Residence Ownership

Description

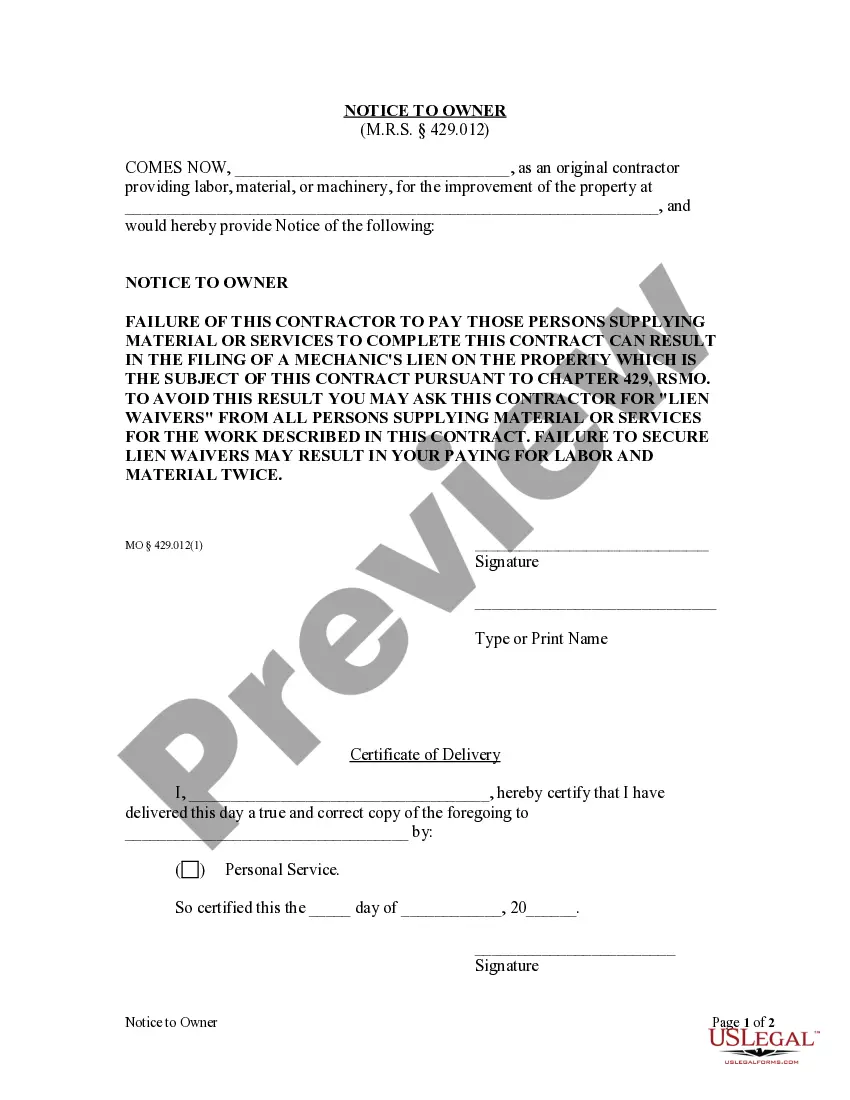

How to fill out Missouri Consent Of Owner - Residential - Individual?

- If you're an existing user, log in to your account and download the necessary form template by clicking the Download button. Ensure your subscription is active; if not, renew it according to your chosen payment plan.

- For first-time users, begin by browsing the Preview mode and reading the form description to confirm it aligns with your requirements and complies with local jurisdiction.

- If necessary, utilize the Search tab above to find a different template that better suits your needs.

- Click on the Buy Now button and select your preferred subscription plan to proceed with the purchase.

- Enter your credit card information or opt for PayPal to finalize your transaction.

- Download your form and save it to your device, so you can fill it out anytime. You can also access it in the My Forms section of your profile.

By following these steps, you'll have access to a powerful tool that makes residence ownership documentation hassle-free.

Experience the benefits of US Legal Forms today—start your journey to legally sound create documents now!

Form popularity

FAQ

The IRS determines your primary residence by looking at various factors, including the amount of time spent at each property, your intention to stay, and where your family resides. They also consider which address you used for federal tax purposes and other official documents. Clarifying these points can prevent confusion during tax time. Utilizing platforms like US Legal Forms can provide insights into residence ownership and IRS regulations, ensuring you stay informed.

While personal circumstances may allow you to occupy two primary residences, only one can be recognized for tax purposes. Having two homes may provide different living experiences, but legally, the IRS only acknowledges one as your primary. It’s important to track your time spent in each location when enforcing this rule. Resources like US Legal Forms can help you understand your rights regarding residence ownership.

For tax purposes, the IRS typically allows only one primary residence at a time. You might have multiple properties, but only one qualifies as your primary residence, which can affect tax deductions. If you frequently change residences, you must demonstrate that the property you claim as primary meets essential criteria. Addressing such details on a reliable platform like US Legal Forms can simplify managing residence ownership.

Determining your tax residency involves evaluating your physical presence in a state or country throughout the tax year. Generally, states require you to be physically present for more than 183 days during the tax year to claim you reside there. Tracking your time spent in various locations can help clarify your tax residency status. For more precise guidance, consulting platforms such as US Legal Forms can offer tailored solutions related to residence ownership.

To determine your primary residence for tax purposes, consider where you spend the majority of your time, where your family lives, and where you are registered to vote. The IRS looks at these factors alongside the physical address you list on your tax return. Additionally, if you own multiple properties, documentation like utility bills can help establish your primary residence. This clarity is essential for understanding residence ownership and the potential tax implications.

You typically receive a 1099-S form when you sell a house, but it depends on the circumstances of the sale and the agency handling the transaction. This form reports the gross proceeds of the sale to the IRS, acting as a necessary record for your residence ownership. However, not receiving one does not exempt you from reporting the sale on your tax return, so keep your own records organized.

Reporting the sale of real property to the IRS requires you to complete and submit IRS Form 8949 alongside your tax return. You will also report any gain or loss from the sale in Schedule D. Ensure that you understand applicable exclusions related to residence ownership; using online platforms like US Legal Forms can simplify this process and guide you effectively.

Proving your primary residence to the IRS involves demonstrating that you live in the property consistently. Consider using documents like utility bills, lease agreements, or government-issued identification showing the address. You may also use paperwork related to residence ownership, such as your mortgage statements, which can serve as evidence of your ongoing residence there.

To designate a property as your primary residence, you generally need to live there most of the year and establish it as your main home. This includes changing your mailing address and registering to vote at that location. Additionally, you may need to provide documentation like utility bills or tax returns to demonstrate your residence ownership when filing for certain tax benefits.

You must report the sale of a home to the IRS if it doesn't meet the exclusion criteria for capital gains related to residence ownership. This includes situations where you make a profit that surpasses the allowable exclusion limit. Properly reporting the sale also helps maintain your tax compliance, and it's beneficial to consult tax software or a professional, such as those available through US Legal Forms, for guidance.