Unpaid Rent In Balance Sheet

Description

Form popularity

FAQ

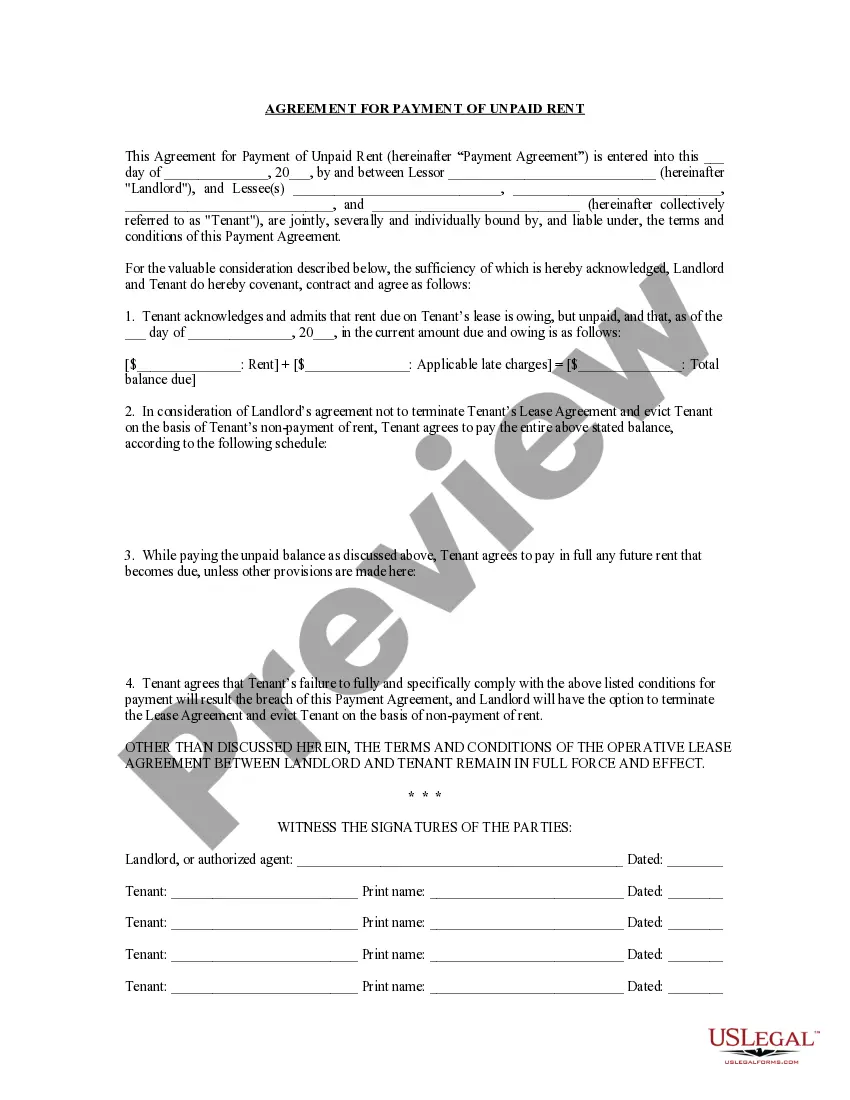

Accounting for unpaid rent involves tracking the expense and the corresponding liability. You must ensure that the unpaid amount appears under liabilities in your balance sheet, correctly reflecting your financial position. Employing tools like uslegalforms can simplify this process, helping you manage your accounts effectively.

To record unpaid rent, you should create a journal entry that reflects the amount owed. Typically, you would debit your rent expense account and credit a liability account—like accounts payable or accrued expenses. This keeps your unpaid rent in balance sheet well-organized, enabling you to track your financial responsibilities accurately.

Outstanding rent is typically classified as a current liability. This classification makes sense as the amount is due within the current accounting period. Properly listing unpaid rent in balance sheet reflects your financial obligations clearly, helping maintain transparency in your accounts.

You may be able to write off unpaid rent under certain conditions, such as bankruptcy or tenant evictions. However, before proceeding, consult your financial advisor to understand the specific implications for your balance sheet. Recording unpaid rent in balance sheet correctly ensures that you follow the appropriate accounting standards.

If someone is not paying rent, it's essential to document all communication and agreements first. You can then consider notifying a legal service or platform like US Legal Forms for further action. They provide resources and guidance on how to handle unpaid rent in balance sheet scenarios effectively. Reporting unpaid rent properly helps you pursue your rights while keeping financial records accurate.

Rent can be shown on the balance sheet as either an asset or expense, depending on the timing of the payment. Generally, if the rent is unpaid, it will be recorded under accounts receivable as an asset. This approach reflects the unpaid rent in balance sheet statements, showcasing expected income. Your balance sheet will give a more accurate view of your financial position with this detail.

To record rent not received, start by creating an accrued rent entry in your accounting system. This entry will represent the unpaid rent, increasing your accounts receivable. By categorizing unpaid rent in balance sheet updates, you provide a clear picture of what revenue is collectible. Keeping accurate records helps you manage revenue more effectively.

Accrued rent that is not received appears on the balance sheet as an asset. This means that while the rent is not yet in your account, you are still entitled to receive it. It's important to track unpaid rent in balance sheet reports to maintain accurate financial records. By doing so, you ensure that stakeholders understand the ongoing rental income that is expected.

To record rent in a journal entry, you will want to debit the Rent Expense account for the rent incurred and credit the Accounts Payable account for the amount owed. This approach helps you maintain clear financial records and ensures that any unpaid rent in balance sheet accounts is accurately reflected. By using platforms such as US Legal Forms, you can access templates and guides that streamline this process, making it easier to stay compliant.

To put unpaid rent on your credit report, you might need to wait until the rental agreement goes into collections or if the landlord reports the information. Generally, unpaid rent that remains unpaid for an extended period can negatively impact your credit. Keeping track of unpaid rent in balance sheet can help you stay aware of your financial responsibilities.