Joint Tenancy With Right Of Survivorship In California

Description

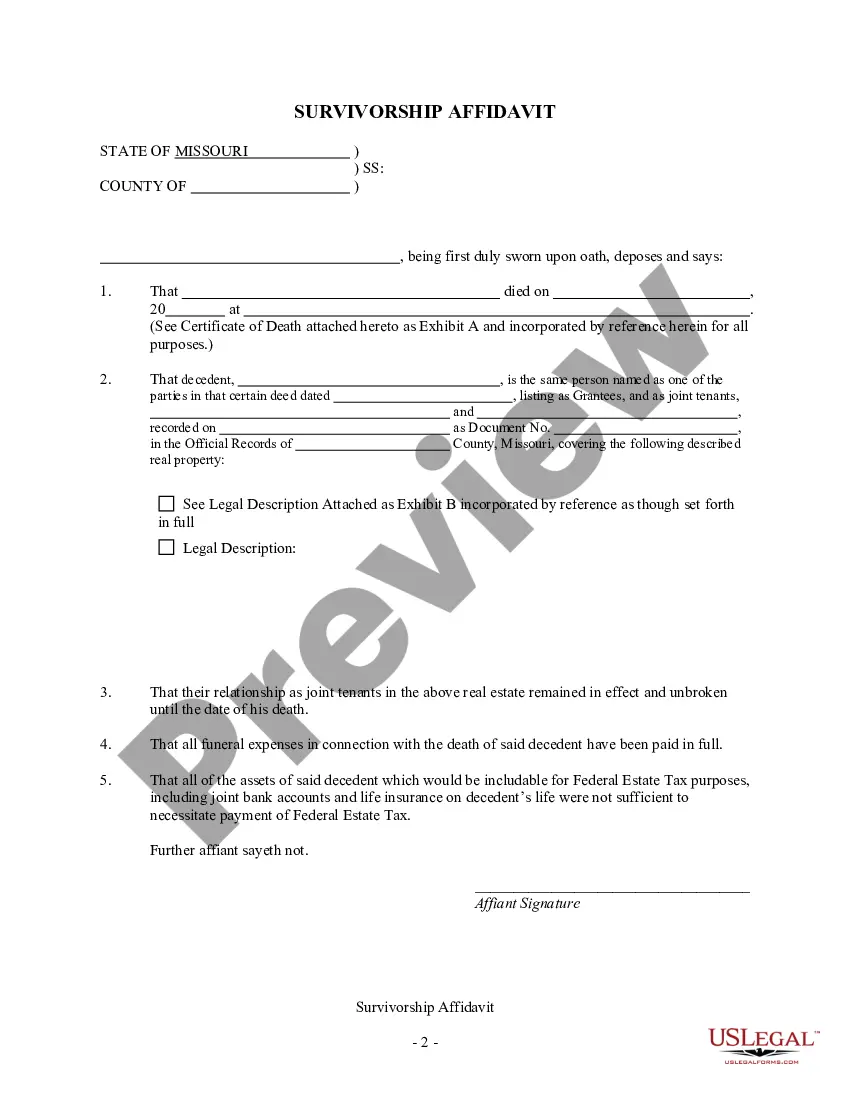

How to fill out Missouri Survivorship Affidavit - Joint Tenants - Husband And Wife?

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more affordable way of preparing Joint Tenancy With Right Of Survivorship In California or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of over 85,000 up-to-date legal documents addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-compliant forms carefully put together for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Joint Tenancy With Right Of Survivorship In California. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to set it up and navigate the catalog. But before jumping straight to downloading Joint Tenancy With Right Of Survivorship In California, follow these tips:

