Minnesota Homestead Document With Property

Description

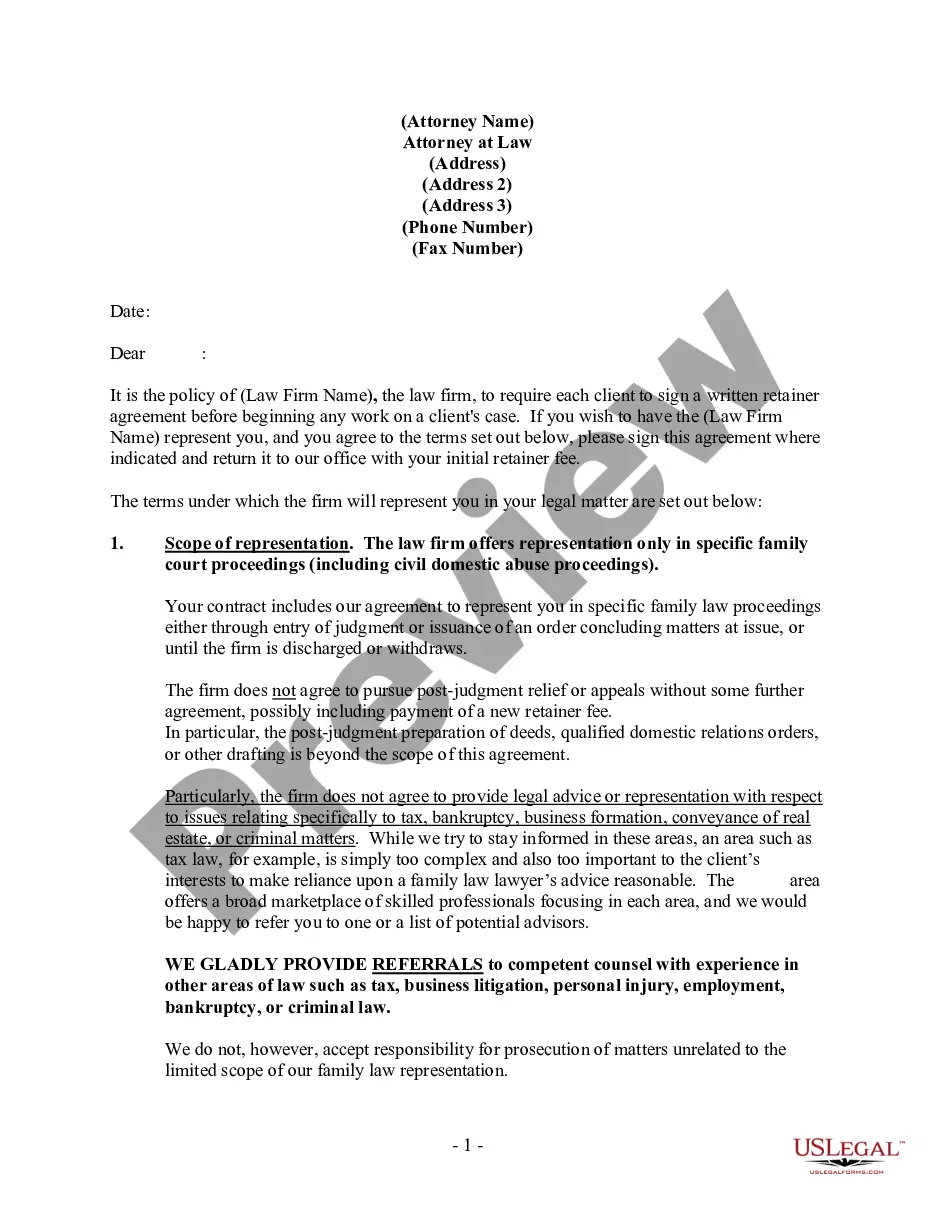

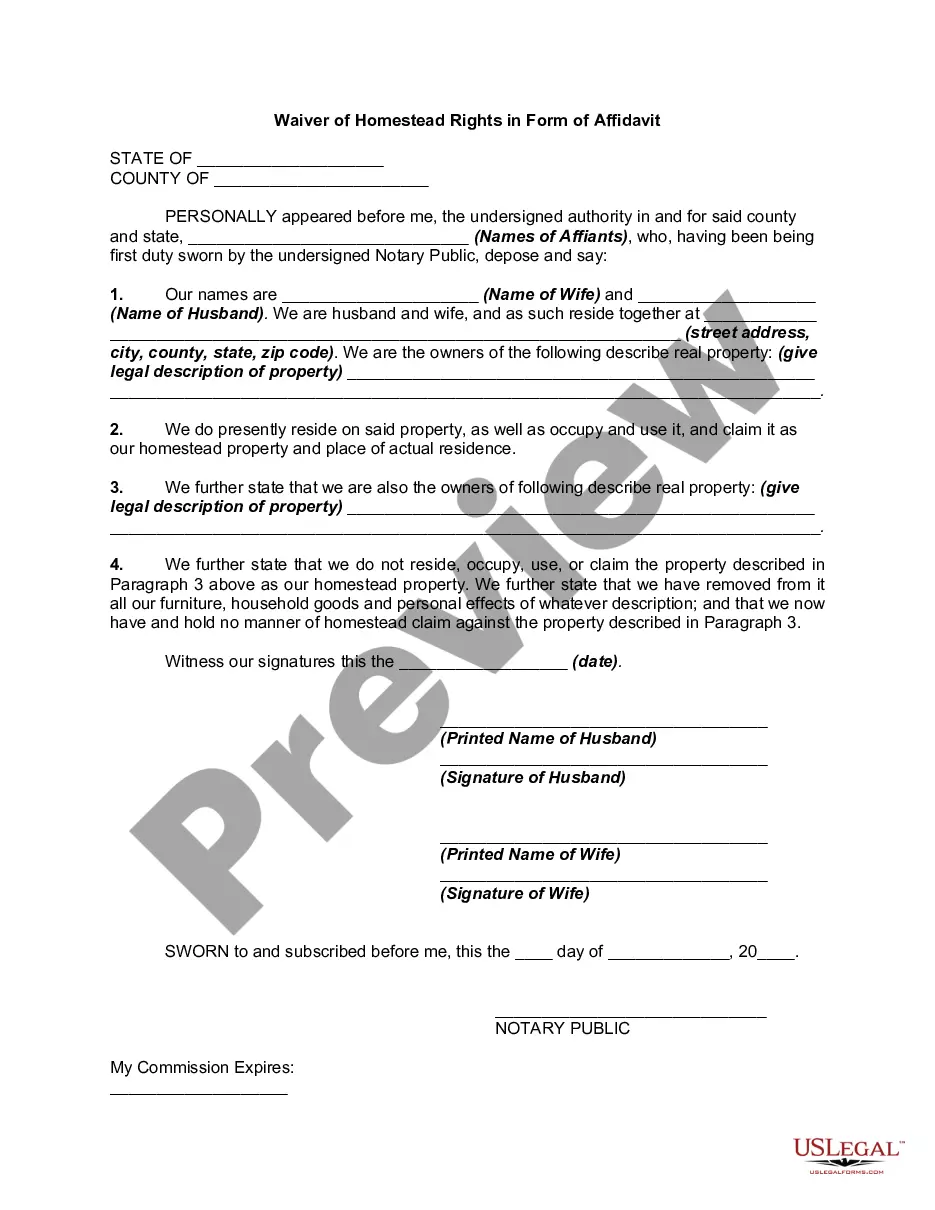

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Creating legal documents from the ground up can frequently feel a bit daunting. Specific situations may require extensive research and significant financial investment.

If you seek a more straightforward and economical method of generating the Minnesota Homestead Document With Property or any other forms without unnecessary complications, US Legal Forms is readily available to assist you.

