Natural Guardian Insurance For The Future

Description

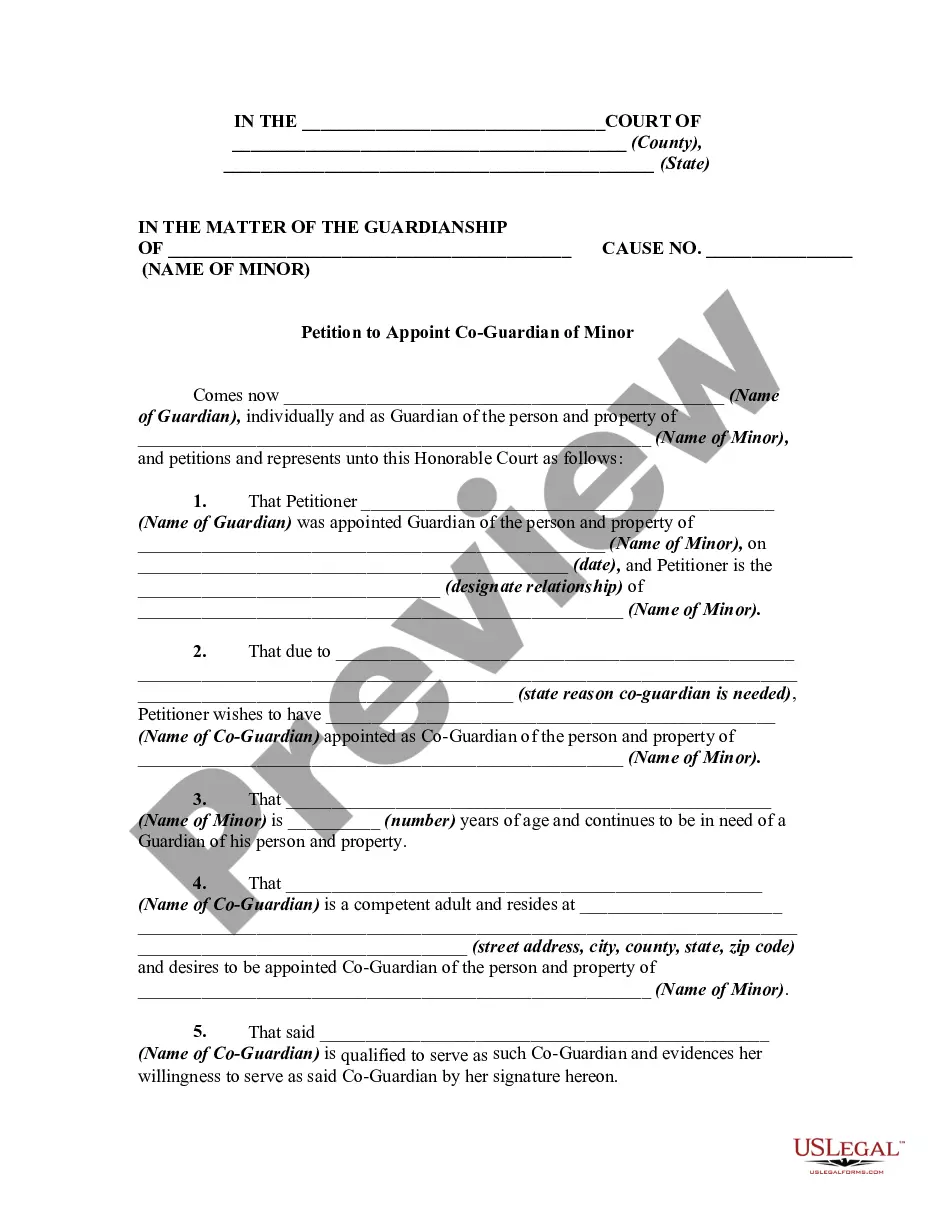

How to fill out Mississippi Petition Of Mother And Natural Guardian Of A Minor For Payment Of Insurance Proceeds?

- If you are an existing user, access your account at this link and download the desired template by clicking the Download button. Ensure you have an active subscription; renew as necessary.

- For new users, start by exploring the Preview mode and form descriptions to make sure you select a template that aligns with your legal needs and complies with your jurisdiction.

- If the initial template doesn't fit your requirements, utilize the Search feature located at the top of the page to find an alternative form that suits your needs better.

- Purchase the necessary document by selecting your preferred subscription plan and clicking the Buy Now button. A new account registration will be required for access to our extensive library.

- Complete your purchase by entering your payment information, whether via credit card or your PayPal account, ensuring secure transactions.

- Download the required form to your device for easy access. You can always retrieve it later from the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by providing a comprehensive collection of legal documents, making form execution quick and efficient. With access to over 85,000 editable legal forms, you can be sure to find what you need.

In conclusion, whether you're renewing your existing insurance plan or navigating new legal territory, US Legal Forms offers invaluable resources. Start using their service today to secure your future!

Form popularity

FAQ

Submitting a claim to Guardian requires a few straightforward steps. First, gather all necessary documents, including the policy number and a certified copy of the death certificate. Next, visit Guardian's website or contact their customer service for specific instructions regarding the Natural Guardian Insurance for the future. They will provide guidance on completing claims forms and any additional documentation required for a smooth process.

You generally have a limited time frame to claim life insurance after a death, often ranging from a few months to several years, depending on the state regulations and the specifics of the policy. It’s vital to consult with the provider of the Natural Guardian Insurance for the future, as they will provide the most accurate deadlines. Keep in mind that timely submission of your claim can expedite the process and ensure your beneficiaries receive the benefits they deserve.

To claim life insurance after death, you should start by locating the policy documents. This will typically include the details of the Natural Guardian Insurance for the future. Next, contact the insurance company or agent to understand the specific process. They will guide you through submitting necessary documentation, including a death certificate and any required forms.

Guardian offers various types of insurance, including life, health, and disability coverage. Their diverse product lineup caters to individual and family needs, ensuring every customer finds an appropriate solution. With natural guardian insurance for the future, you can achieve peace of mind, knowing you have robust coverage across multiple categories.

The future increase rider allows policyholders to increase their disability insurance coverage without providing additional evidence of insurability. This feature helps you keep your benefits aligned with rising income or inflation. By choosing natural guardian insurance for the future, you can integrate this valuable rider into your policy for added security.

Guardian consistently ranks well in customer satisfaction and financial strength, making it a trustworthy insurance company. They offer a wide array of products, including natural guardian insurance for the future, which caters to different needs. This multifaceted approach allows you to find the right plans for your unique situation.

Yes, Guardian is recognized for its robust disability insurance offerings. Many policyholders appreciate the flexible options and strong benefits that Guardian provides. With Natural guardian insurance for the future, you ensure a reliable income stream in case of unforeseen circumstances that may affect your ability to work.

Guardian Insurance is owned by the Guardian Life Insurance Company of America, an established mutual life insurance company. This ownership structure allows them to focus on the needs of policyholders rather than shareholders. When considering Natural guardian insurance for the future, it's reassuring to know that you are supported by a company dedicated to its clients.

Glic refers to the Guardian Life Insurance Company of America, commonly known as Guardian. This company specializes in various insurance products, including life, health, and disability insurance. With Natural guardian insurance for the future, you can expect comprehensive coverage options tailored to your needs.

Guardian offers a range of annuity products, making it a solid choice for those considering long-term financial planning. Many customers appreciate the reliability and strong performance of Guardian’s annuities. Additionally, with Natural guardian insurance for the future, you get a partner that facilitates a secure investment for your retirement.