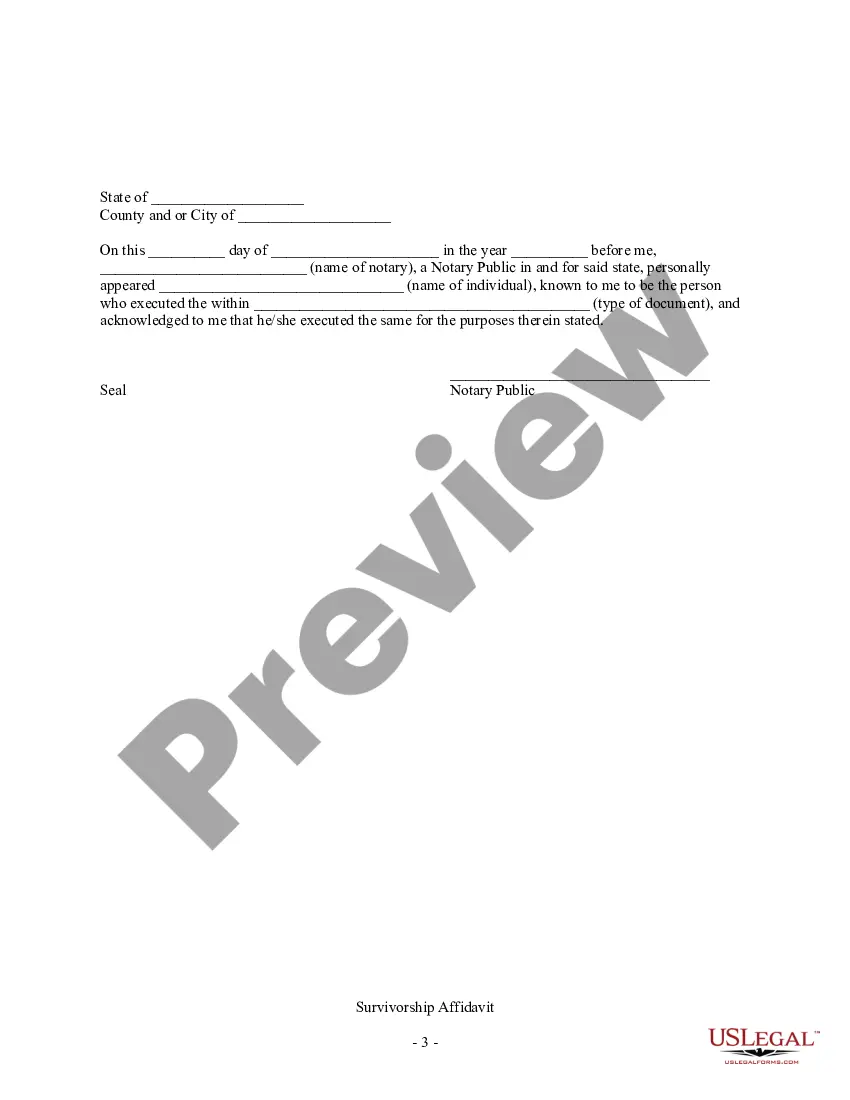

- Check the document preview and descriptions to ensure that you are on the the document you are looking for.

- Check if form you select conforms with the requirements of your state and county.

- Choose the right subscription option to purchase the Joint Tenancy With Right Of Survivorship In California.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and turn form execution into something simple and streamlined!

Form popularity

FAQ

With joint tenancy? the right of survivorship is implied, so if one joint tenant dies, the other joint tenant or tenants automatically become the owners of the deceased tenant's interest in the property without the property having to pass through probate.

Joint tenancy is a way for two or more people to own property in equal shares so that when one of the joint tenants dies, the property can pass to the surviving joint tenant(s) without having to go through probate court.

Joint Tenancy Has Some Disadvantages They include: Control Issues. Since every owner has a co-equal share of the asset, any decision must be mutual. You might not be able to sell or mortgage a home if your co-owner does not agree.

For spouses: Assets in JTWROS accounts may get a step-up on cost basis when either spouse passes away. This can help reduce capital gains taxes when selling a property, but you can only step-up half of the full value of the asset. This 50% step-up represents the portion owned by the joint owner who died.