Living Trust Form With Bank Account

Description

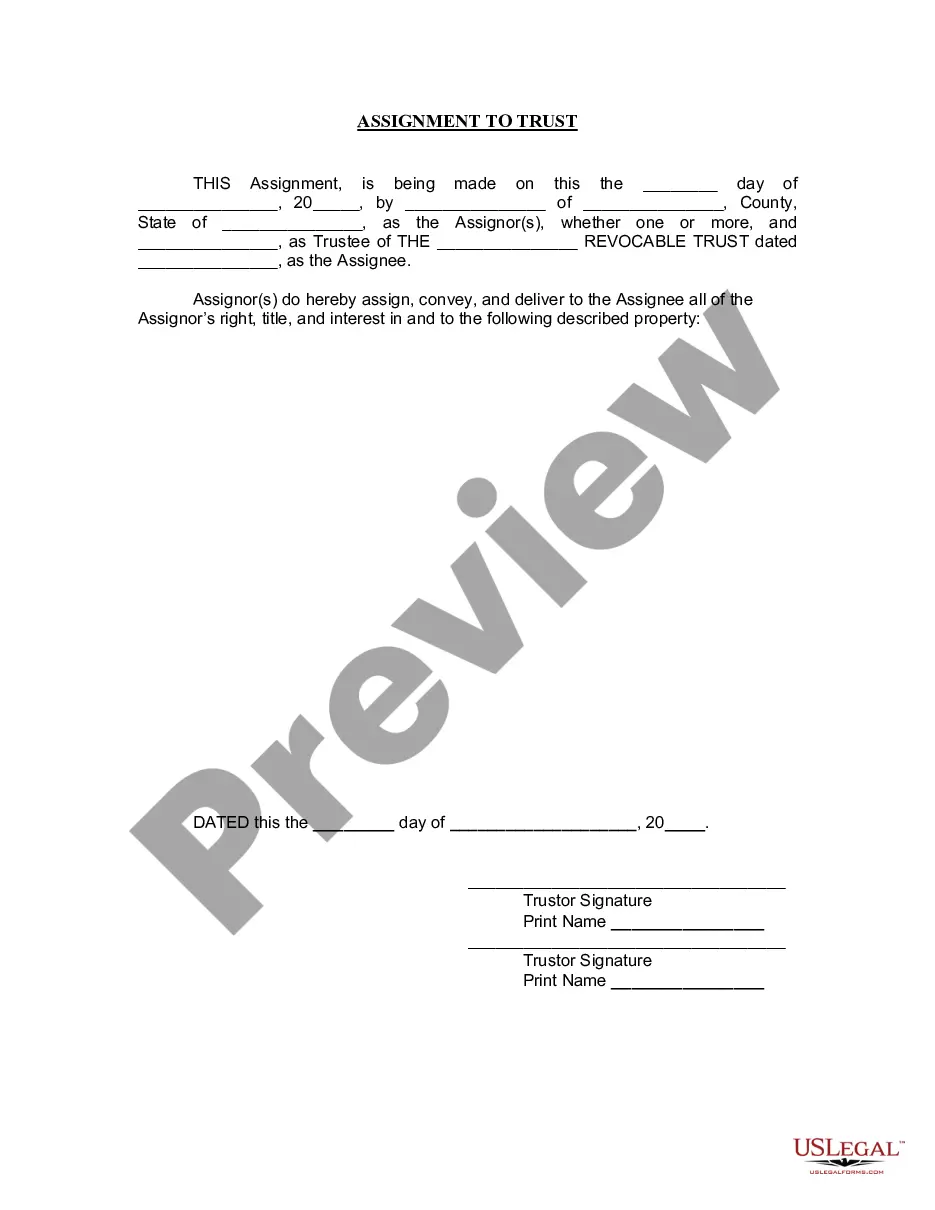

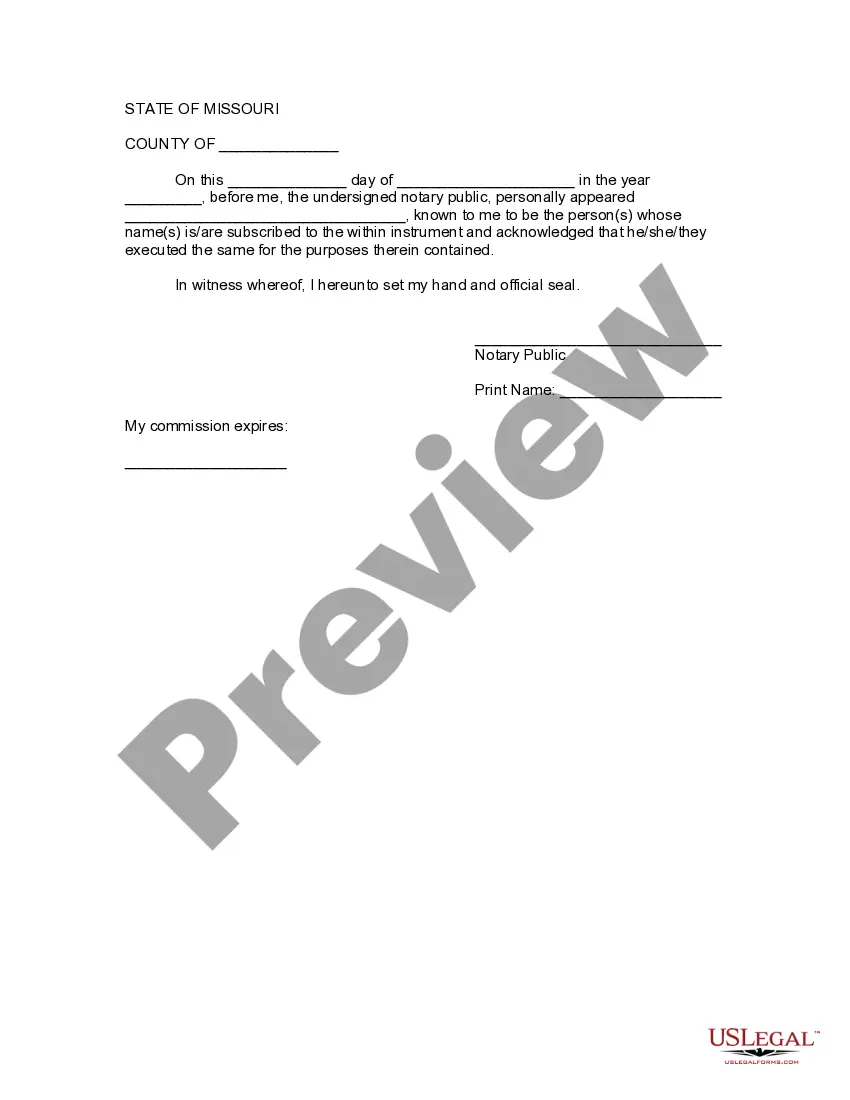

How to fill out Missouri Assignment To Living Trust?

- Visit the US Legal Forms website and log in if you are an existing user. Ensure your subscription is active for uninterrupted access.

- Browse the preview mode and ensure you select the suitable living trust form with bank account that meets your specific needs.

- If you do not find the appropriate form, use the search feature to locate other options tailored to your requirements.

- Once the correct document is identified, click on the Buy Now button to proceed with purchasing the form.

- Complete your payment by providing your credit card details or using PayPal, and create a user account for full access to the library.

- Download the form directly to your device, and you can always revisit it later in your My Forms section.

US Legal Forms stands out with its extensive collection of over 85,000 editable legal forms, making it your go-to resource for legal documentation.

Start your journey to secure legal peace of mind by visiting US Legal Forms today and accessing the right living trust form for your needs.

Form popularity

FAQ

Certain assets are typically better kept outside a trust. For example, retirement accounts like IRAs often have specific tax implications when placed in a trust. Additionally, personal properties that might require frequent access or management, like vehicles, might not be ideal. Make sure to consult with a professional to determine how a living trust form with bank account can fit your overall strategy.

Many banks have moved away from offering dedicated trust accounts because of the increased regulatory requirements. These accounts often require more management and oversight than standard accounts. If you are looking for a living trust form with bank account, using a trust may be more straightforward without additional banking restrictions.

Deciding whether to place your checking account in a trust depends on your financial goals. If your priority is to avoid probate and ensure smooth asset transfer, a living trust form with bank account may be beneficial. However, if you need easy access to your funds for regular transactions, it might be better to keep the account outside of the trust.

Placing a checking account in a trust can complicate your finances. It may limit your access to funds for everyday expenses. Additionally, a living trust form with bank account may require additional administration and paperwork, which can be cumbersome. Instead, consider keeping your checking account separate to retain flexibility.

