Landlord Tenant Laws Without A Lease

Description

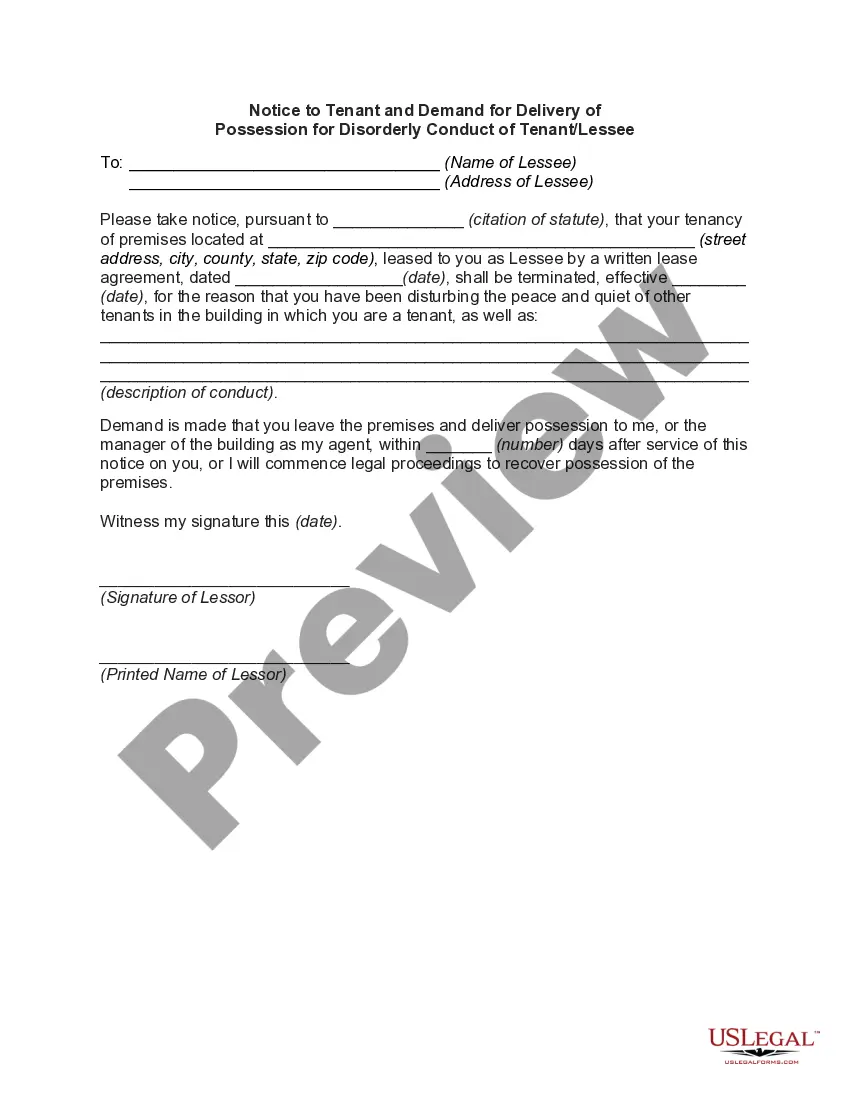

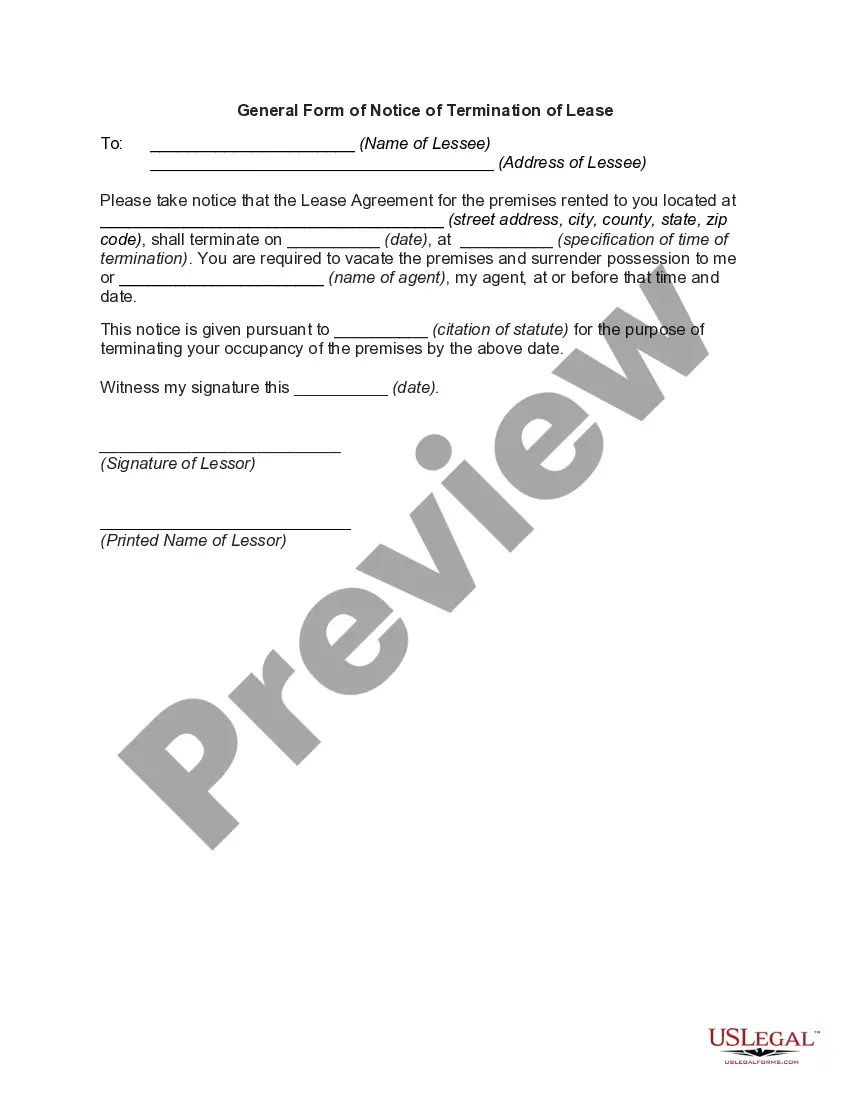

How to fill out Missouri Landlord Notices For Eviction / Unlawful Detainer Forms Package?

Navigating legal documents and processes can be a lengthy addition to your daily schedule.

Landlord Tenant Laws Without A Lease and similar forms generally necessitate you to search for them and understand how to fill them out efficiently.

For this purpose, whether managing financial, legal, or personal issues, possessing a comprehensive and accessible online repository of forms when required will greatly assist.

US Legal Forms is the leading online service for legal templates, offering over 85,000 state-specific documents alongside various resources to expedite your document completion.

Is this your first time using US Legal Forms? Sign up and create a complimentary account within minutes to gain access to the form library and Landlord Tenant Laws Without A Lease. Then, follow the steps outlined below to complete your document: Ensure you have located the correct form using the Review option and examining the form details. Click Buy Now when prepared, and choose the subscription plan that suits your requirements. Select Download, then fill out, eSign, and print the document. US Legal Forms brings twenty-five years of expertise in aiding individuals manage their legal paperwork. Find the document you require today and streamline any process effortlessly.

- Browse the collection of relevant documents available at your fingertips with just one click.

- US Legal Forms provides you with state- and county-specific documents available for download at any time.

- Safeguard your document management processes with a premier service that enables you to assemble any document in mere minutes without any extra or concealed charges.

