Irrevocable Trust For Minor Child

Description

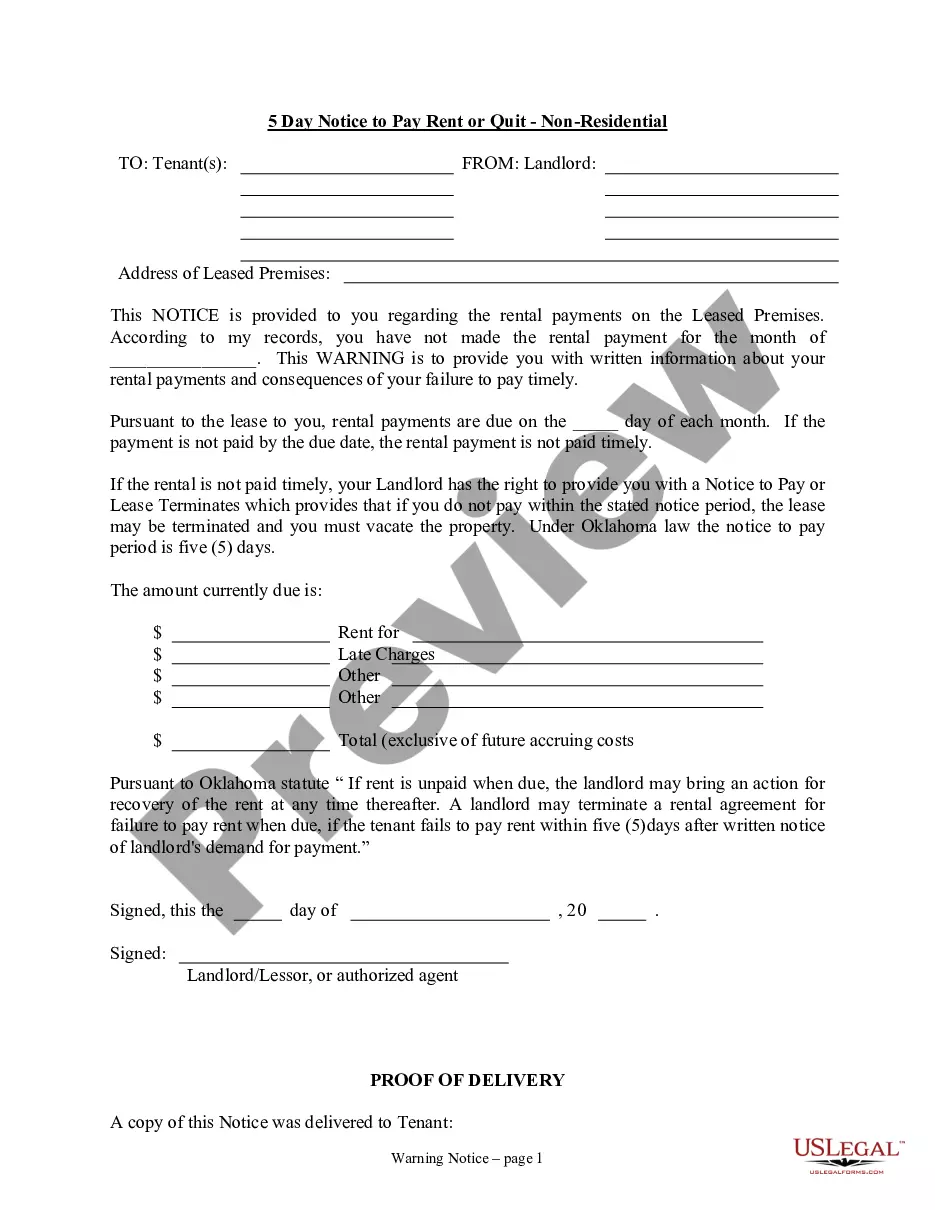

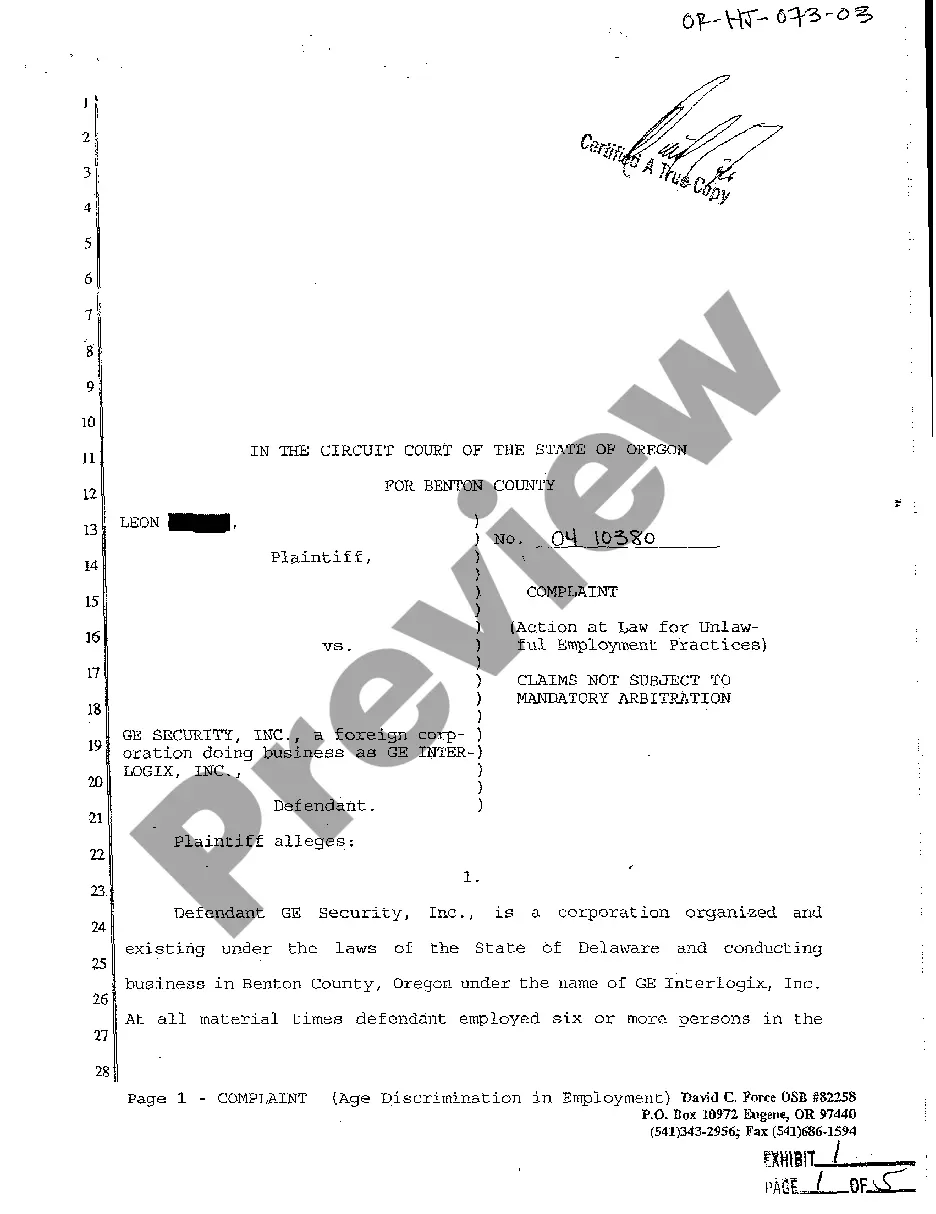

How to fill out Missouri Self-Settled Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

- Log into your US Legal Forms account if you're an existing user, or create a new account to start your journey.

- Review the available templates, paying close attention to the preview mode and descriptions to find the correct irrevocable trust form that meets your state’s requirements.

- If needed, utilize the Search feature to find additional templates that may fit your needs more precisely.

- Once you've identified the correct document, click on the 'Buy Now' button and select your desired subscription plan.

- Complete your purchase using a credit card or PayPal to access the entire library of forms.

- Download your selected irrevocable trust form and save it on your device. You can revisit it anytime under the 'My Forms' section of your profile.

By utilizing US Legal Forms, you're gaining access to a vast library of over 85,000 editable legal documents, ensuring you make informed and precise choices. With expert assistance readily available, you can be confident that your forms are completed accurately.

Don’t delay in providing for your child's future. Start today by visiting US Legal Forms and discover how easy it is to set up an irrevocable trust.

Form popularity

FAQ

The most tax-efficient strategy for leaving a home to a child is to set up an irrevocable trust for minor child. This allows you to transfer ownership while possibly avoiding capital gains tax and probate fees. By carefully planning your estate, you can ensure that your loved ones benefit from your property without excessive tax burdens.

To transfer your house to your child without incurring taxes, consider establishing an irrevocable trust for minor child, which can help shield you from immediate tax liabilities. This trust can minimize estate taxes and provide long-term financial benefits. An estate planning attorney can assist you in understanding the legal aspects and tax implications involved.

Creating an irrevocable trust for minor child involves several steps, but it starts with defining your goals and selecting a trustee. You will need to draft a trust document that outlines the terms and conditions, such as who manages the assets and when distributions occur. Using platforms like US Legal Forms can simplify this process, providing templates and guidance tailored to your needs.

