Account For Trust

Description

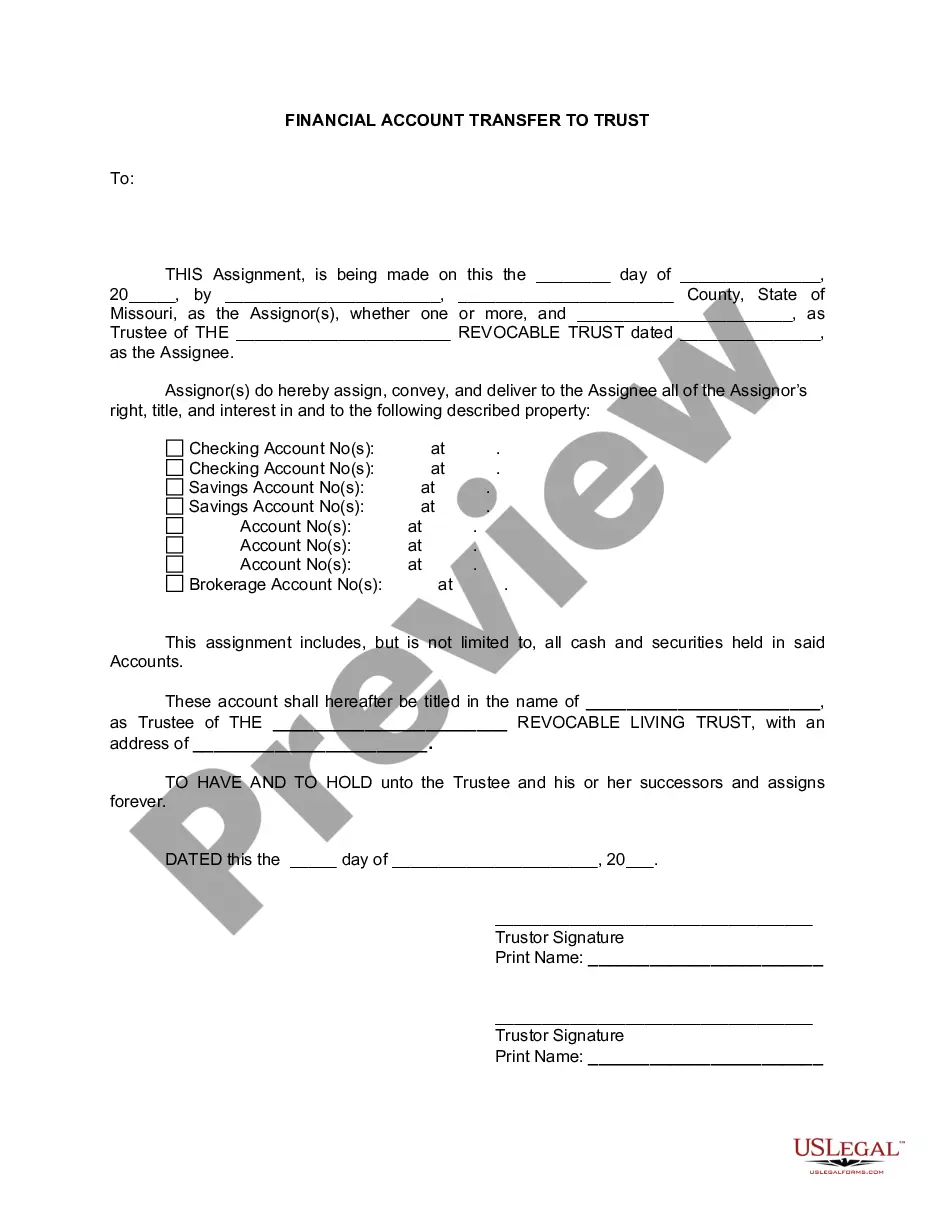

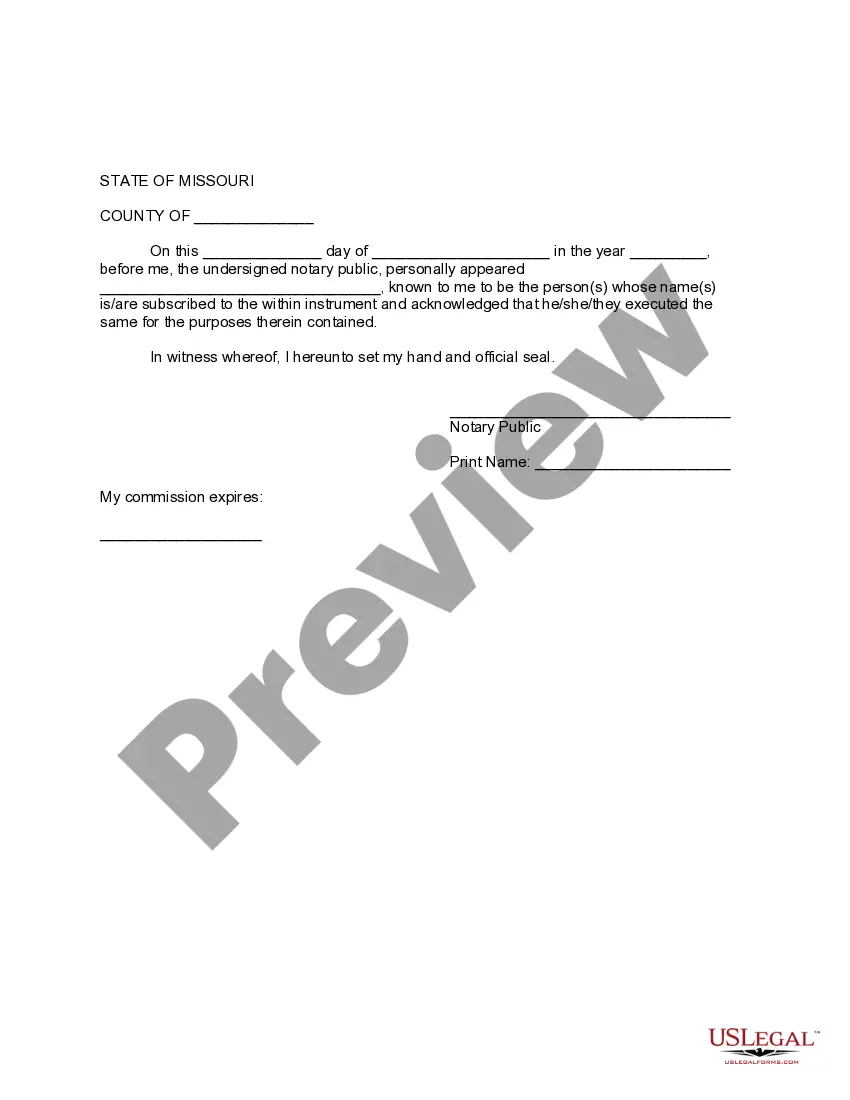

How to fill out Missouri Financial Account Transfer To Living Trust?

- If you're a returning user, log in to your account. Make sure your subscription is active to access your saved forms.

- For first-time users, begin by exploring the Preview mode to review the description of the forms available. Confirm that the chosen form meets your needs and adheres to your jurisdiction's requirements.

- If adjustments are needed, utilize the Search function to find alternative templates that better suit your requirements.

- Once you've found the right document, click on the Buy Now button. Select a subscription plan and create an account to unlock the full library.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download the required form and store it on your device. You can access this document anytime in the My Forms section of your profile.

In conclusion, US Legal Forms streamlines the process of obtaining legal documents, ensuring users can easily find and complete forms tailored to their specific needs. With expert assistance available, rest assured your documents will be accurate and reliable.

Start taking advantage of this extensive library today!

Form popularity

FAQ

To set up a bank account for a trust, begin by choosing a bank that offers trust account services. After selecting a bank, present the required documentation, including the trust agreement and the tax ID number. The bank will assist you in completing the process smoothly, making it straightforward to establish an account for trust that meets your financial needs.

Yes, a trust typically needs a special bank account dedicated solely to its purposes. This account for trust helps maintain clear financial boundaries between the trust's assets and personal assets of the trustee or beneficiaries. Using a separate account also simplifies record-keeping and ensures proper management of the trust's funds, avoiding potential legal complications.

To create a bank account for a trust, you first need to gather essential documents such as the trust agreement, the trust's tax identification number, and identification for the trustee. Once you have these documents prepared, visit your chosen bank and request to open an account for trust. The bank will guide you through their specific requirements, ensuring that you set up the account for trust correctly and in compliance with legal standards.

Choosing the right bank for a trust account depends on various factors such as fees, services, and reputation. A strong contender is a well-established local bank that offers personalized service and expertise in managing accounts for trusts. You should also consider if the bank provides online access and robust customer support. Exploring your options can help you find a bank that aligns with your specific needs for an account for trust.

