Mississippi Life Estate Deed Form With Powers

Description

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more cost-effective way of creating Mississippi Life Estate Deed Form With Powers or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates carefully put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Mississippi Life Estate Deed Form With Powers. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes little to no time to register it and explore the library. But before jumping directly to downloading Mississippi Life Estate Deed Form With Powers, follow these recommendations:

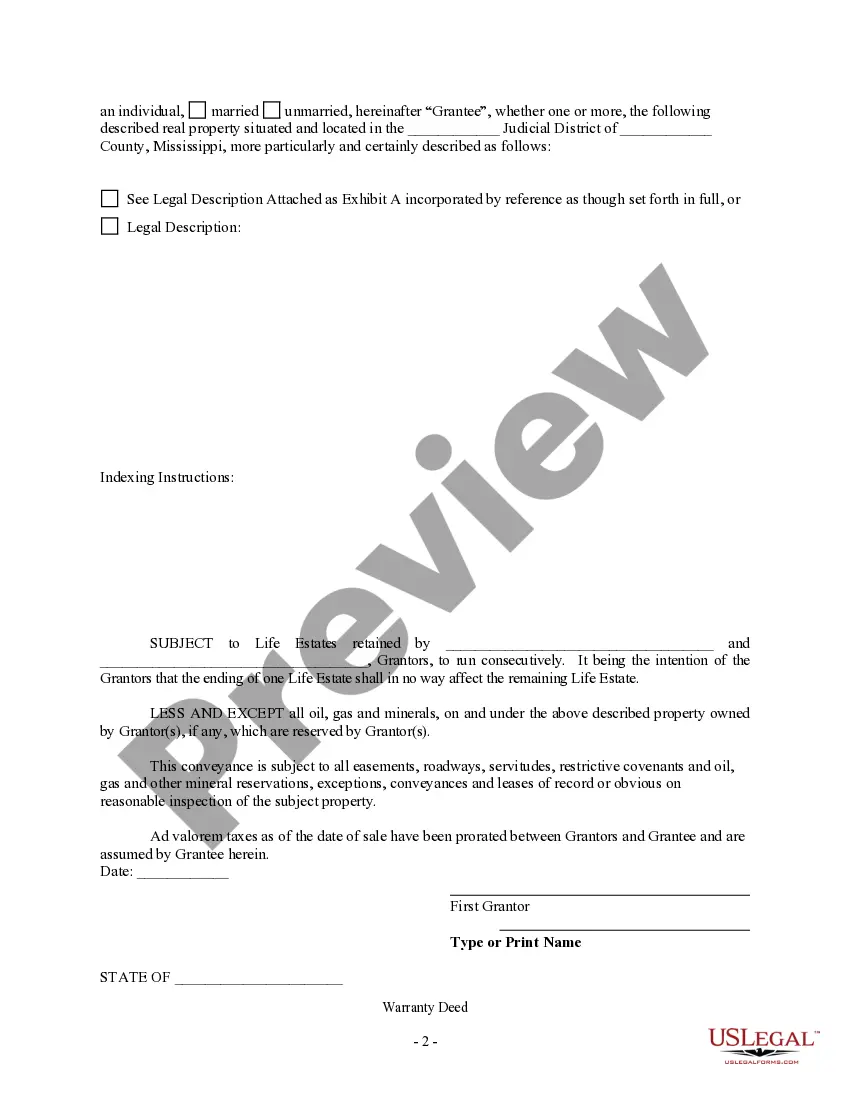

- Check the document preview and descriptions to ensure that you have found the document you are looking for.

- Check if form you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Mississippi Life Estate Deed Form With Powers.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us now and transform form completion into something easy and streamlined!

Form popularity

FAQ

Legal document is required (such as will or deed). Unless the legal document restricts rights, the life estate owner has the right to possess, use, and obtain profits from the property (such as rents). Life estate interest can be sold. Life estates do not descend to heirs.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

If a couple has a life estate and one spouse dies, the remaining spouse is the sole owner of the life estate. When the remaining spouse dies, the person holding the remainder interest then has the right to possess and use the property.