Trust Account For Investment

Description

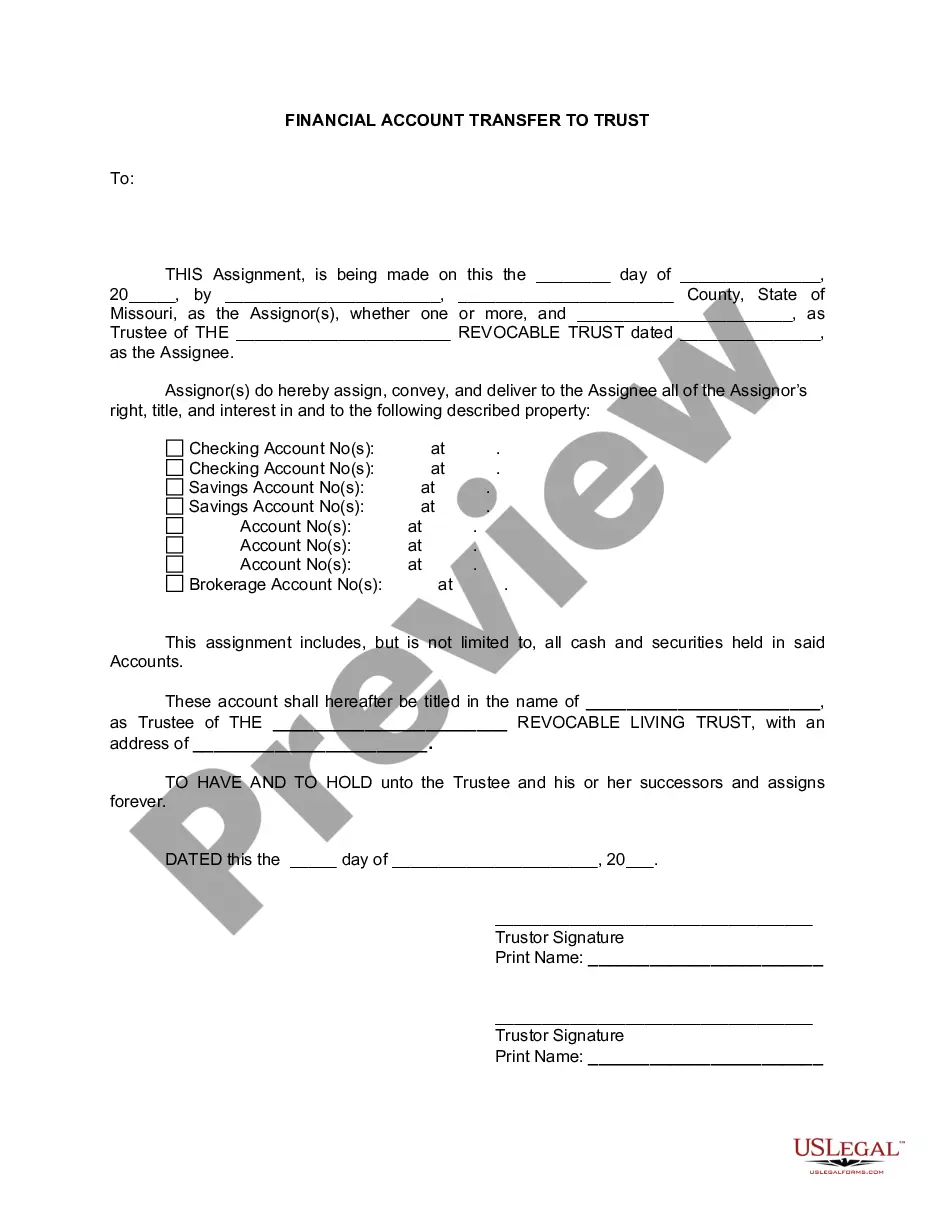

How to fill out Missouri Financial Account Transfer To Living Trust?

- If you're a returning user of US Legal Forms, log in to your account and check the subscriptions. Make sure it's active to enable downloads.

- If you're new to the service, begin by reviewing the form descriptions in the Preview mode to ensure you select the appropriate document that matches your needs and jurisdiction.

- If the initial template is not suitable, utilize the Search tab to explore other available forms designed for your exact requirements.

- Once you find the correct document, click on the Buy Now button and select your desired subscription plan. You'll need to create an account for full access.

- Proceed to the checkout by entering your payment information, whether using a credit card or PayPal for the purchase.

- After the transaction is complete, download the form and save it on your device. You can access it later from the My Forms section of your profile.

Taking advantage of US Legal Forms means utilizing a vast library that includes over 85,000 easily editable templates. Whether you are an individual or an attorney, you can depend on their resources for creating precise legal documents.

Don’t wait any longer; start your journey towards effective investment management by accessing US Legal Forms today!

Form popularity

FAQ

Yes, you can set up a trust fund by yourself, but it is essential to understand the legal requirements involved. A trust account for investment offers flexibility, but a well-structured trust ensures that your wishes are honored. By using tools from Uslegalforms, you can navigate the setup process confidently, ensuring that all necessary legal documents are correctly completed.

Filling out a trust fund requires careful attention to details. First, gather information about the assets you wish to include in your trust account for investment. Next, specify the beneficiaries and the terms for disbursement of the funds. Platforms like Uslegalforms provide templates and guidance that make this process easier, ensuring you include all essential components accurately.

A trust investment account works by allowing a trustee to take control of the assets placed in the trust, managing them on behalf of the beneficiaries. The trustee makes decisions regarding investments and distributions, following the guidelines set forth in the trust document. By establishing a trust account for investment, you create a reliable structure that ensures your assets are managed with care and prudence.

The main purpose of a trust account is to manage and protect assets on behalf of beneficiaries. This structure ensures that the assets are used in accordance with the wishes of the grantor, providing peace of mind and financial security. A trust account for investment helps facilitate the growth of assets while maintaining clear guidelines for their use.

While trust accounts provide various benefits, they can also come with potential disadvantages. One key drawback is the setup and ongoing management costs, which can be higher than traditional investment accounts. Additionally, using a trust account for investment may involve complex legalities that could require professional guidance, possibly complicating the overall process.

Trust accounts are generally a good idea for individuals who want to manage their assets efficiently and ensure they benefit the designated beneficiaries. They offer legal protections and can provide a strong framework for long-term wealth management. By utilizing a trust account for investment, you can simplify the transfer of assets and potentially minimize tax implications.

A trust investment account is a financial arrangement wherein an individual, called a trustee, manages assets for the benefit of another person or group, known as the beneficiaries. This type of account allows for structured investment management and can provide significant advantages, especially in estate planning. If you’re looking to secure your assets while making them work for you, a trust account for investment can be an excellent choice.

The best bank for opening a trust account often depends on your specific requirements and investment goals. Banks like TD Ameritrade and Charles Schwab offer robust investment tools and resources to manage your trust account effectively. It is wise to evaluate the services each bank provides, including online banking features and customer support. Discovering the right fit can significantly enhance your investment strategy.

Many banks provide trust account options tailored for investment purposes. Popular choices include Wells Fargo, Bank of America, and Chase, known for their comprehensive financial services. When selecting a bank, consider factors such as fees, minimum balance requirements, and investment options. Comparing these elements will help you find the right trust account for your investment needs.

To open an investment account for a trust, you first need to establish the trust legally, providing details about the trust's purpose and terms. Once set up, you can apply for an investment account through your chosen financial institution, often requiring a tax identification number. Utilizing platforms like USLegalForms can streamline the trust setup process, making it easier for you to manage your investment effectively.