Trust Fund Attorney Cost

Description

How to fill out Missouri Living Trust For Husband And Wife With Minor And Or Adult Children?

Dealing with legal paperwork and procedures can be a lengthy addition to your whole day. Trust Fund Attorney Expense and similar forms typically require you to look for them and figure out how to fill them out properly.

As a result, whether you are managing financial, legal, or personal affairs, having a comprehensive and accessible online directory of forms readily available will greatly assist you.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and a range of resources to help you complete your paperwork smoothly.

Browse the collection of relevant documents available to you with just one click.

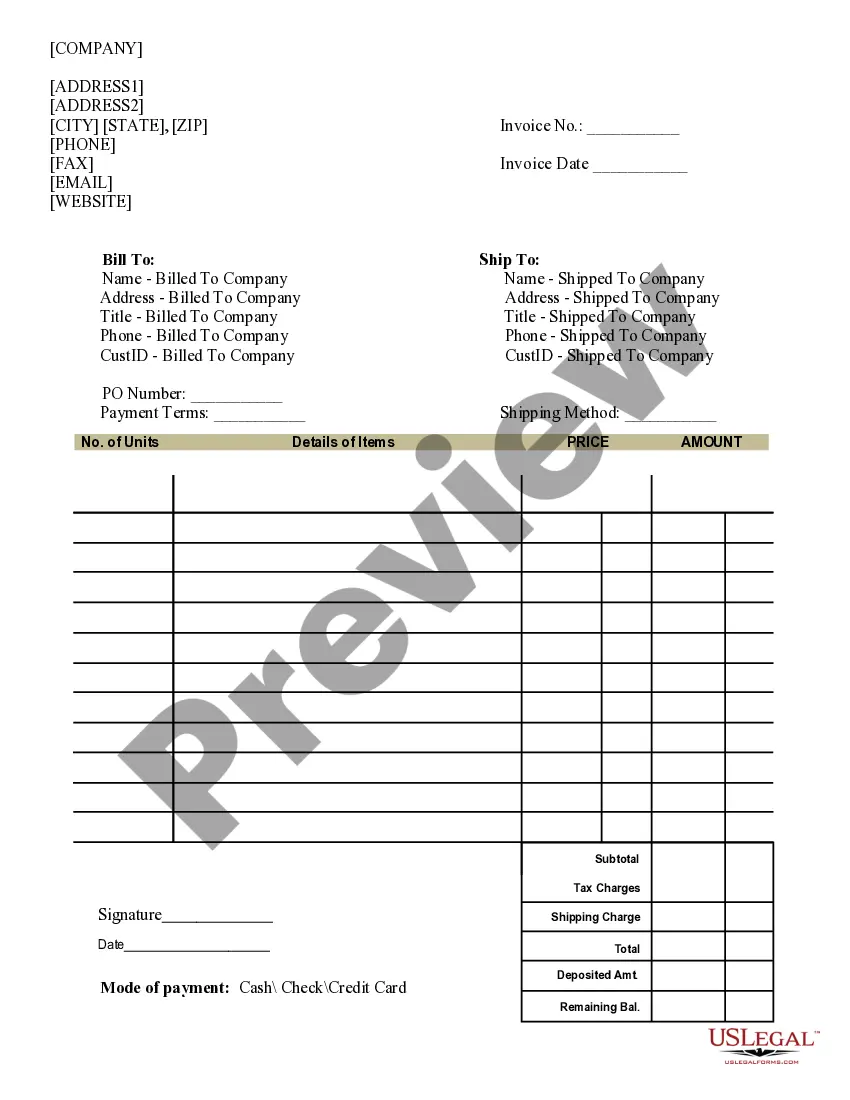

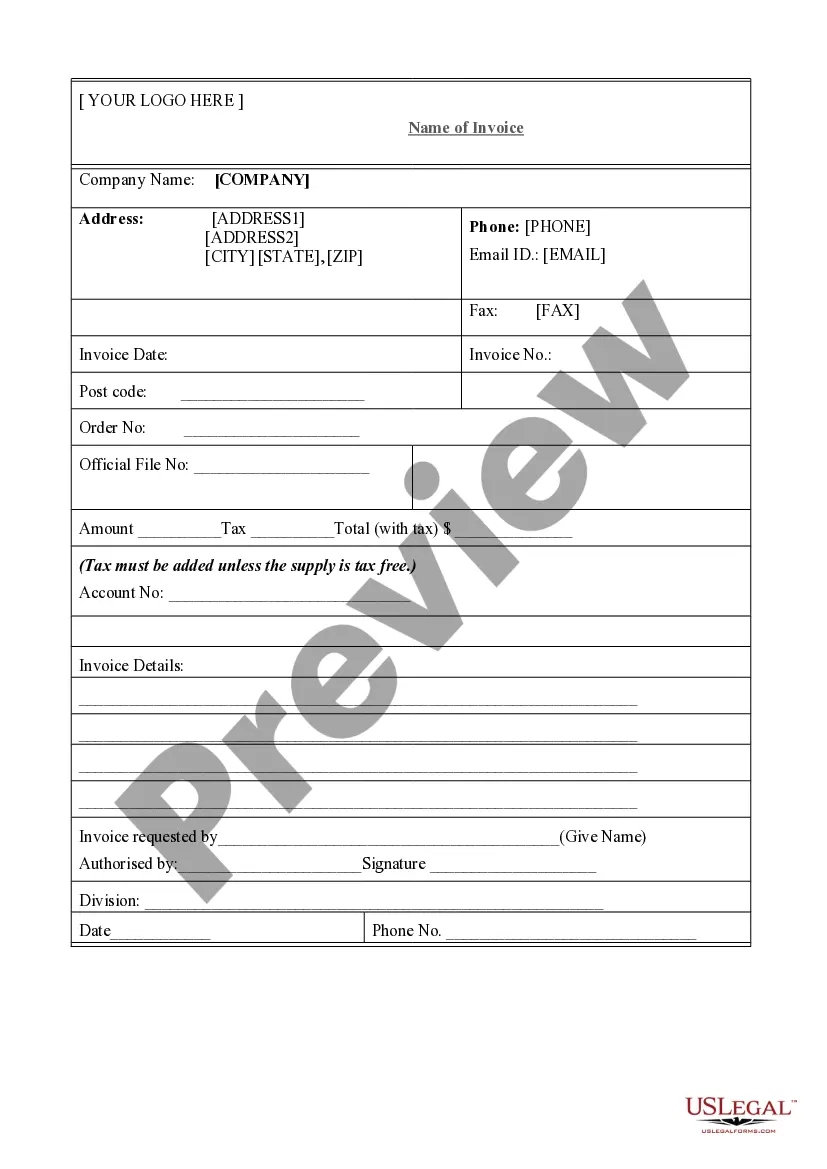

Then, follow the steps below to finish your form: Ensure you have found the correct document using the Preview feature and reviewing the form description. Click Buy Now when ready, and select the subscription plan that suits your requirements. Choose Download then fill out, eSign, and print the document. US Legal Forms has twenty-five years of expertise helping users handle their legal paperwork. Acquire the form you need today and streamline any process effortlessly.

- US Legal Forms offers you state- and county-specific documents accessible at any time for download.

- Protect your document management processes with a top-notch service that enables you to prepare any form in minutes without extra or concealed fees.

- Simply Log In to your account, locate Trust Fund Attorney Expense, and obtain it directly from the My documents section.

- You can also access previously saved documents.

- Is this your first time using US Legal Forms? Register and create your account in a few minutes, and you’ll gain access to the form directory and Trust Fund Attorney Expense.

Form popularity

FAQ