- Simply Log In to your account, find Landlord Tenant Laws Without A Lease and download it immediately from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

Does a small company that operates as a sole proprietorship need an employer identification number (EIN)? A sole proprietor without employees and who doesn't file any excise or pension plan tax returns doesn't need an EIN (but can get one).

While there's no mandatory action to create a sole proprietorship, you can follow four straightforward steps to kickstart your business: Choose A Business Name. File A Fictitious Business Name Statement With Your County. Apply For Licenses, Permits, And Zoning Clearance. Obtain An Employer Identification Number (EIN)

You don't need to take any legal steps to form this type of business. If you are the only owner and begin conducting business, you automatically become a sole proprietorship. There is no need to formally file paperwork or submit anything at the federal, state, or local level to be recognized as such.

A sole proprietorship is an unincorporated business that one person owns and manages. As the business and the owner are not legally separate, it is the simplest form of business structure. It is also known as individual entrepreneurship, sole trader, or simply proprietorship.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

You don't have to file a document to ?form? your Sole Proprietorship in California, you're already a business owner. However, there are a few things you may need to (or want to) do in order to operate legally. For example, your business may need a license or permit to operate.

And, as is the case with other types of business entities, sole proprietors are also subject to self-employment taxes. As a sole proprietor, instead of filing a separate tax return for your business, you report your business income on IRS Form 1040, using Schedule C to report your business profit or loss.