Missouri Affidavit Form Withholding

Description

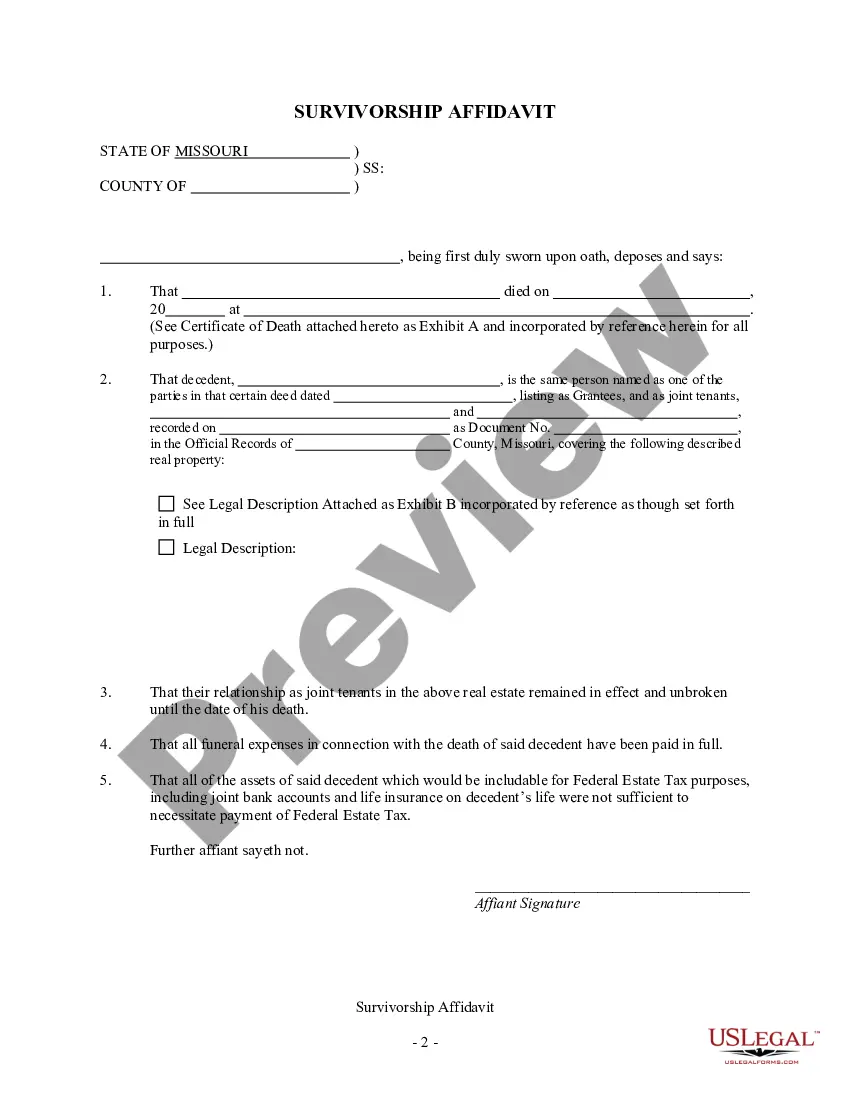

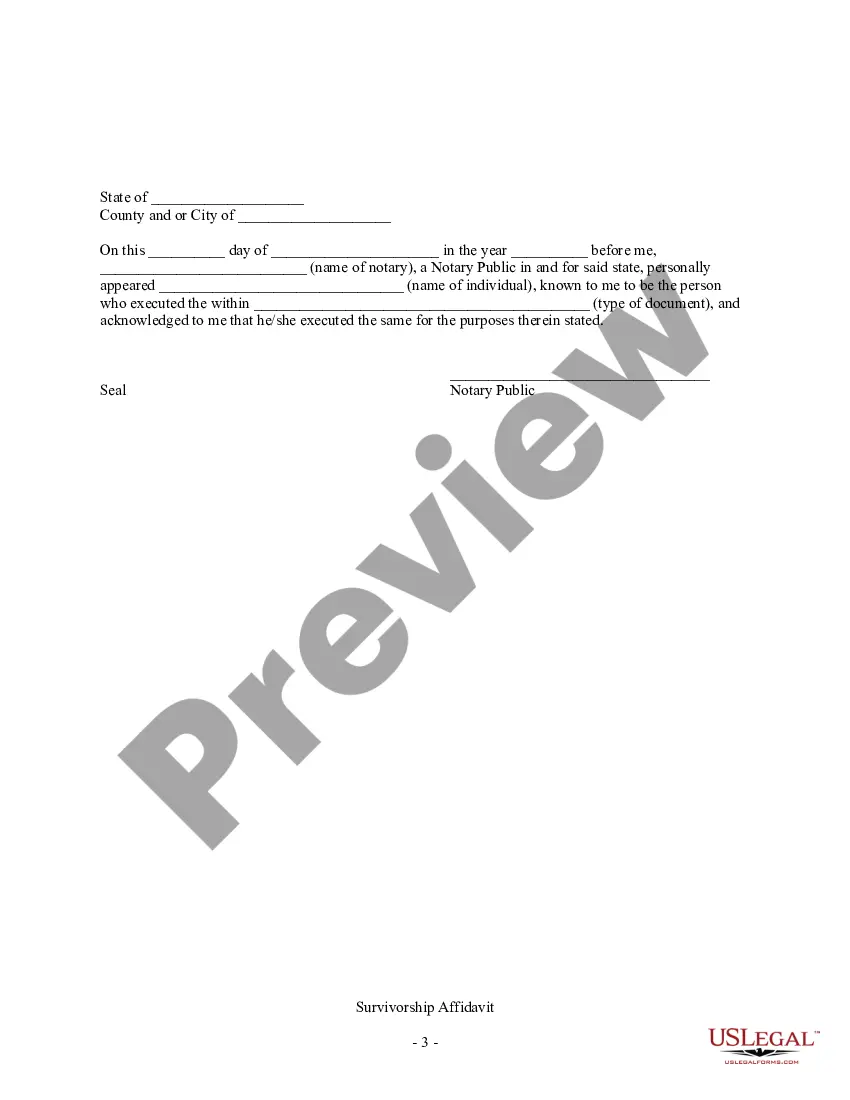

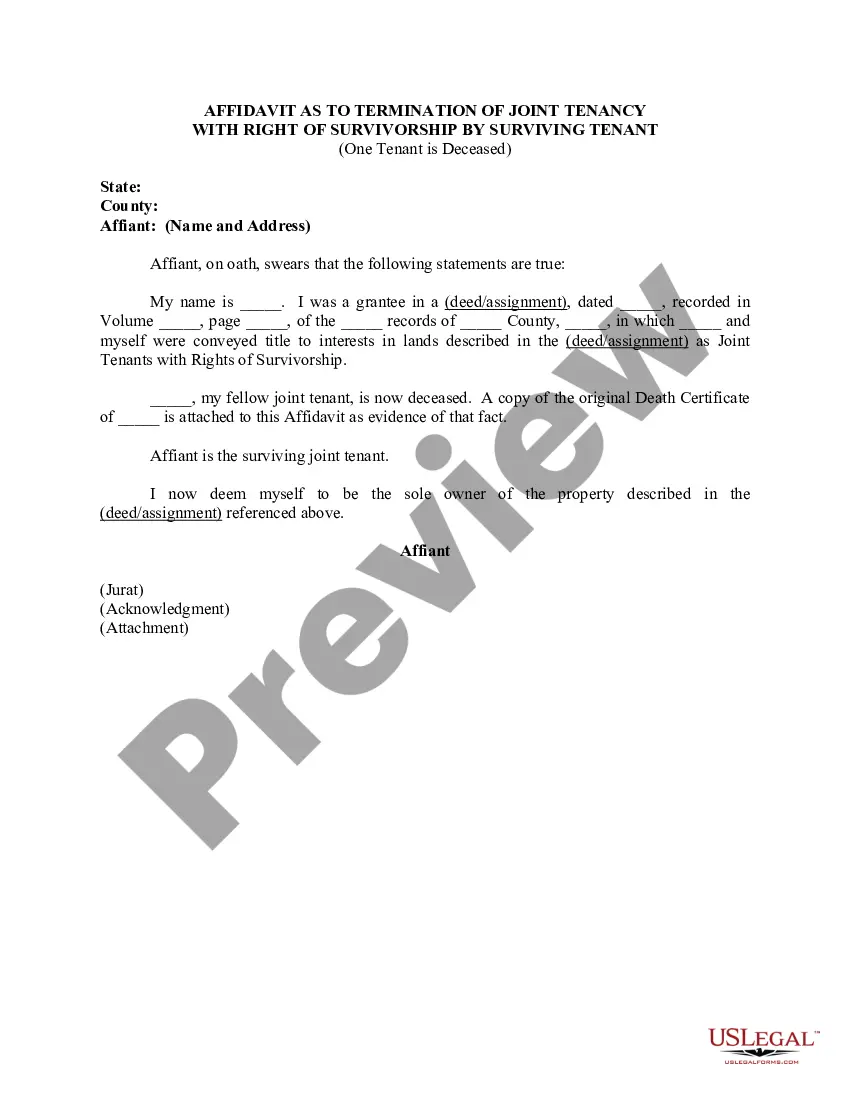

How to fill out Missouri Survivorship Affidavit - Joint Tenants - Husband And Wife?

It’s well known that you cannot become a legal authority overnight, nor can you swiftly learn how to draft the Missouri Affidavit Form Withholding without having a specialized education.

Generating legal papers is a lengthy process that necessitates particular training and expertise. So why not entrust the drafting of the Missouri Affidavit Form Withholding to the experts.

