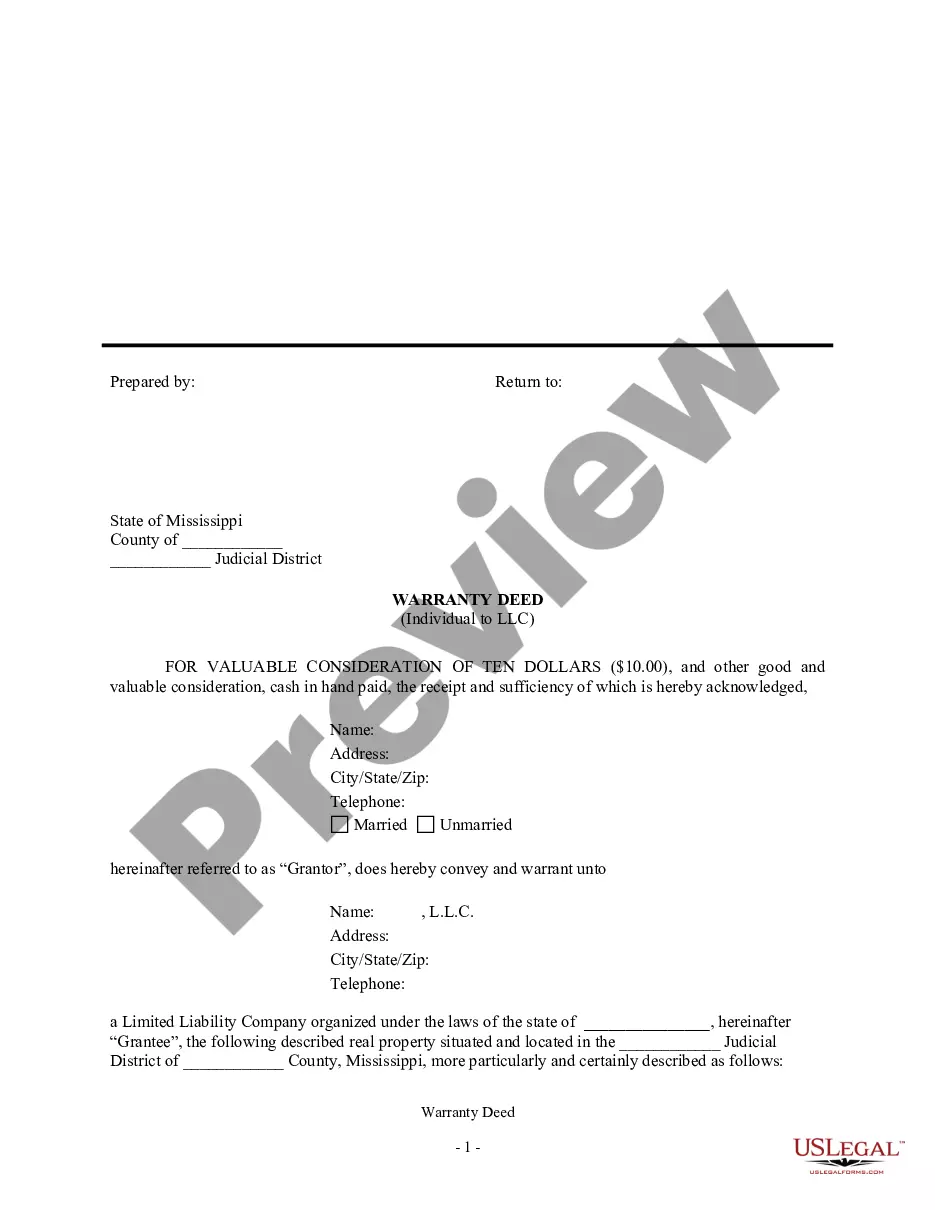

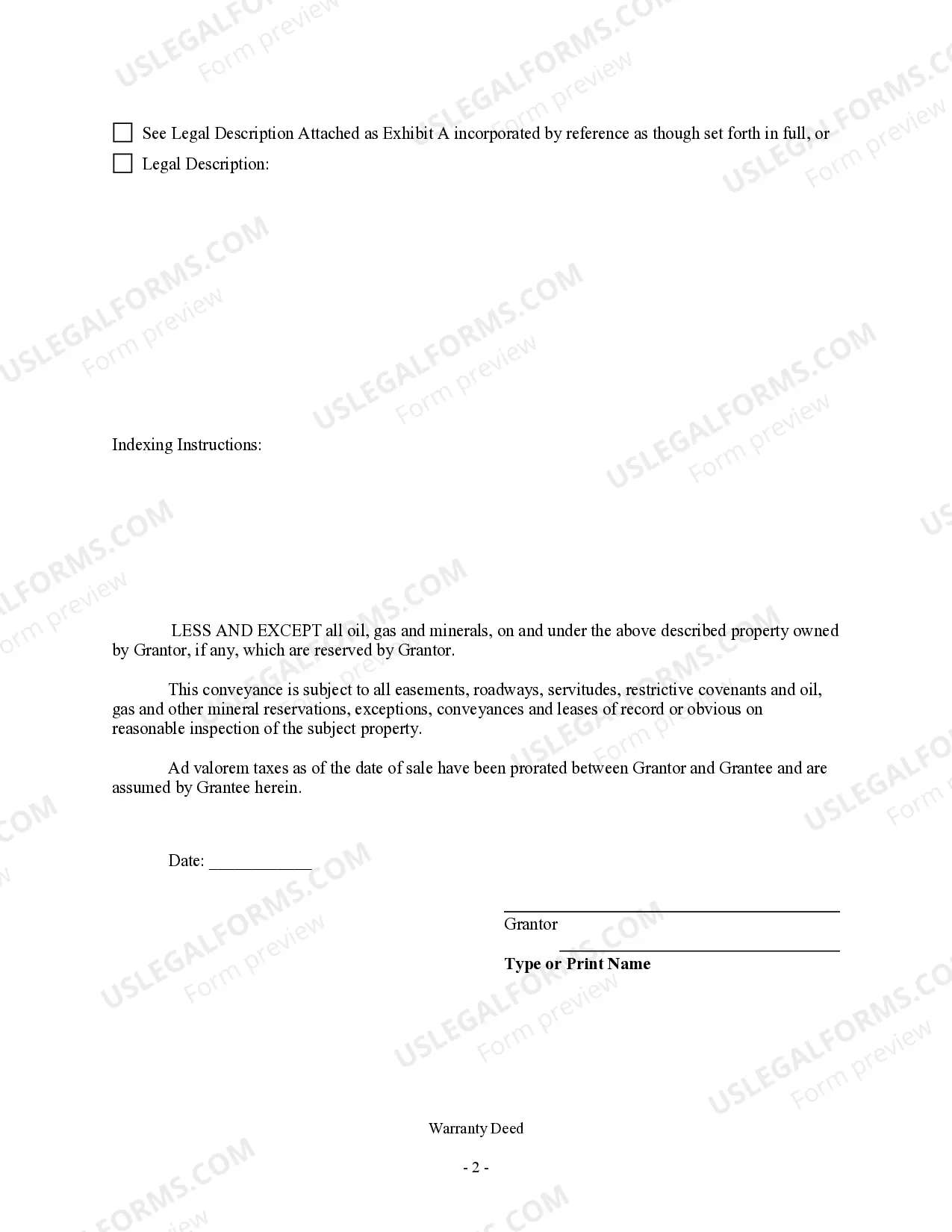

How to fill out Mississippi Warranty Deed From Individual To LLC?

Locating a reliable source to obtain the latest and applicable legal documents is part of the challenge of navigating bureaucracy.

Obtaining the right legal paperwork necessitates precision and meticulousness, which is why it is vital to source Warranty Deed Attorney Near Me samples only from reputable providers, such as US Legal Forms. A faulty template will waste your time and delay your situation. With US Legal Forms, you have minimal concerns. You can access and examine all the details regarding the document’s applicability and significance for your situation and in your jurisdiction.

