Mo Attorney Missouri Form Mo-1120 Instructions

Description

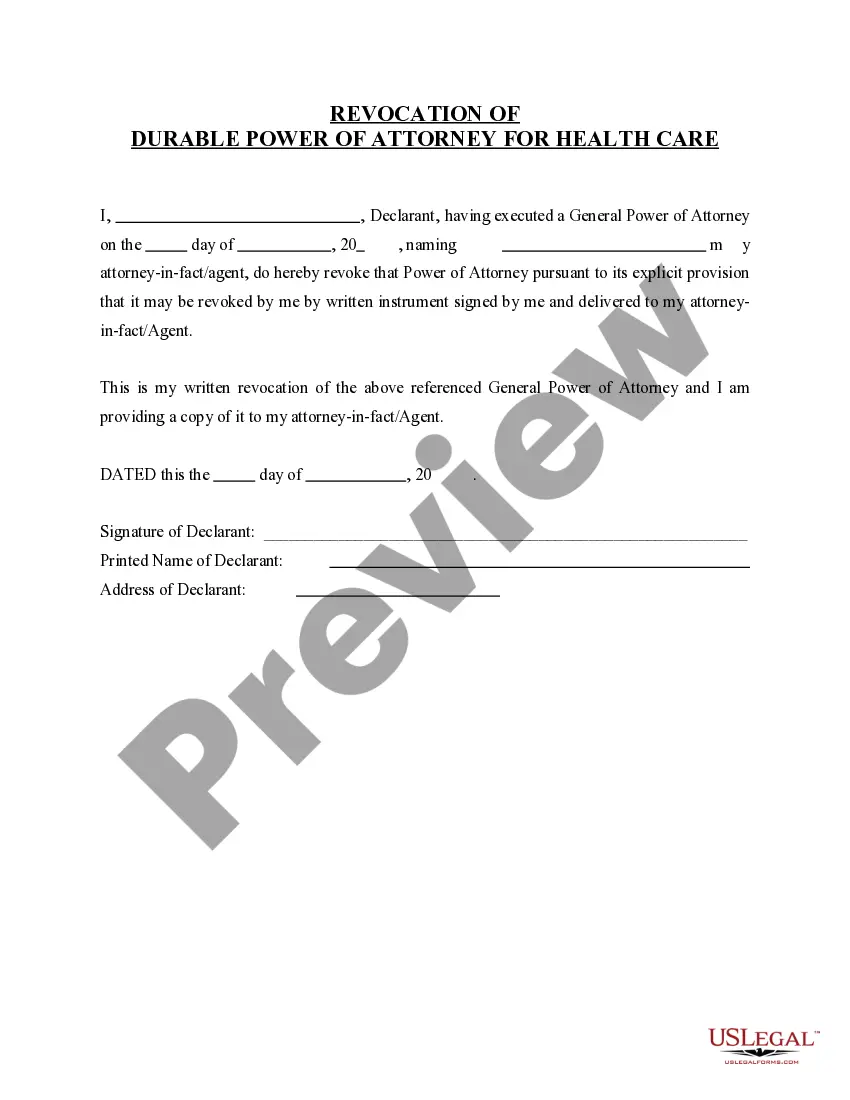

How to fill out Missouri Revocation Of Durable Power Of Attorney For Health Care?

Identifying a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucratic processes. Locating the correct legal documents requires accuracy and careful consideration, which is why it’s essential to obtain samples of Mo Attorney Missouri Form Mo-1120 Instructions only from trustworthy providers, such as US Legal Forms. An incorrect template can lead to wasted time and delay your current situation. With US Legal Forms, most concerns can be alleviated. You can access and review all the details related to the document's application and pertinence to your particular circumstances and location.

Follow these steps to complete your Mo Attorney Missouri Form Mo-1120 Instructions.

Eliminate the hassle related to your legal documentation. Browse through the detailed US Legal Forms catalog where you can discover legal samples, check their applicability to your situation, and download them right away.

- Utilize the library navigation or search function to find your template.

- Review the form’s description to verify if it aligns with your state and county’s requirements.

- View the form preview, if available, to confirm it is the correct document you need.

- Continue searching for the suitable template if the Mo Attorney Missouri Form Mo-1120 Instructions does not meet your requirements.

- Once you are confident about the form’s relevance, download it.

- If you have an authorized account, click Log in to verify and access your selected forms in My documents.

- If you haven't set up an account yet, click Buy now to acquire the form.

- Select the pricing option that best meets your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Mo Attorney Missouri Form Mo-1120 Instructions.

- Once you have the form on your device, you can edit it with the editor or print it and complete it by hand.

Form popularity

FAQ

Line 4. Line 4 asks for your corporation's dividends and inclusions. To fill out line 4, you must complete Schedule C (Dividends, Inclusions, and Special Deductions) which begins on page 2 of 1120. Record the total dividends and inclusions from line 23 column a of Schedule C here.

C corporations use Form 1120 to calculate their taxes due. S corporations use Form 1120S as an information return. S corporations must also prepare a form 10 K-1 for each shareholder to include with their individual returns.

Every corporation, as defined in Chapter 143, RSMo, is required to file a return of income in Missouri for each year it is required to file a federal income tax return and has gross income from sources within Missouri of $100 or more.

If you have a refund or have no amount due, mail your return to: Missouri Department of Revenue, P.O. Box 700, Jefferson City, MO 65105-0700. If you have a balance due, payments must be postmarked by April 18, 2022, to avoid interest and late payment charges.

Schedule UTP (Form 1120) asks for information about tax positions that affect the U.S. federal income tax liabilities of certain corporations that issue or are included in audited financial statements and have assets that equal or exceed $10 million.