Choosing between gifting a house or placing it in an irrevocable trust for minor child really depends on your situation. While gifting can seem straightforward, a trust offers more long-term benefits, such as asset protection and control over the distribution. By opting for a trust, you can ensure that your property is safeguarded for your children's future.

One effective approach to pass your house to your children is through an irrevocable trust for minor child. This method allows you to set guidelines for how your property is used and maintained. Moreover, it helps to avoid probate, making the transfer smoother and faster for your loved ones.

An irrevocable trust for minor child provides an excellent method to leave your property to your kids. By placing your assets in this trust, you ensure that they are managed and distributed according to your wishes and protect your children from potential mismanagement. Additionally, you can minimize tax implications by using a trust instead of a direct inheritance.

There are three primary reasons to establish an irrevocable trust for minor child. First, it protects assets from creditors and lawsuits, ensuring your child's inheritance remains intact. Second, it provides tax benefits by removing assets from your taxable estate. Lastly, it ensures that funds are distributed according to your wishes, maintaining control over how your child receives their inheritance. With uslegalforms, setting up this trust becomes a straightforward process.

The best type of trust for a minor is often an irrevocable trust for minor child. This trust ensures that assets are protected and managed appropriately until the child reaches adulthood. An irrevocable trust limits the grantor's control over the assets, providing security and stability for your child's financial future. Using uslegalforms, you can easily create this trust, ensuring it aligns with your specific goals and needs.

Deciding whether your parents should put their assets in a trust depends on their financial goals and family situation. An irrevocable trust for a minor child can provide long-term security and ensure assets are used for the child's benefit. However, it's essential to consider the implications of losing control over those assets. Engaging with a legal expert or using resources like UsLegalForms can provide valuable guidance in this decision.

To set up an irrevocable trust for a minor child, you need to choose a trustee and outline the trust's terms in a formal written document. This document should specify how funds will be managed and distributed when the child reaches certain milestones, such as reaching adulthood. It's advisable to consult with a legal professional to ensure compliance with state laws and to address any specific needs or goals. Platforms like UsLegalForms can help simplify this process.