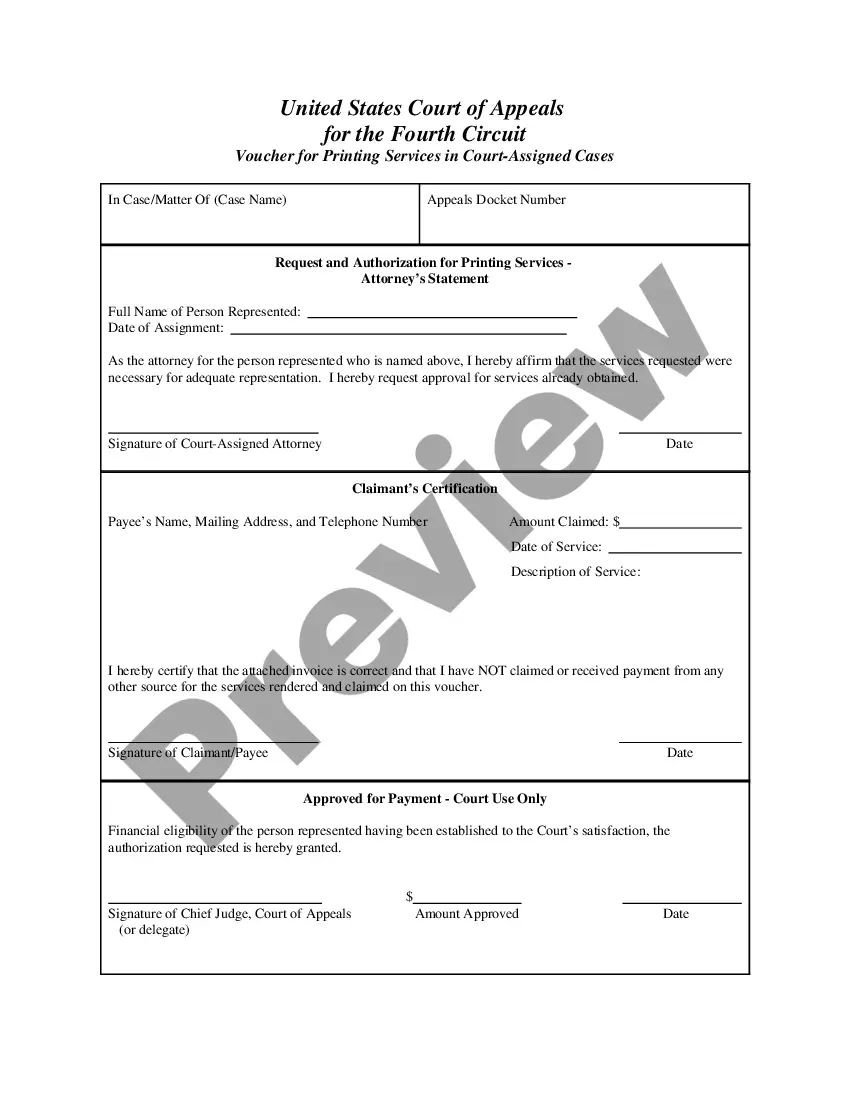

Our online collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific templates carefully crafted for you by our legal experts.

Utilize our platform whenever you need dependable and trustworthy services to quickly find and download the Minnesota Homestead Document With Property. If you are a returning user and have previously set up an account with us, simply Log In, find the form, and download it or re-download it anytime in the My documents section.

US Legal Forms enjoys an impeccable reputation and has over 25 years of expertise. Join us today and make document processing an effortless and efficient experience!

- Not signed up yet? No worries. It requires minimal time to register and explore the library.

- Before diving straight into downloading the Minnesota Homestead Document With Property, consider these recommendations.

- Review the form preview and descriptions to confirm that you have located the correct form.

- Verify that the template you select meets the standards of your state and county.

- Select the appropriate subscription option to obtain the Minnesota Homestead Document With Property.

- Download the form, then complete, certify, and print it.

Form popularity

FAQ

About Homestead Credit You must be one of the owners of the property or be a qualifying relative of one of the owners. You must occupy the property as your primary place of residence. occupancy does not qualify. You must be a Minnesota resident.

If you're a Minnesota homeowner or renter, you may qualify for a Property Tax Refund. The refund provides property tax relief depending on your income and property taxes. A recent law change increases the 2022 Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund (Form M1PR).

You may qualify for homestead if you answer yes to any of these statements: You are a Minnesota resident. You own the property in your own name ? not as a business entity. You live in the property year-round. You or your property co-owner have a social security number or an individual taxpayer identification number.

What is the homestead credit refund program? the maximum refund decreases. The program uses household income, a broad measure that includes most types of income, including income that is not subject to income tax. Deductions are allowed for dependents and for claimants who are over age 65 or disabled.

Effective beginning with assessment year 2024. EXPLANATION OF THE BILL Under current law, the homestead market value exclusion reduces the taxable market value for all homesteads valued below $413,800. The exclusion is 40% of the first $76,000 of market value, yielding a maximum exclusion of $30,400.