Living Trust Form With Bank Statement

Description

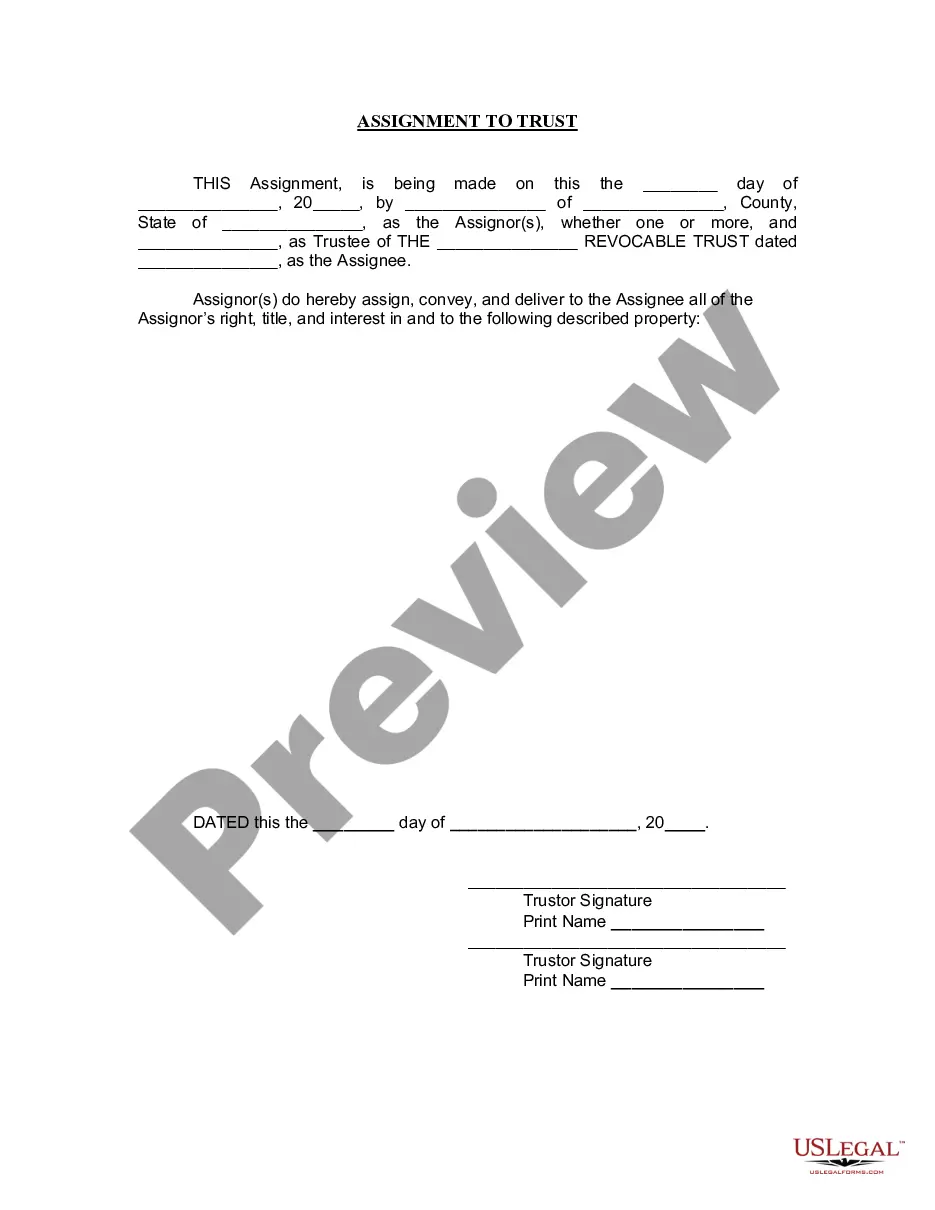

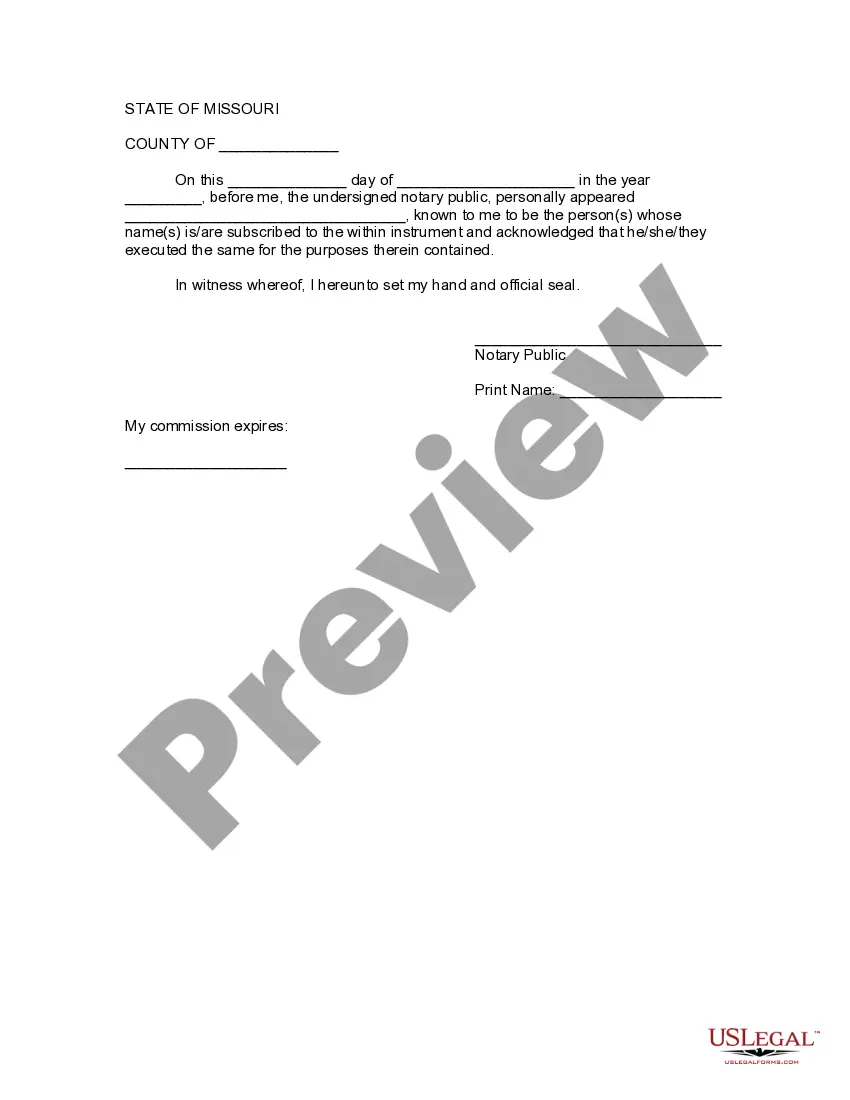

How to fill out Missouri Assignment To Living Trust?

- If you're a returning user, log in to your account and access your desired forms directly to your device by clicking the Download button. Ensure your subscription is up-to-date; if not, renew it.

- For new users, start by browsing the Preview mode and description of the living trust form. Confirm that it aligns with your needs and local jurisdiction requirements.

- If necessary, search for additional templates using the Search tab to find a more suitable form. Once you've identified the right one, proceed to the next step.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account for full access to our extensive library.

- Complete your purchase by submitting your payment details via credit card or PayPal, granting you access to premium resources.

- Finally, download your form to your device and easily complete or access it later from the My Forms section of your profile.

US Legal Forms provides the ultimate convenience for both individuals and attorneys, equipping you with a vast selection of over 85,000 fillable legal forms and packages.

Take the first step towards securing your assets today! Visit US Legal Forms to get started.

Form popularity

FAQ

The main downfall of having a trust is that it can create additional responsibilities and administrative tasks. Setting up and maintaining a trust requires regular updates and documentation to stay compliant. Moreover, you may incur fees for legal and management services. Therefore, assessing your needs carefully before creating a trust using a living trust form with bank statement is vital.

Yes, including bank accounts in a living trust can provide significant benefits. It allows for smoother asset transfer upon your passing, bypassing the probate process. However, it's essential to consider the implications and ensure proper management of the trust. Utilizing a living trust form with bank statement can help you incorporate your bank accounts efficiently.