Choosing the right bank account for trust involves looking for features that meet your needs. Many banks offer specialized trust accounts designed to manage and protect trust assets efficiently. It's recommended to select a financial institution with expertise in trust management and a robust online banking platform. Such features can save you time and simplify the administration of your account for trust.

The best account for a trust typically combines accessibility with favorable terms. A standard trust checking account is often recommended, as it allows for easy transactions while managing the trust. Look for accounts that offer competitive interest rates, minimal fees, and online banking options to simplify management. Consult resources like US Legal Forms for more information on setting up an effective account for trust.

Not all accounts are suitable for trust inclusion. For instance, retirement accounts, such as IRAs and 401(k)s, often have specific beneficiary designations and may not require trust ownership. Additionally, personal checking accounts might not benefit from being in a trust due to taxation issues. Therefore, it’s essential to evaluate each account individually and consult experts when in doubt about what belongs in your account for trust.

An account in trust serves to manage assets on behalf of beneficiaries. It is designed to ensure that the funds are used according to your wishes and provides legal protections for your loved ones. This type of account can simplify estate management and help prevent disputes among heirs. Overall, it's an effective way to preserve wealth for future generations.

The best type of trust often depends on your individual financial situation. Revocable trusts are popular for their flexibility, allowing you to modify or eliminate the trust as needed. On the other hand, irrevocable trusts provide tax benefits and asset protection but cannot be changed once established. Choosing the right trust type is crucial, so consulting professionals from platforms like US Legal Forms can guide you through the decision.

When considering an account for trust, a dedicated trust account usually works best. This type of account allows you to manage funds separately from personal accounts, ensuring clarity in trust management. It's essential to choose an account that offers good interest rates and low fees, as these factors can enhance the trust’s value. Additionally, many financial institutions offer specific trust account options designed to meet legal requirements.