Trust Account For Attorney

Description

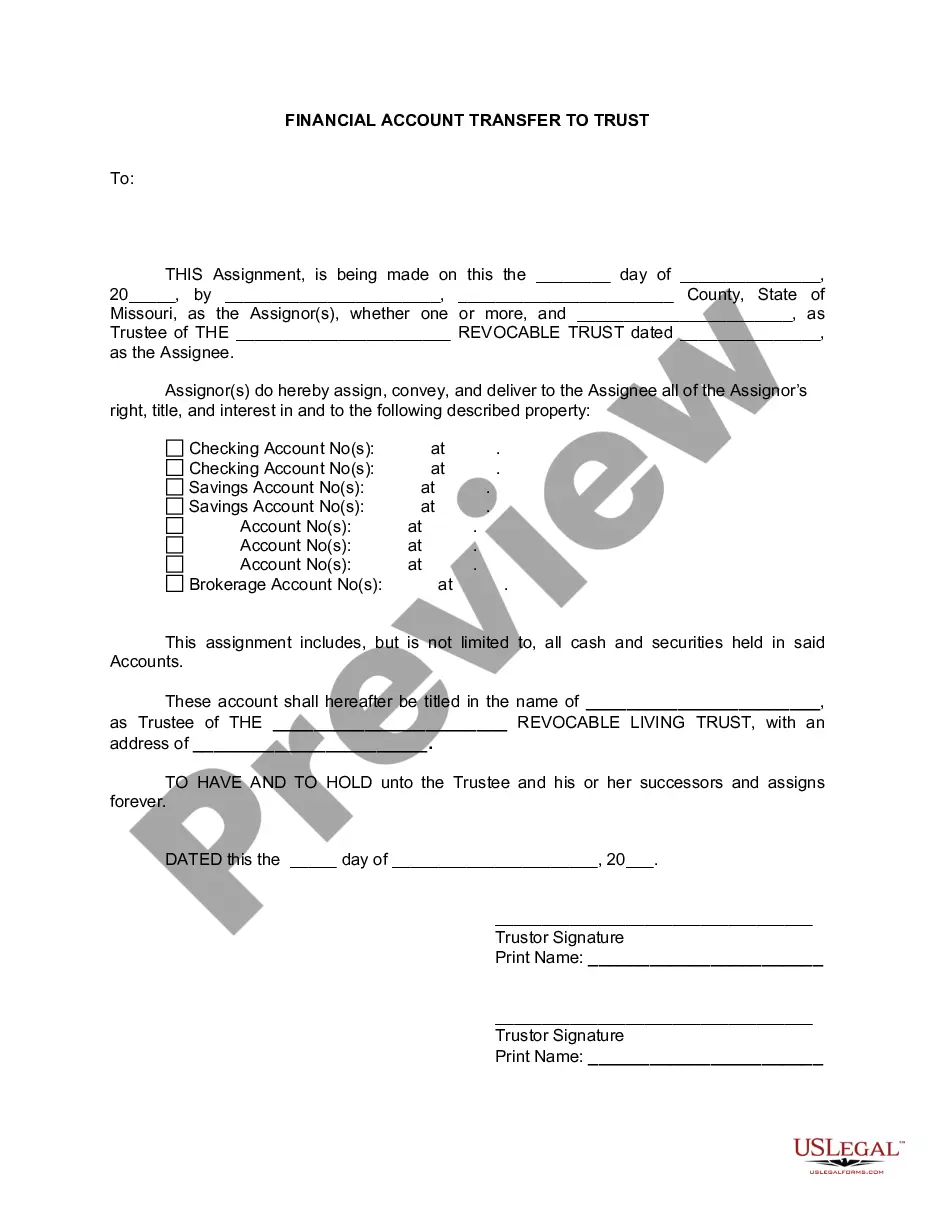

How to fill out Missouri Financial Account Transfer To Living Trust?

- Start by logging into your US Legal Forms account. If you're a first-time user, register for an account.

- Browse the extensive library of over 85,000 legal forms. Use the Preview mode to review descriptions and ensure you've selected the right form for your trust account needs.

- If necessary, utilize the Search tab to find any additional templates that may suit your requirements.

- Choose the document you need by clicking the Buy Now button and select your subscription plan for ongoing access.

- Complete the purchase by entering your payment info through credit card or PayPal. Confirm your subscription to unlock the full library.

- After payment, download your form to your device and access it anytime via the My Forms section for future use.

By following these steps, you can effortlessly establish a trust account for your attorney practice, equipped with all necessary legal documentation.

Don't hesitate! Start accessing US Legal Forms today to simplify your legal document needs.

Form popularity

FAQ

A trust account serves to hold and manage client funds securely, distinguishing them from an attorney's operating funds. This separation is crucial to prevent any potential disputes and maintain ethical practices. Moreover, trust accounts simplify the audit process and ensure that clients’ financial interests are protected.

The purpose of a client trust account is to safeguard funds that belong to clients, ensuring they are used only for their intended purposes. This type of account provides protection against misappropriation and enhances client trust in your legal services. Additionally, it helps attorneys comply with legal and ethical standards.

Recording trust accounts involves documenting every transaction accurately in a ledger. Each deposit and withdrawal must be clearly noted to ensure accountability and transparency. Implementing accounting software tailored for managing trust accounts can streamline this process and help you maintain accurate records.

To perform an accounting for a trust, you should maintain accurate records of all deposits and withdrawals in the trust account for attorney. Regularly updating these records will help you track the funds and ensure they align with client expectations. Consider using accounting software or services specifically designed for trust account management to simplify this process.

When managing funds for multiple clients, establishing a separate trust account for each client is generally a best practice. This separation helps you track individual client funds accurately and maintain clear records. Furthermore, a distinct trust account for each client enhances transparency and protects both your clients and your practice. Consider using US Legal Forms to streamline the setup and management of trust accounts for attorneys.

The best place to open a trust account for attorney use often depends on your specific needs and location. Many law firms opt for local banks or credit unions that are familiar with the regulations governing trust accounts. However, it's essential to compare options, considering factors like fees, customer service, and online banking capabilities.

The best person to set up a trust account is typically an attorney, as they have the knowledge and experience to navigate the legal requirements. They can also provide advice tailored to your individual needs and circumstances. By working with an attorney who specializes in trusts, you can ensure that your account meets all legal standards.

To get a trust account for attorney services, start by researching banks or financial institutions that offer trust accounts specifically for legal practices. You will need to gather the necessary documents, such as your law license and identification. Once you have the required materials, contact the chosen institution to complete the application process and set up your trust account.

Yes, you can set up a trust fund by yourself, but it is often beneficial to consult with a legal professional. A trust account for attorney can guide you through the complexities and nuances of trust creation. Additionally, having expert help ensures that all legal requirements are met and your wishes are correctly documented. Self-service options are available, but professional guidance can enhance understanding and effectiveness.

To write a check to an attorney trust account, make the check payable to the attorney’s law firm or the name of the trust. Clearly indicate the purpose in the memo section, providing context for the funds. This practice enhances accountability and organization. Keeping detailed records of each transaction can help maintain a clear overview of your financial interaction with the attorney’s trust account.