The biggest mistake often made by parents is failing to fund the trust properly. After creating a trust, it is crucial to transfer assets into the trust to ensure they are protected and managed effectively. Otherwise, the trust serves no functional purpose. Using a living trust form with bank statement can help streamline the funding process and avoid this common pitfall.

Putting assets in a trust can lead to loss of immediate access to those assets. This means that if you need to use the assets for an emergency, you may face challenges accessing them promptly. Furthermore, establishing a living trust requires careful planning and can sometimes incur legal fees. Therefore, it's crucial to consider these aspects when filling out a living trust form with bank statement.

A family trust can sometimes limit your control over your assets. When you transfer assets into a trust, they become the property of the trust, and you may lose some flexibility in managing them. Additionally, there can be ongoing administrative fees and complexities involved in maintaining the trust. Thus, it's important to weigh these factors before using a living trust form with bank statement.

To transfer a bank account to your living trust, begin by obtaining the necessary living trust form with bank statement sections filled out. Then, contact your bank to inform them of your intent to transfer ownership to the trust. Typically, you will need to provide your trust documents and complete the bank's required forms for a smooth transition. This process ensures that your funds are managed according to your wishes.

Yes, putting bank accounts in a living trust can simplify the transfer of your assets after your passing and help avoid probate. This approach ensures that your beneficiaries can access funds promptly without unnecessary delays. Using a living trust form with bank statement details helps streamline this process and reinforces your asset management strategy.

To put your bank account into a living trust, you will need to complete a living trust form with bank statement information. First, open your living trust and identify the bank account you wish to transfer. Next, visit your bank and request the process for changing the account ownership to the trust. This usually involves filling out specific forms and providing the trust documentation.