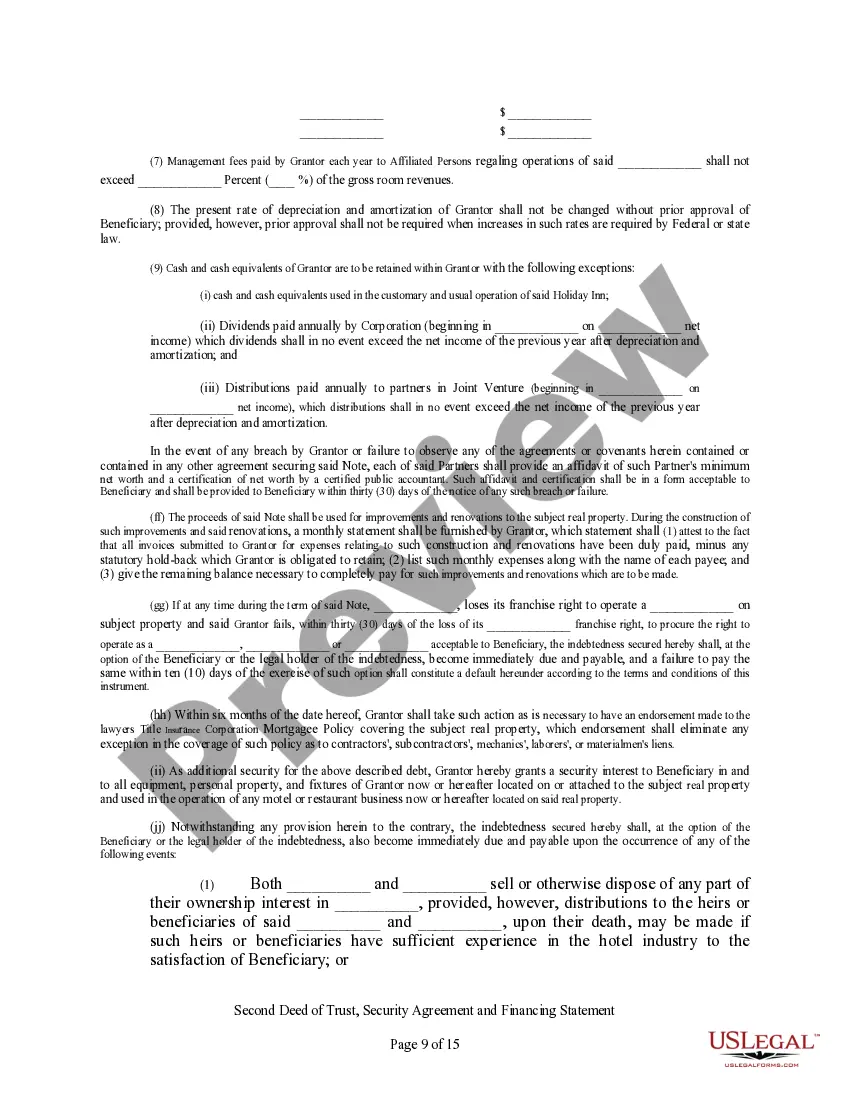

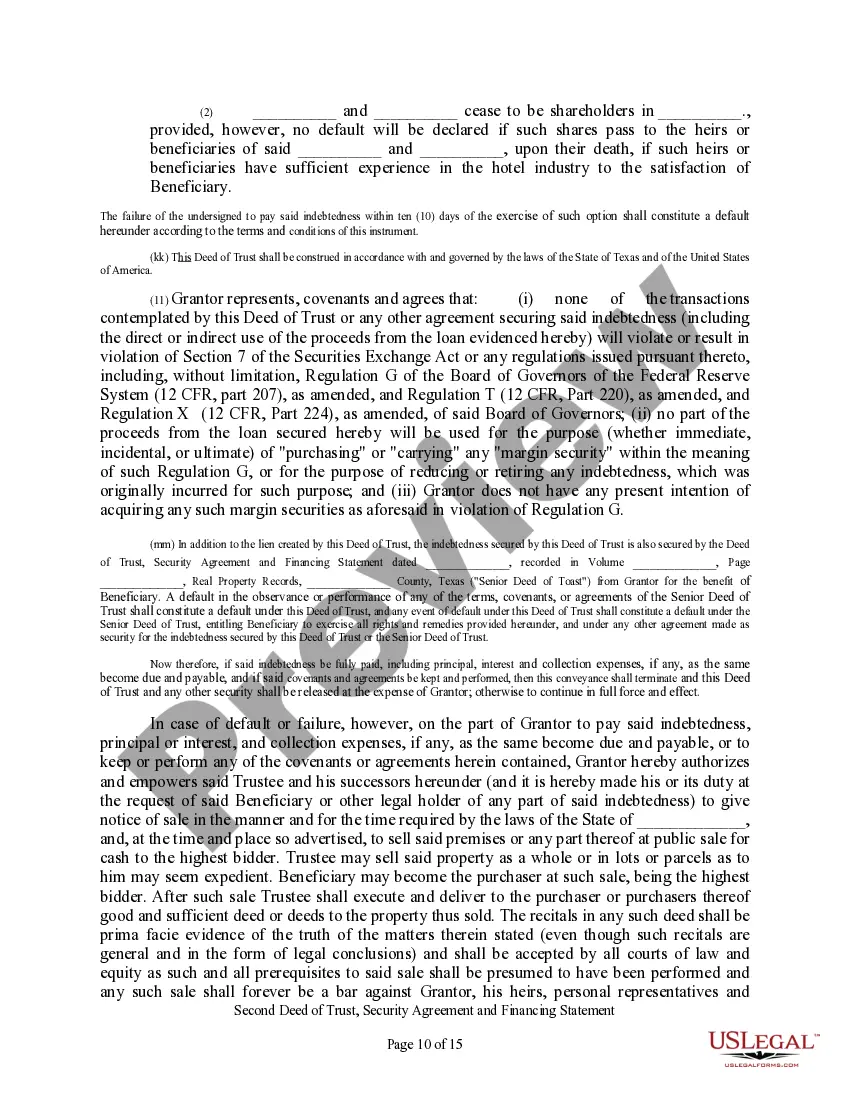

Second Deed Of Trust With Request For Notice

Description

How to fill out Second Deed Of Trust With Request For Notice?

Individuals generally link legal documentation with something complex that solely an expert can manage.

In a particular respect, this is accurate, as crafting a Second Deed Of Trust With Request For Notice requires extensive understanding of subject matter, including state and local laws.

Nevertheless, with US Legal Forms, matters have become simpler: ready-to-use legal templates for any life and business scenario tailored to state regulations are compiled in a single online directory and are now accessible to all.

All templates in our collection are reusable: once obtained, they remain saved in your account. You can access them whenever necessary through the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and area of application, allowing the search for Second Deed Of Trust With Request For Notice or any other specific template to take mere minutes.

- Existing users with an active subscription are required to Log In to their profiles and click Download to obtain the form.

- New users to the service must first establish an account and subscribe before they can store any documents.

- Here is the step-by-step instruction on how to obtain the Second Deed Of Trust With Request For Notice.

- Carefully review the page content to ensure it meets your requirements.