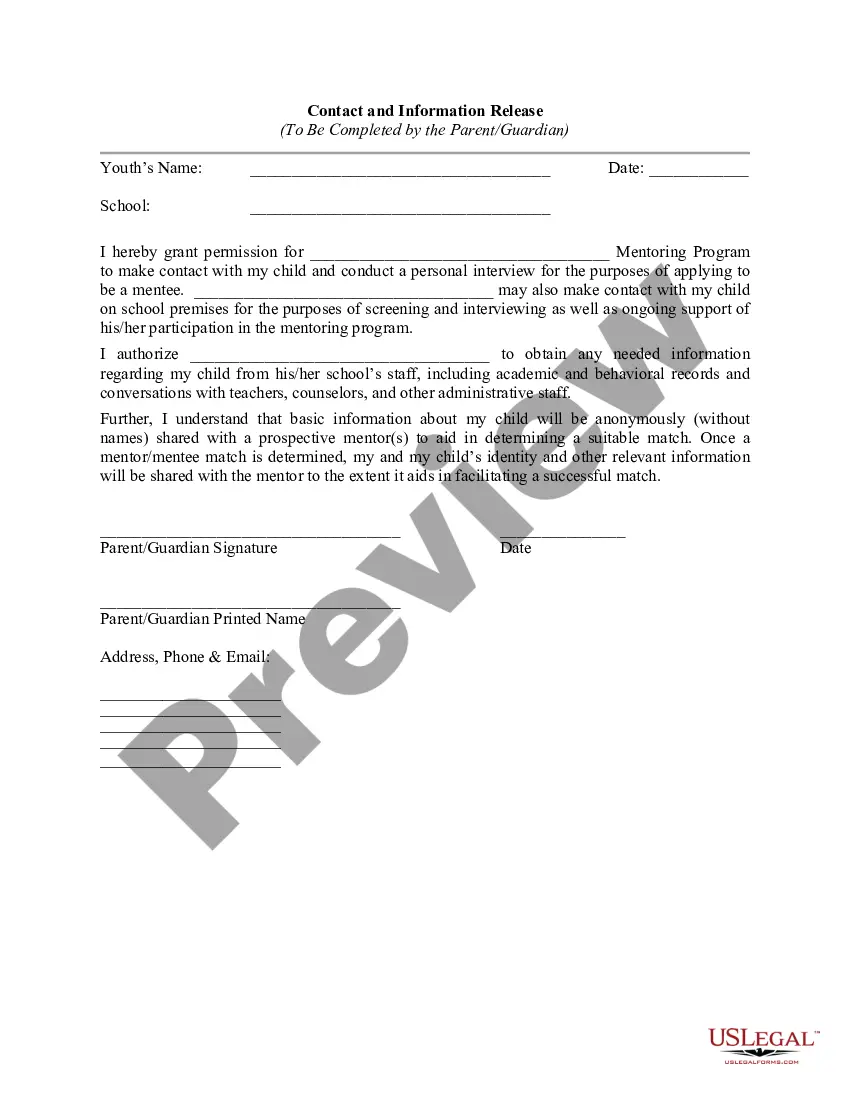

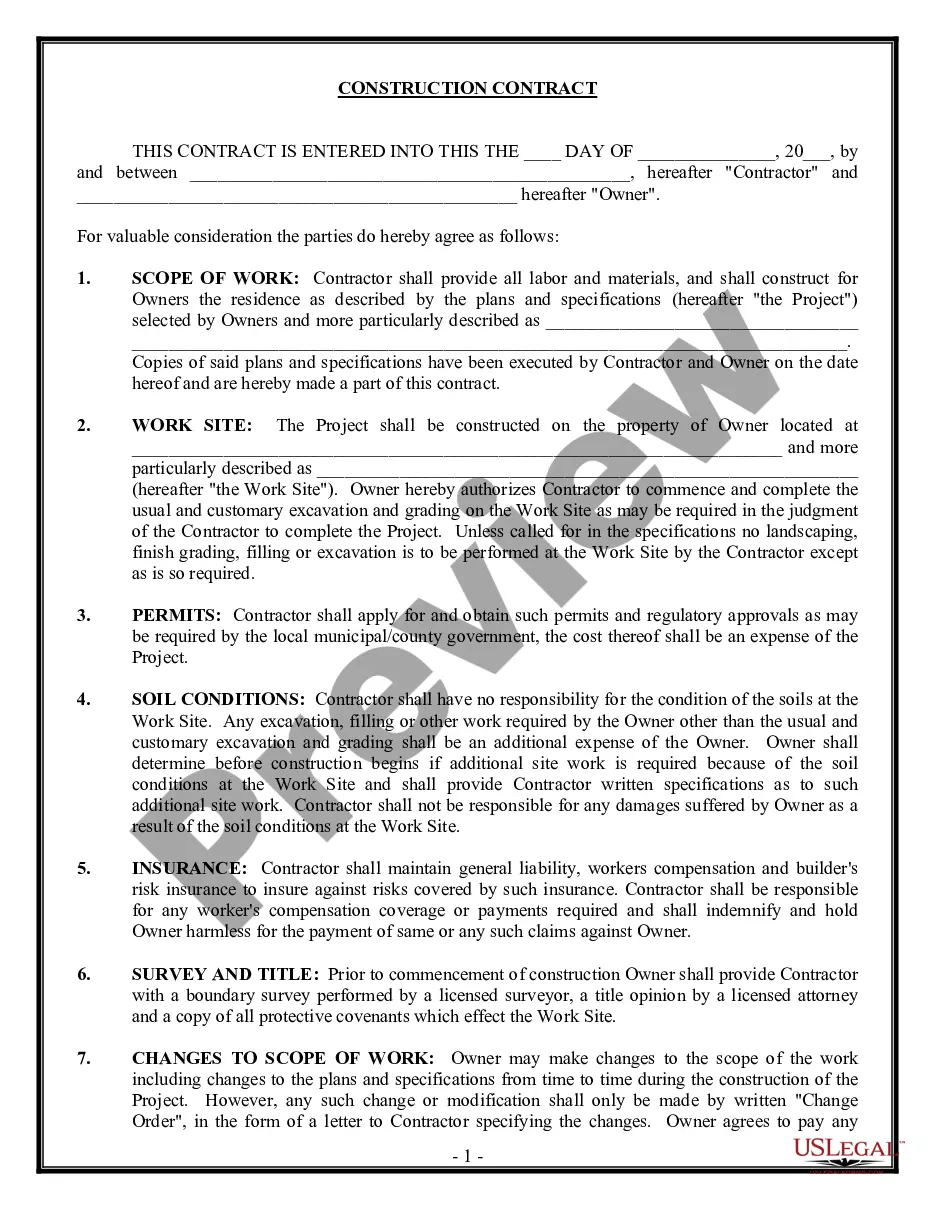

With US Legal Forms, one of the most extensive libraries of legal documents, you can discover everything from court documents to templates for internal communication.

You can access your forms again from the My documents section at any time. If you’re a returning customer, you can simply Log In, and find and download the template from the same section.

Regardless of the aim of your documents—whether they are financial, legal, or personal—our website has everything you need. Give US Legal Forms a try now!

- Utilize the search bar at the top of the page to find the form you require.

