Form Pay

Description

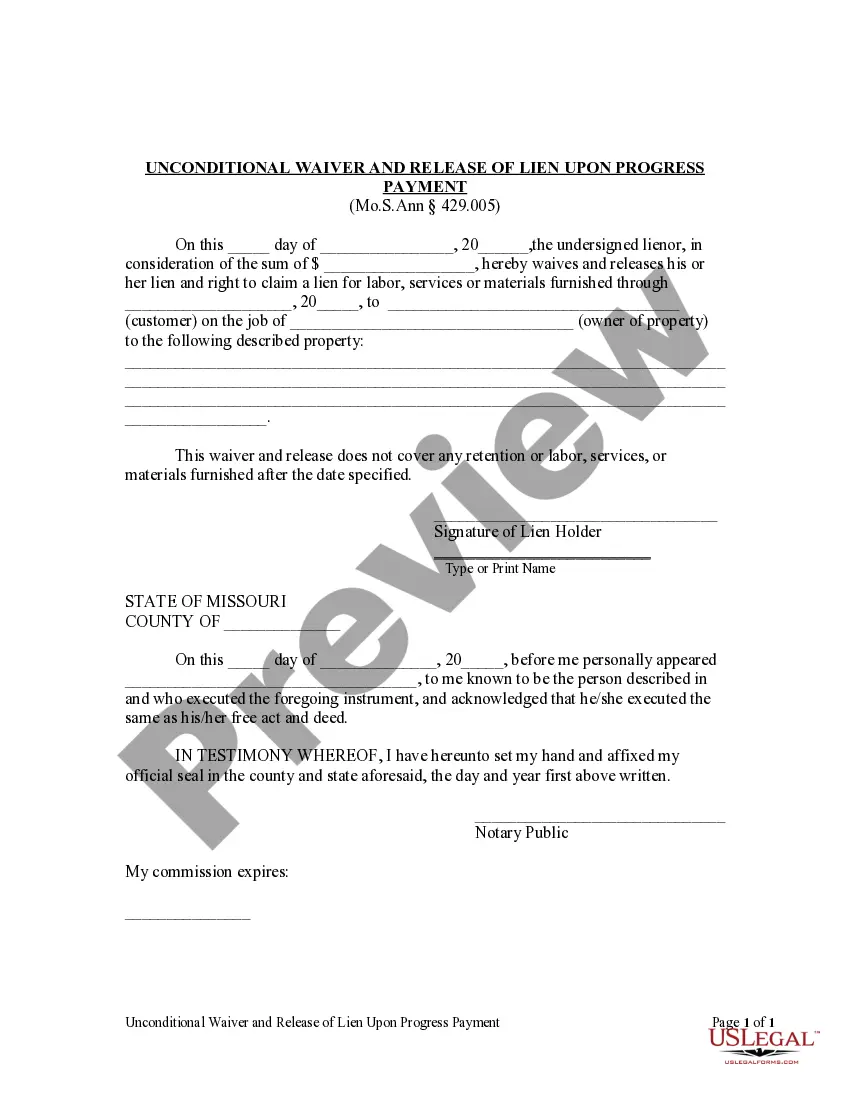

How to fill out Missouri Unconditional Waiver And Release Of Lien Upon Progress Payment?

- If you are an existing user, log in to your account and ensure your subscription is active. Click the Download button to access your form.

- For first-time users, preview the available templates and read the form descriptions. Verify that the form meets your requirements and complies with your local jurisdiction.

- Use the Search tab to explore additional templates if necessary. Finding the right document is crucial before proceeding.

- Select and purchase your desired document by clicking on 'Buy Now.' Choose the subscription plan that best suits your needs and register an account for library access.

- Complete your payment by entering your credit card information or using your PayPal account. Ensure the transaction is confirmed.

- Download the form to your device. You can access it later in the My Forms section of your profile.

In conclusion, using US Legal Forms to form pay simplifies the legal documentation process. Whether you are a seasoned user or a newcomer, these steps ensure that you have the necessary tools to create legally sound documents quickly. Don't hesitate; start your journey toward hassle-free legal solutions today!

Explore the benefits of US Legal Forms and take control of your legal documentation now.

Form popularity

FAQ

You should file Form 941 with the IRS at the address specified for your location. Different areas have unique addresses for paper submissions, so be sure to check the IRS website for the correct mailing address. If you e-file, software can assist you in navigating through the process smoothly. Using USLegalForms can simplify this step by providing accurate information and resources.

FormPay is a payment processing solution designed to simplify transactions within online forms. It allows users to collect payments securely and efficiently while managing their responses. By integrating FormPay into your forms, you can streamline your payment processes, making it easier for both you and your customers.

Yes, you can add a payment link to a Google Form, enhancing its functionality. Typically, users choose to embed links from payment services such as PayPal or FormPay. Make sure to provide instructions for users to easily access and complete their payments after submitting the form.

To make a Google Form payable, you can use third-party payment services such as PayPal or FormPay. After setting up your payment link with these platforms, include it in your form by adding a multiple-choice or text section. This ensures that users can easily access payment options while filling out your form.

Claiming 0 on your Form W-4 does not guarantee that you will not owe taxes. Several factors, such as additional income, tax credits, or deductions, can impact your final tax liability. If your situation changes during the year or if you have other sources of income, you may still find yourself owing taxes despite claiming 0. It’s advisable to regularly review your withholding and consult resources like US Legal Forms to adjust your forms as needed.

To fill out your withholding form, start by entering your personal information, including your name, address, and Social Security number. Next, you'll need to determine your filing status and the number of allowances you want to claim. Finally, sign and date the form before submitting it to your employer. If you need assistance, US Legal Forms offers resources and templates for filling out your withholding form accurately.

Claiming 0 on your Form W-4 means more taxes will be withheld from your paycheck, leading to a potentially larger refund at tax time. In contrast, claiming 1 means less tax is withheld, which could result in a smaller refund or possibly owing taxes at the end of the year. It's essential to assess your financial situation and choose the option that fits your tax strategy best. US Legal Forms can guide you through the implications of each option.

For payroll purposes, you typically need to fill out the IRS Form W-4. This form helps your employer determine the correct amount of federal income tax to withhold from your paycheck. It's crucial to fill out the Form W-4 accurately to avoid underpayment or overpayment of taxes. US Legal Forms provides easy access to the Form W-4 and other related forms to simplify this process.