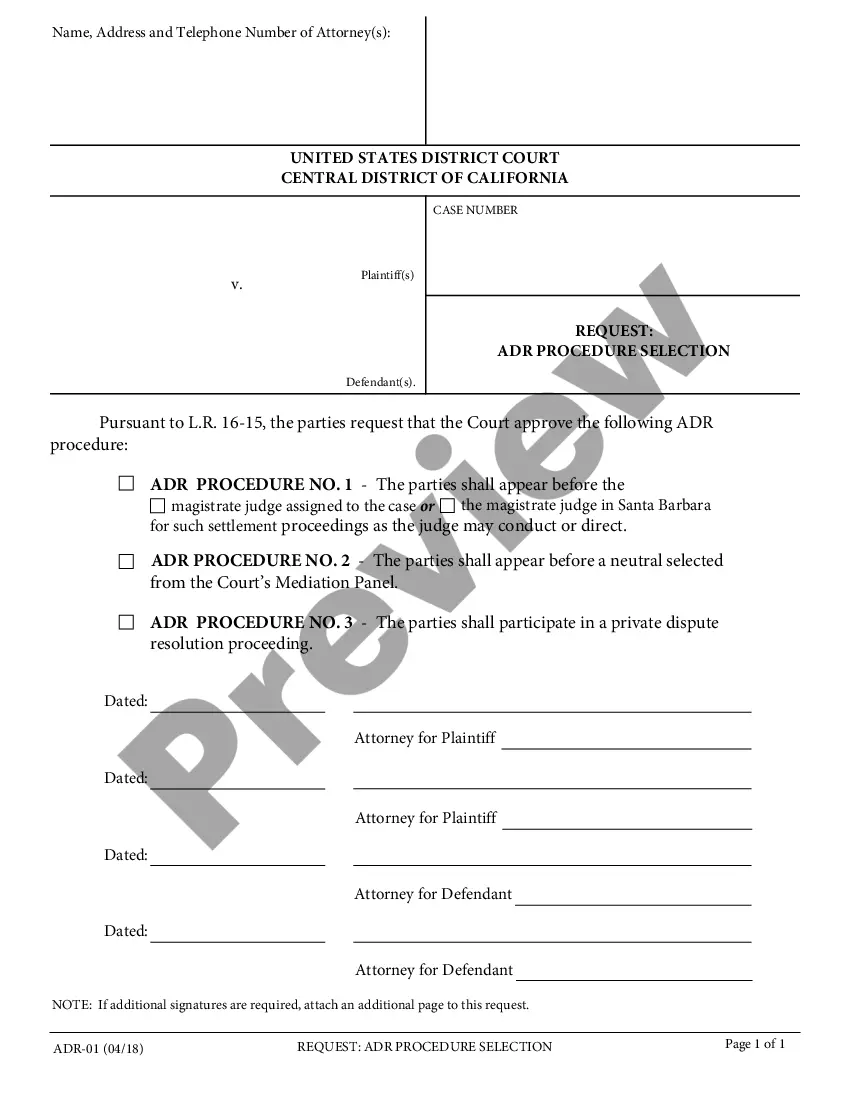

- Check the form description or look at it using the Preview option.

- If the previous one is not suitable, find another template using the Search bar at the top.

- Press Buy Now once you locate the appropriate Second Deed Of Trust With Request For Notice.

- Choose a pricing plan that suits your needs and financial situation.

- Sign up for an account or Log In to advance to the payment section.

- Complete the payment for your subscription through PayPal or your credit card.

- Select the format for your document and click Download.

- Print your document or bring it into an online editor for quicker completion.

Form popularity

FAQ

The first deed of trust is the primary lien against a property, while the second deed of trust comes into play as a secondary lien. The first deed must be settled before any payments are made towards the second. Understanding the differences between these two can prevent confusion during financial transactions. When considering these trusts, using US Legal Forms can help clarify any legal procedures, including the second deed of trust with request for notice.

A second deed of trust on a reverse mortgage often arises when additional funds are borrowed against the property. This second deed could be a measure to provide more financial flexibility for the homeowner. It is important for borrowers to understand how these deeds interact, especially the implications of a second deed of trust with request for notice. Such a notice keeps them informed about any potential foreclosure actions.

The primary difference between a first and second deed of trust is their order of priority in claim against the property. The first deed of trust takes precedence over the second deed, meaning it must be satisfied first in the event of a foreclosure. This hierarchy affects the risk level for lenders and the potential financial implications for borrowers. Knowing these differences can guide your decisions on utilizing a second deed of trust with request for notice.

A second trust deed is a financial agreement that allows a borrower to secure additional funding using their property. This deed acts as a lien on the property, subordinate to the first trust deed. It can help you leverage your home equity for renovations, debt consolidation, or other expenses. Consider using our platform for specific information on second deeds of trust with a request for notice.

Yes, a trust deed can be varied through mutual agreement among the involved parties. Any changes should be documented carefully to prevent misunderstandings. If you are dealing with a second deed of trust with request for notice, ensure any variations are also recorded to maintain clear title and financial records.

One significant disadvantage of a trust deed is that it may impact your credit score negatively. Additionally, entering into a trust deed often means losing some control over your assets. With things like a second deed of trust with request for notice, the complexities increase, making it essential to seek expert advice to navigate the implications.

Yes, you can place your house in a trust even if you have a mortgage in the UK. However, it's crucial to notify your mortgage lender about your decision. They will review the second deed of trust with a request for notice to understand how this might affect your mortgage obligations.

Updating a trust deed involves several steps, including drafting an amendment or a new deed. You must ensure that all parties involved agree to the changes. If you're working with a second deed of trust with request for notice, it is vital to file any updates with your local government for proper recording.

Absolutely, homeowners can have two trust deeds on the same property. The first trust deed typically secures the original mortgage, while a second deed of trust with request for notice serves as additional security. This arrangement allows homeowners to access additional funds but requires careful consideration of repayment terms and conditions.

Yes, you can have more than one trust deed on a property. When you have multiple trust deeds, they represent different loans secured against the same property. This can include a first trust deed and a second deed of trust with request for notice. Keeping track of these deeds is essential to managing your financial obligations effectively.