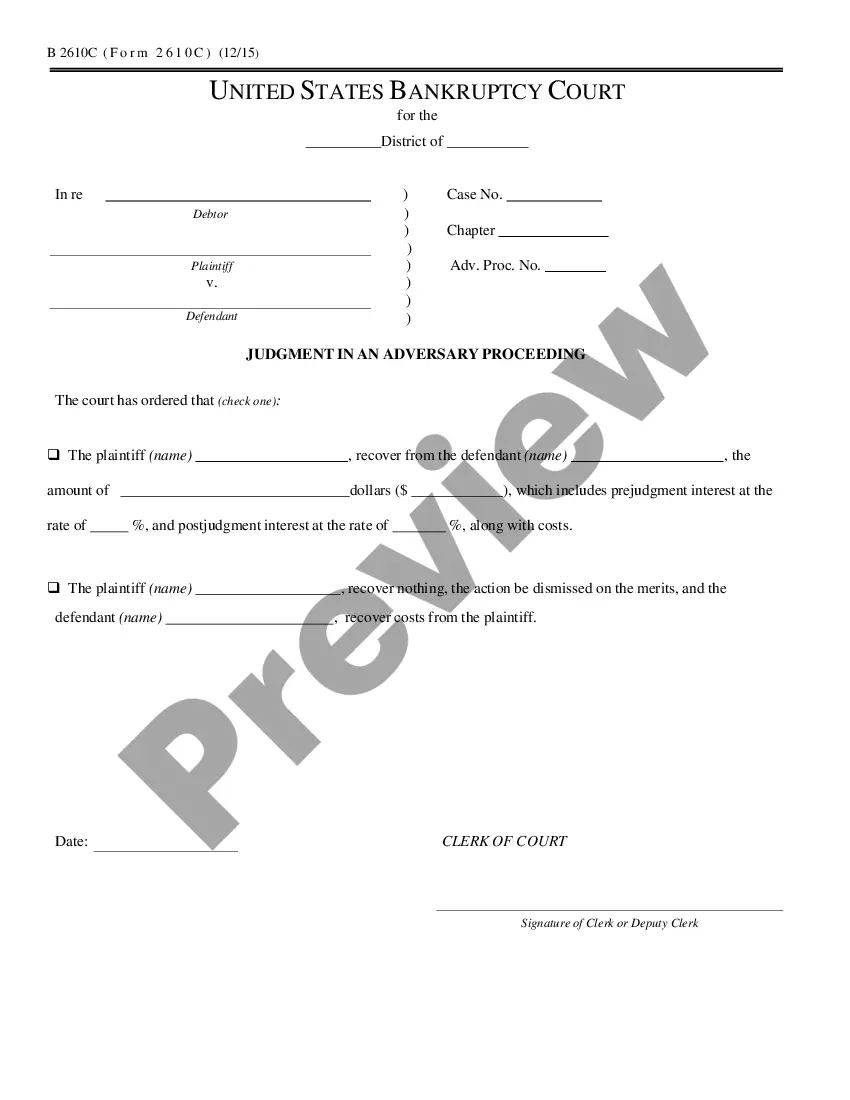

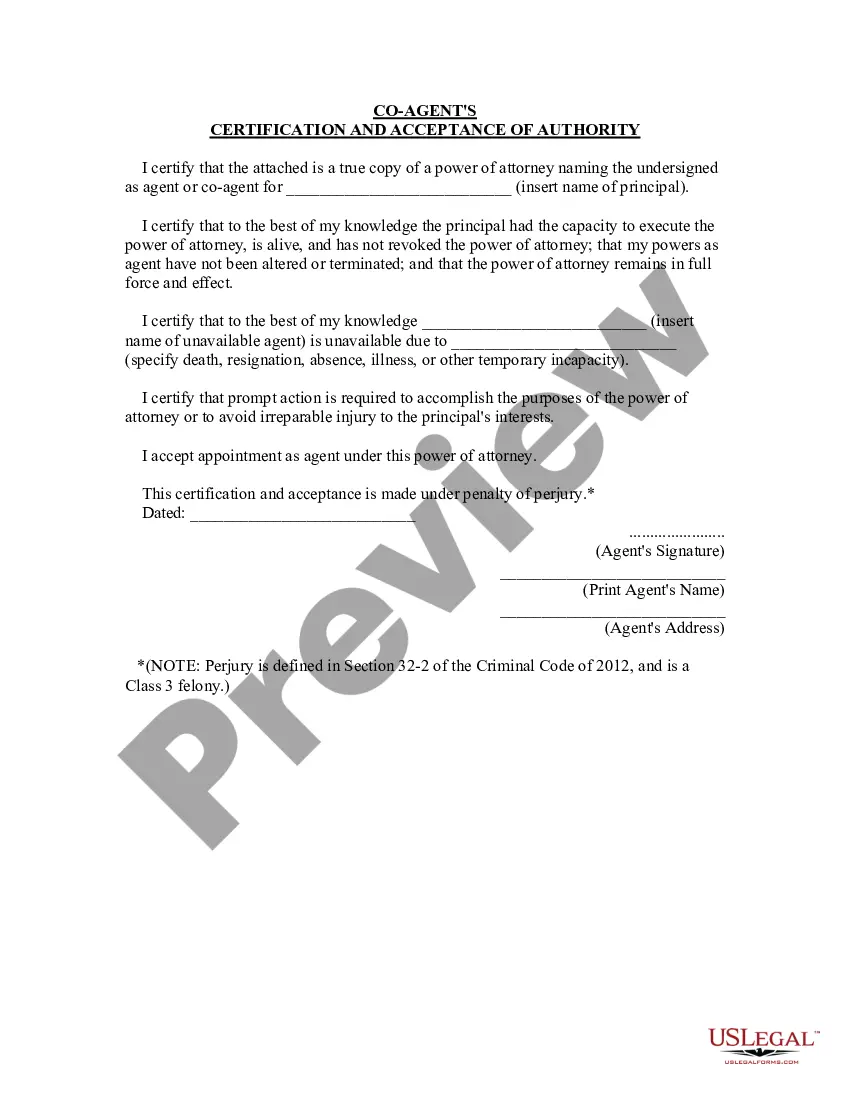

- If available, preview it and read the accompanying description to ascertain if the Missouri Affidavit Form Withholding is what you seek.

- If you need a different form, restart your search.

- Create a free account and select a subscription plan to acquire the template.

- Click Buy now. After the payment is processed, you can download the Missouri Affidavit Form Withholding, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Withholding tax returns may be filed on a quarter-monthly (weekly), monthly, quarterly or annual basis. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Employers withholding over $9,000 per month must file and pay using the quarter-monthly (weekly) frequency.

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.

Missouri Withholding Tax ? Multiply the employee's Missouri taxable income by the applicable annual payroll period rate. Begin at the lowest rate and accumulate the total withholding amount for each rate. The result is the employee's annual Missouri withholding tax.

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown ...

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows ?