Mo Attorney Missouri Withholding

Description

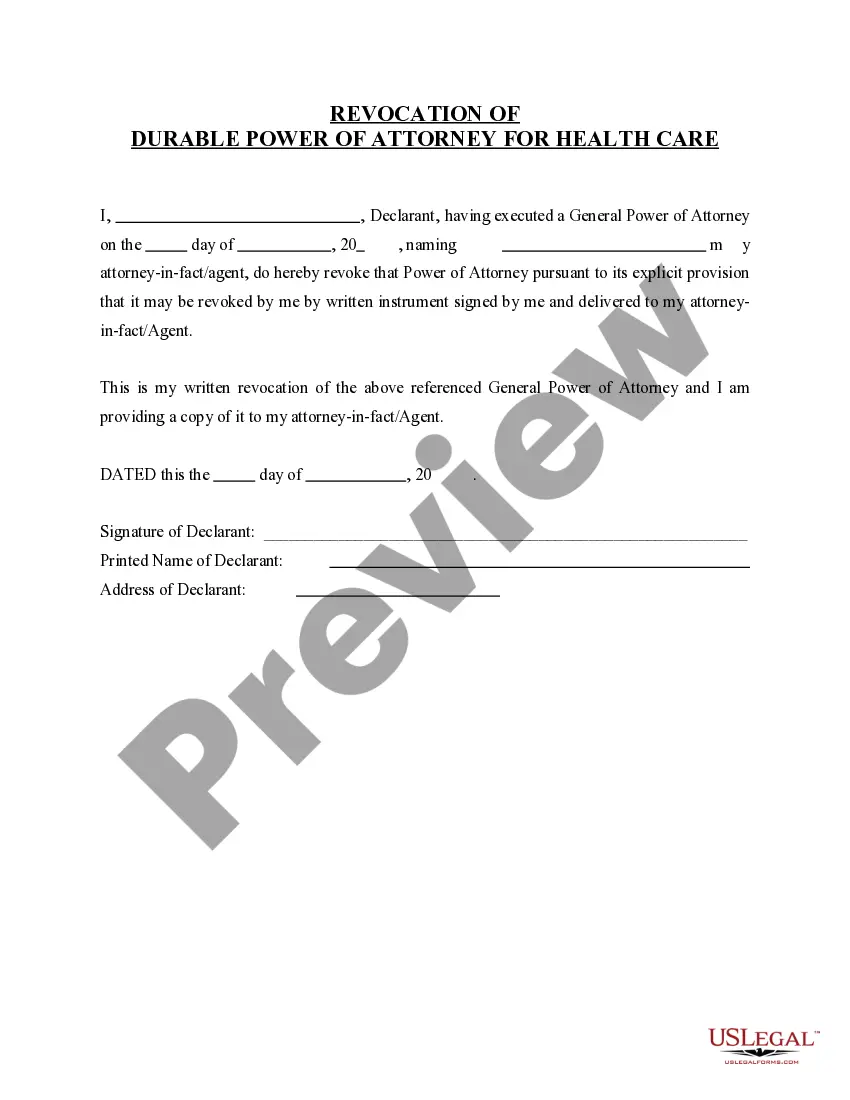

How to fill out Missouri Revocation Of Durable Power Of Attorney For Health Care?

Handling legal paperwork and processes can be a lengthy addition to your schedule.

Mo Attorney Missouri Withholding and similar forms often necessitate that you locate them and find your way to fill them out accurately.

As a result, if you are managing financial, legal, or personal issues, having a comprehensive and accessible online directory of forms when needed will greatly assist.

US Legal Forms is the premier online platform for legal documents, providing over 85,000 state-specific forms and numerous resources to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create a free account in just a few minutes and you’ll gain access to the form directory and Mo Attorney Missouri Withholding. Then, follow the instructions below to finalize your form: Make sure you have the correct document using the Preview feature and reviewing the form description.

- Browse the array of relevant documents available to you with just a click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Protect your document management activities with a high-quality service that allows you to prepare any form in minutes without additional or hidden fees.

- Simply Log In to your account, find Mo Attorney Missouri Withholding, and download it immediately in the My documents section.

- You can also access forms that you have previously saved.

Form popularity

FAQ

Missouri Withholding Tax ? Multiply the employee's Missouri taxable income by the applicable annual payroll period rate. Begin at the lowest rate and accumulate the total withholding amount for each rate. The result is the employee's annual Missouri withholding tax.

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.

Exemption from withholding. You may claim exemption from withholding for 2023 if you meet both of the following conditions: you had no federal income tax liability in 2022 and you expect to have no federal income tax liability in 2023.

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows ?

The form is divided into 5 steps. The only two steps required for all employees are Step 1, where you enter personal information like your name and filing status, and Step 5, where you sign the form. If Steps 2 ? 4 apply to you, your withholding will more accurately match your tax liability if you complete them.