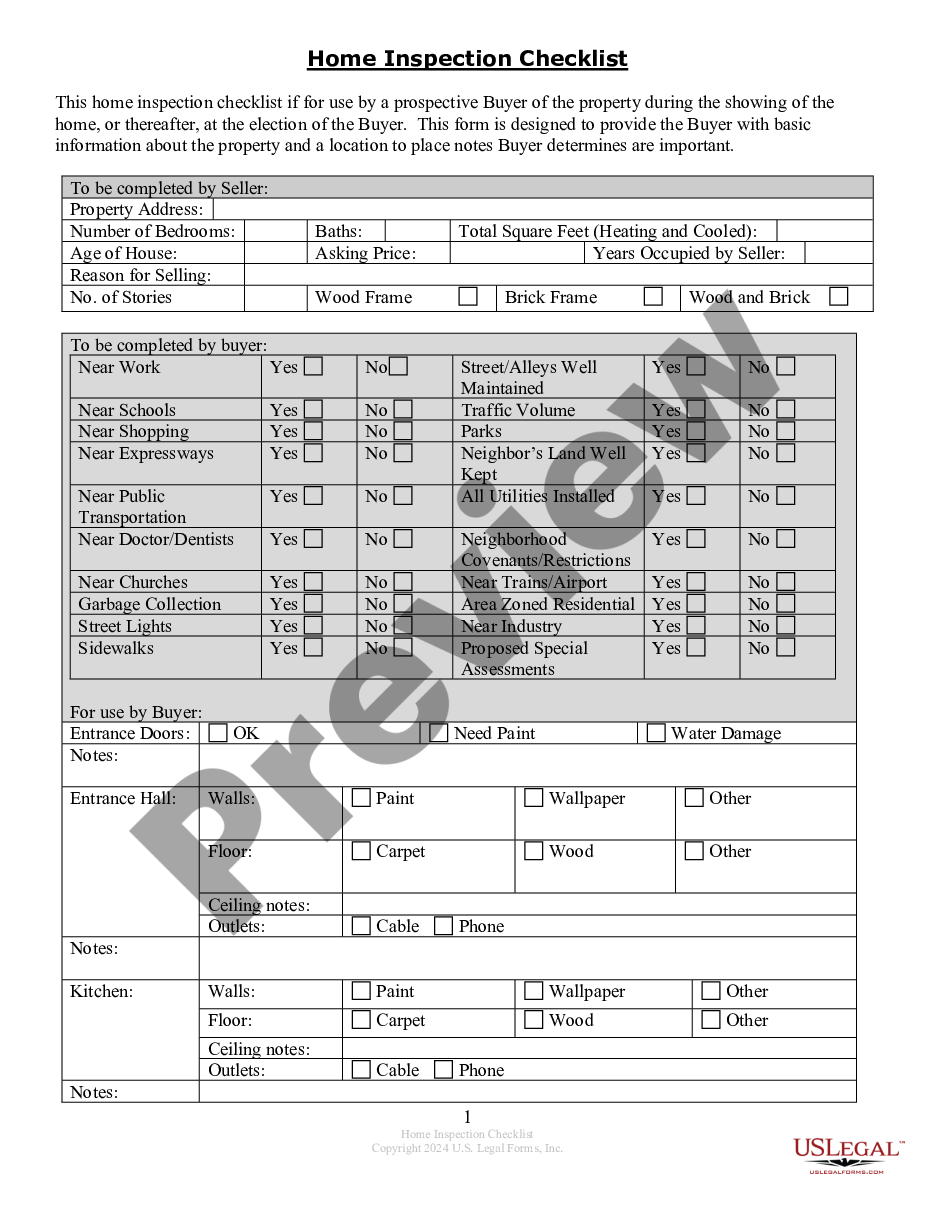

Home Checklist

Description

How to fill out Missouri Buyer's Home Inspection Checklist?

- If you are an existing user, log in to your account. Ensure your subscription is active to download the required forms.

- For first-time users, start by browsing the Preview mode and detailed descriptions to select forms that fit your local jurisdiction and needs.

- If the form isn't quite right, utilize the Search feature at the top to explore alternative templates until you find the perfect match.

- Once you've identified the correct form, click the Buy Now button and select a subscription plan that suits your needs to continue.

- Finalize your purchase by entering your payment details via credit card or PayPal.

- After payment, download the form to your device and access it anytime from the My Forms section.

US Legal Forms stands out by offering a wider variety of forms than many competitors, ensuring that you have the legal tools you need at an affordable price.

With expert assistance available for form completion, you can ensure that your documents are precise and legally sound. Start today and simplify your legal processes!

Form popularity

FAQ

While you don’t need to submit your social security card when filing taxes, you do need your social security number. This number helps the IRS identify your tax records. Using a home checklist can remind you to gather all necessary identification and documentation.

Yes, owning a home usually means you need to file taxes unless your income falls below a specific threshold. The tax implications of homeownership can be complex, but a home checklist can provide guidance on necessary documents and potential deductions.

Even if you only made $5,000, your obligation to file taxes may depend on your filing status and age. Generally, if your income exceeds the standard deduction, you're required to file. A home checklist can help clarify your specific situation and ensure you meet tax requirements.

Yes, owning a home can provide several tax breaks. You may deduct mortgage interest and property taxes on your income tax return. To best understand these benefits, refer to a home checklist tailored for homeowners to maximize your deductions.

Documenting your home inventory involves compiling a detailed list of your belongings. Take photos and note the value of each item, grouping them by category. Remember, using a home checklist can streamline this process, ensuring you don’t overlook important possessions.

Owning a house comes with specific tax documentation requirements. You will need your mortgage interest statement, property tax receipts, and potentially records of rental income if you rent part of your home. A well-organized home checklist can assist you in assembling these vital documents.

To file your taxes after purchasing a house, you should gather essential documents. These include your closing statement, mortgage interest statement (Form 1098), property tax records, and any receipts for home improvements. Using a comprehensive home checklist can help ensure you collect all required paperwork.

In a home checklist, you should prioritize clarity and completeness. Include items related to design, budgeting, timelines, and inspections to cover all aspects of the home-building process. A well-structured home checklist ensures you stay focused and organized as you work towards your dream home.

The best home building checklist is one that is tailored to your specific needs and project requirements. Look for a comprehensive resource that covers all phases of construction, from planning to final inspections. Platforms like US Legal Forms provide various templates and tools to help you create a customized home checklist that suits your situation.

The correct order to build a house typically follows a structured sequence. Start with site preparation, then move on to foundation work, framing, roofing, and installing utilities. Finishing touches come last, including interior fittings and landscaping. Utilizing a home checklist can help ensure you adhere to this order and keep your project on track.