Eliminate the stress associated with your legal documents. Explore the comprehensive US Legal Forms library where you can discover legal templates, verify their suitability for your needs, and download them immediately.

- Utilize the directory navigation or search box to locate your template.

- Access the form’s details to verify if it meets your jurisdiction's criteria.

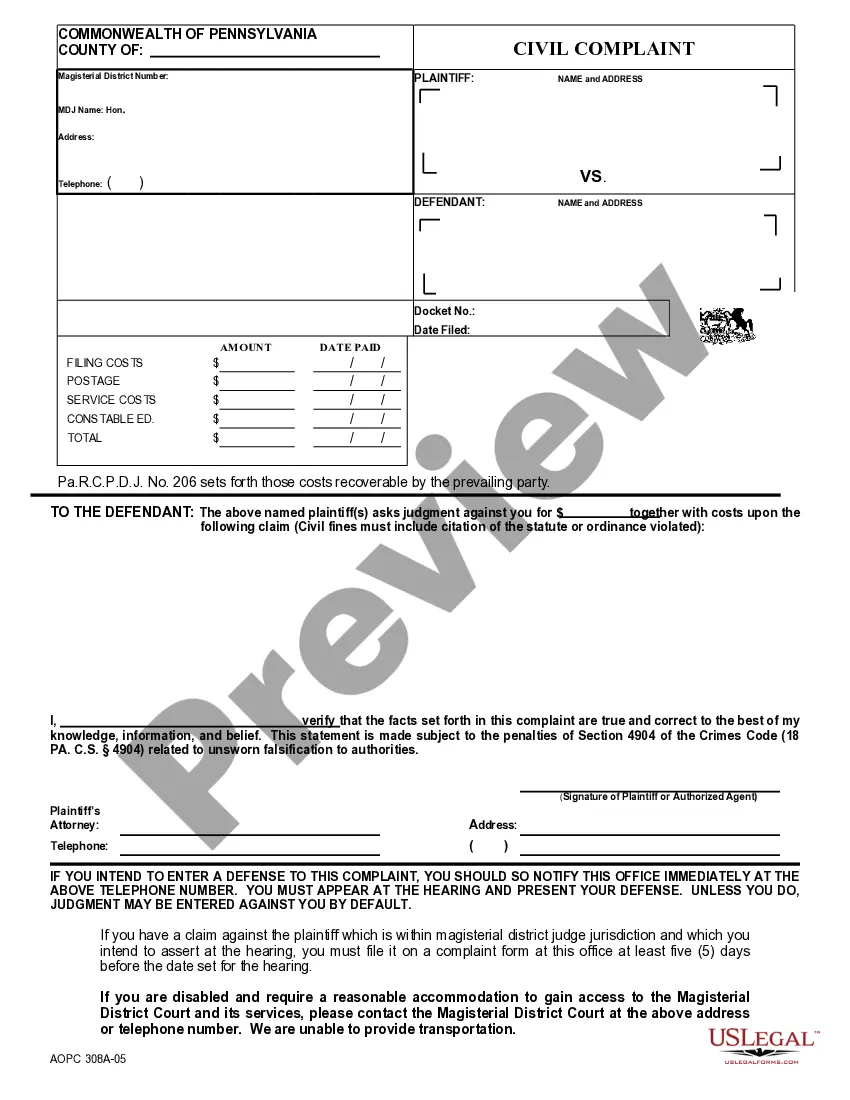

- View the form preview, if available, to confirm it is the document you are looking for.

- Go back to the search and seek the correct template if the Warranty Deed Attorney Near Me does not satisfy your needs.

- Once you are certain about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Choose the pricing plan that suits your needs.

- Proceed with the registration to complete your transaction.

- Finalize your purchase by selecting a payment option (credit card or PayPal).

- Select the file format for downloading the Warranty Deed Attorney Near Me.

- After obtaining the form on your device, you can edit it using the editor or print it out and fill it out by hand.

Form popularity

FAQ

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws.

Secured promissory notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Deed of Trust (DOT): A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. The real estate serves as the security for the promissory notes.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.