The cost to hire a trust lawyer generally depends on their experience and the services provided. On average, trust fund attorney costs can range from $150 to $400 per hour, with flat rates for specific services being common as well. It's essential to discuss fees upfront with your attorney to understand the total expense involved. US Legal Forms can also provide helpful templates and information to potentially reduce your need for extensive legal services.

The average cost of a simple trust can vary significantly based on your specific needs and the complexity of the trust. Typically, the trust fund attorney cost for a simple trust ranges from a few hundred to a few thousand dollars. This cost often includes drafting the trust documents and providing initial legal advice. To ensure you receive comprehensive service, consider using platforms like US Legal Forms, which offer resources to help you navigate the process.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

While there's no minimum amount needed to open a trust fund, the benefits should clearly outweigh the costs. That's why trusts are often associated with wealthy individuals, although people with a range of net worths could still use them in many situations.

If you don't have many assets, aren't married, and/or plan on leaving everything to your spouse, a will is perhaps all you need. On the other hand, a good rule of thumb is to consider a revocable living trust if your net worth is at least $100,000.

Many advisors and attorneys recommend a $100K minimum net worth for a living trust. However, there are other factors to consider depending on your personal situation. What is your age, marital status, and earning potential?

Less than 2 percent of the U.S. population receives a trust fund, usually as a means of inheriting large sums of money from wealthy parents, ing to the Survey of Consumer Finances. The median amount is about $285,000 (the average was $4,062,918) ? enough to make a major, lasting impact.