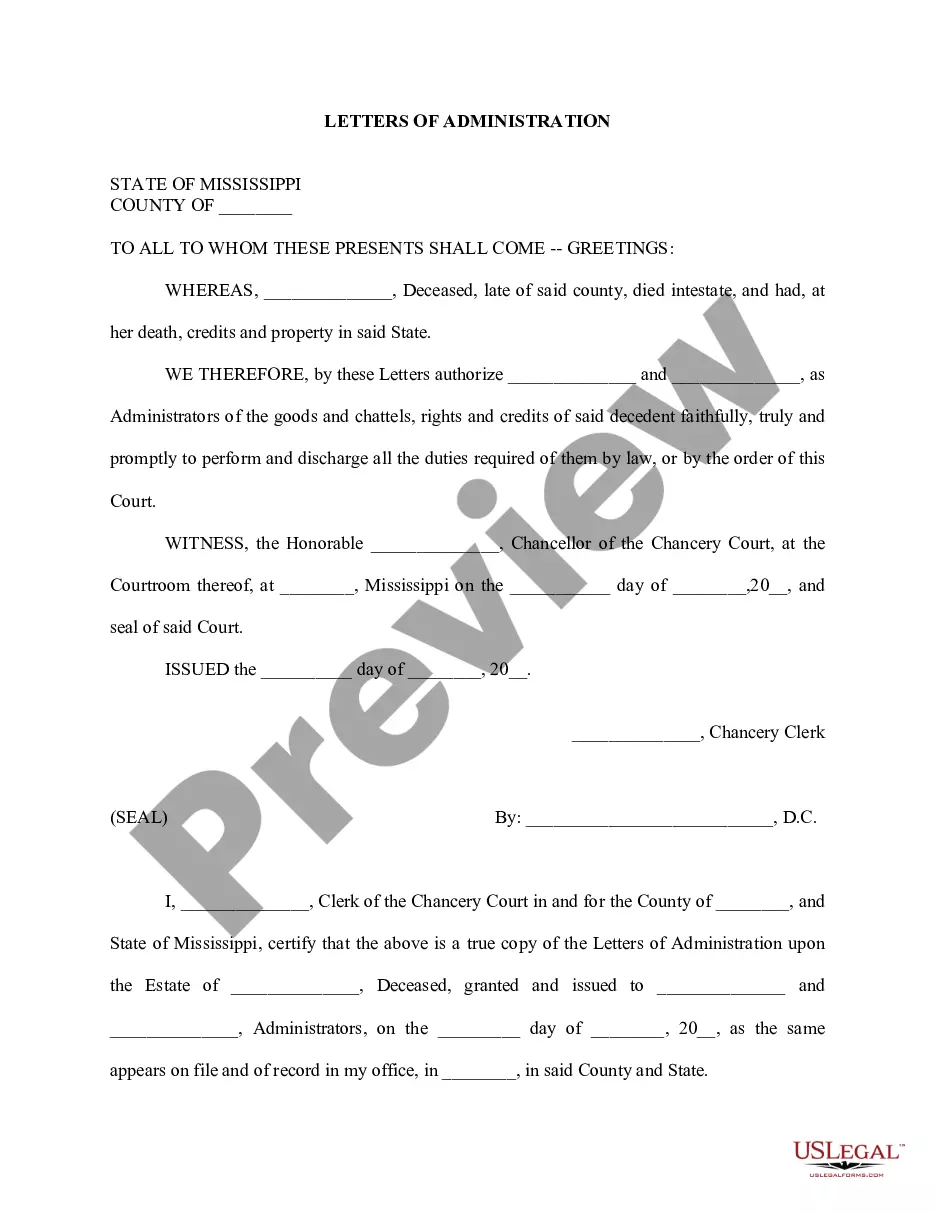

Letter From Fshs Program Administrator With The Irs

Description

How to fill out Mississippi Letter Of Administration?

Acquiring legal document examples that adhere to national and local regulations is essential, and the internet presents a variety of choices to select from.

However, what's the benefit of spending time looking for the appropriately composed Letter From Fshs Program Administrator With The Irs sample online when the US Legal Forms digital library already contains such templates consolidated in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for various professional and personal situations. They are easy to navigate with all documents categorized by state and intended use. Our experts stay updated with legal amendments, so you can always trust that your form is current and compliant when acquiring a Letter From Fshs Program Administrator With The Irs from our site.

Click Buy Now once you've found the appropriate form and choose a subscription plan. Create an account or Log In and complete the payment using PayPal or a credit card. Select the format for your Letter From Fshs Program Administrator With The Irs and download it. All documents you discover through US Legal Forms are reusable. To re-download and complete previously purchased forms, access the My documents section in your profile. Enjoy the most comprehensive and user-friendly legal document service!

- Acquiring a Letter From Fshs Program Administrator With The Irs is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the desired format.

- If you are unfamiliar with our website, follow the steps listed below.

- Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Search for another sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

To obtain a copy of your IRS nonprofit letter, you can request it directly from the IRS. You can do this by calling their customer service or submitting a request in writing. Make sure to specify your nonprofit status and mention the need for the letter from fshs program administrator with the IRS to expedite the process. This approach ensures you have the necessary documentation for your nonprofit activities.

An administrative letter is a formal communication from a governmental agency, such as the IRS, addressing specific matters regarding your tax situation. The letter from fshs program administrator with the IRS serves as an example, providing essential details about your tax status or obligations. Understanding these letters can help you stay informed about your tax responsibilities.

To request a letter from the IRS, you need to contact the IRS directly via phone or submit a written request through their website. Make sure to provide your personal details, tax identification number, and specify the letter you need, such as the letter from fshs program administrator with the IRS. By following these steps, you can ensure a timely response to your request.

You can view your IRS letters online by accessing your online account with the IRS. After logging in, navigate to the correspondence section where you can find the letter from fshs program administrator with the IRS and other communications. This method provides a convenient way to keep track of important tax information without paper clutter.

The IRS often sends letters out for various reasons, including notifications about tax return processing, audits, or changes in tax laws. These communications aim to ensure taxpayers are informed and compliant. If you've received a letter from fshs program administrator with the IRS, it is crucial to review it for important instructions and actions you may need to take.

An IRS audit letter typically contains specific information regarding the IRS's request for additional documentation. This letter is formal and outlines the points of concern in your filing. Understanding the contents of a letter from fshs program administrator with the IRS can demystify this process and guide your response.

An estate closing letter from the IRS is often necessary for settling an estate properly. This letter serves as proof that all tax obligations have been met. Additionally, if you receive a letter from fshs program administrator with the IRS, it will clarify your requirements concerning this letter.

Yes, the IRS does issue estate closing letters. This important document indicates that the IRS has completed its review of an estate tax return. Having a letter from fshs program administrator with the IRS can provide reassurance and confirmation of your estate's standing.

To obtain an IRS transcript for an estate, you can use Form 4506-T to request the document. This process can take several weeks, so it’s wise to plan accordingly. If your situation involves complex issues, consider consulting the letter from fshs program administrator with the IRS for additional guidance.

To qualify for the IRS forgiveness program, individuals typically need to meet certain income and eligibility criteria. This program is designed for taxpayers who face significant financial difficulty. If you have received a letter from fshs program administrator with the IRS, it might contain useful information regarding your eligibility.