Determining whether your parents should place their assets in a trust depends on specific circumstances and goals. A living trust form with bank account can streamline the transfer of assets, reduce probate costs, and provide a clear plan for asset distribution. However, it’s advisable for them to consult with an estate planning attorney to evaluate their needs and ensure that a trust aligns with their objectives. Having an informed decision will benefit their financial legacy.

The primary downside of putting assets in a trust can include the loss of direct control over those assets. When you create a living trust form with bank account, the legal title of the assets transfers to the trust, which may complicate access. Furthermore, if the trust is not structured correctly, it could lead to unwanted tax implications or other unintended consequences. To avoid these issues, consider getting guidance from professionals.

While having a trust provides many benefits, a common downfall is the complexity it introduces to your estate planning. Managing a living trust form with bank account involves ongoing responsibilities, including proper record-keeping and compliance with legal requirements. If the trust is not administered correctly, it may not offer the intended protection or advantages. It's crucial to stay informed and regularly review your trust arrangements.

To put your bank account into a living trust, start by preparing the necessary documentation, including your living trust form with bank account specifics. Next, visit your bank, as they typically require you to fill out a transfer form and present the trust document. Once completed, your account will be held in the trust, securing your assets for your heirs without the hassle of probate.

Transferring a bank account to a living trust involves a few straightforward steps. First, complete the living trust form with bank account details. Then, contact your bank to inquire about their specific requirements for transferring ownership to the trust. This often includes providing a copy of the trust document and signing necessary forms, ensuring the account is correctly funded.

Yes, placing bank accounts in a living trust can be beneficial. This approach allows for smoother management and transfer of assets upon your passing. Additionally, a living trust form with bank account ensures that your funds are accessible to your beneficiaries without going through a lengthy probate process. Overall, it simplifies estate management and provides peace of mind.