Divorce Budget Worksheet With Percentages

Description

Form popularity

FAQ

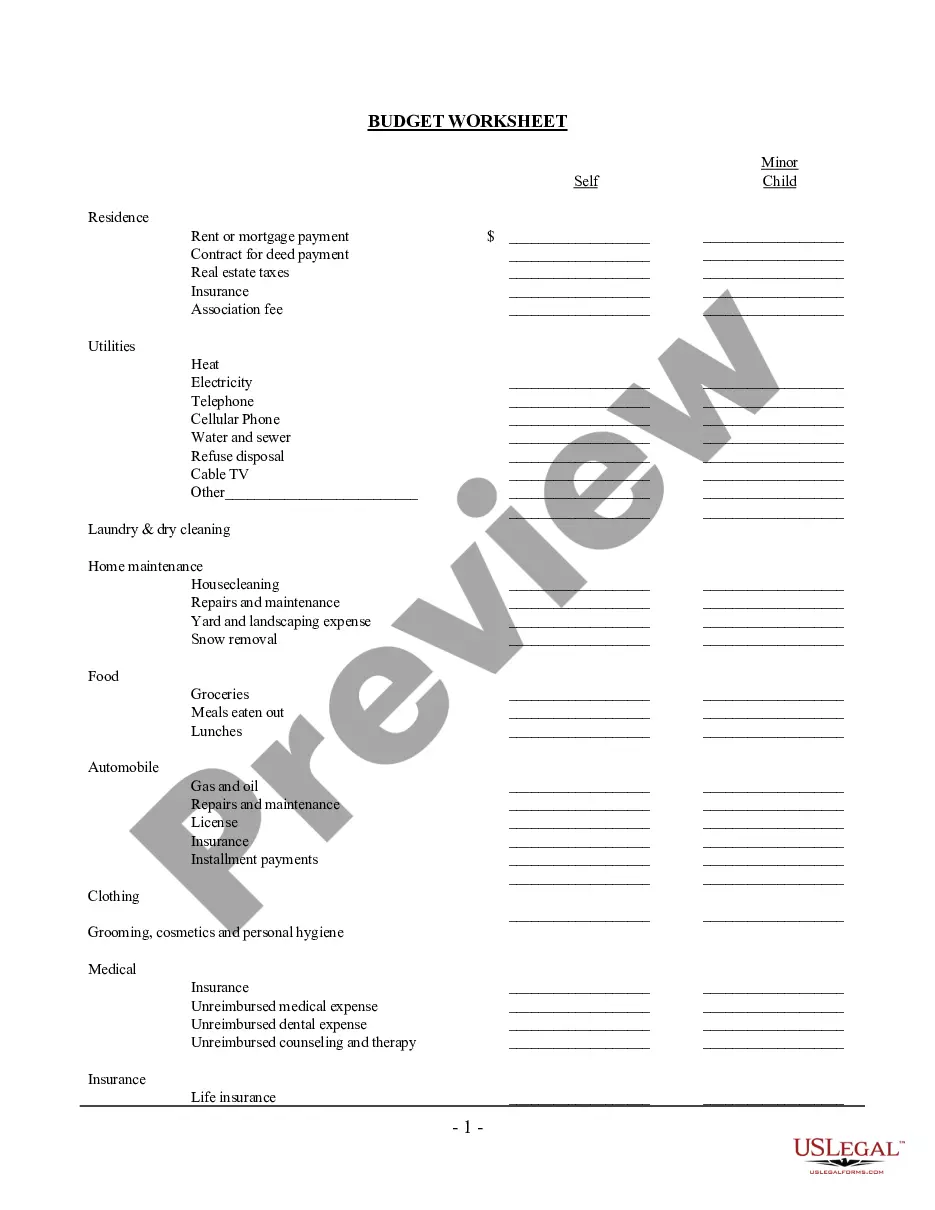

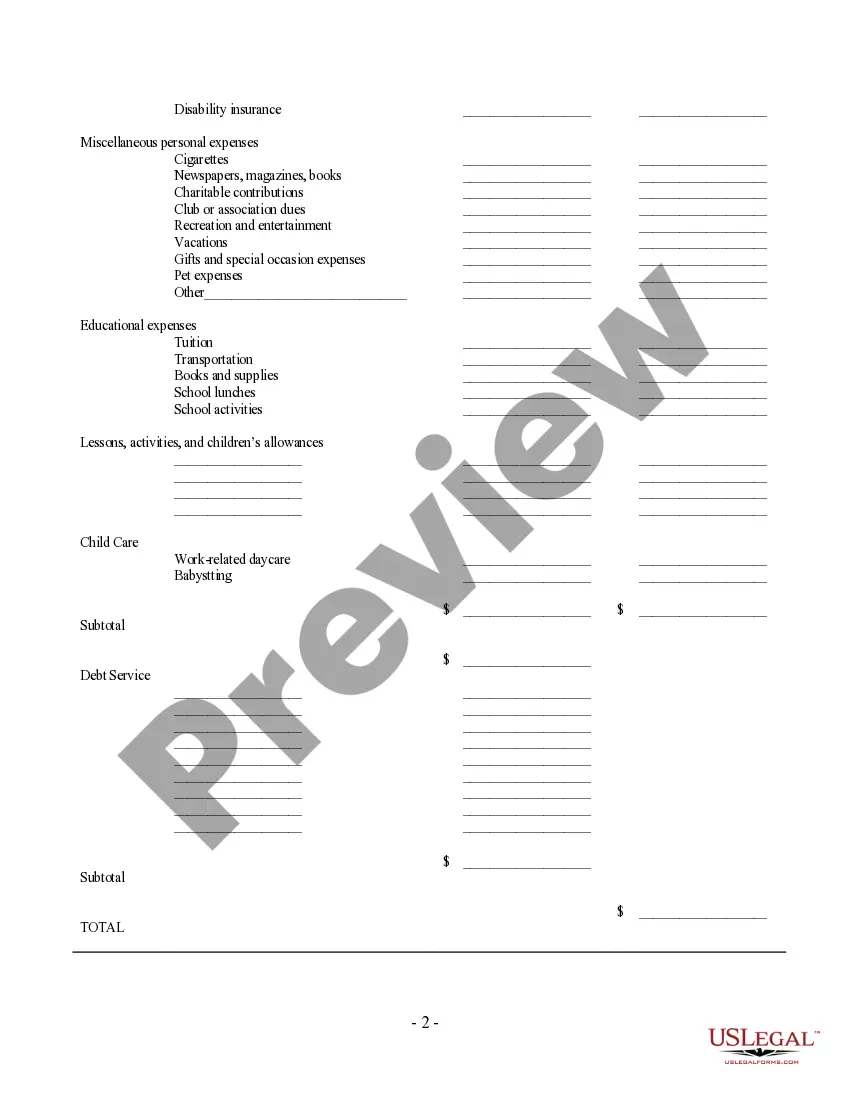

Filling out a budget worksheet involves listing all your income and expenses, then categorizing them appropriately. Begin with your total income at the top, followed by your essential expenses like housing and utilities. After that, include discretionary spending and savings goals within your divorce budget worksheet with percentages. This structured approach will give you a clear overview of your financial status and help guide your spending habits.

Your budget worksheet should contain details about your total income, fixed expenses, variable expenses, savings goals, and debt obligations. It's important to itemize each expense to understand your financial situation thoroughly. Utilizing a divorce budget worksheet with percentages can help you visualize how much of your income is dedicated to different categories. This approach makes it easier to identify areas where you can cut costs.

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework can simplify your financial planning, especially during a divorce. By applying this rule to your divorce budget worksheet with percentages, you can achieve a balanced financial outlook. This ensures you prioritize essentials while keeping future goals in mind.

To complete a budget plan, start by listing your income sources and estimating your monthly earnings. Next, outline your expenses, including fixed costs like rent and variable expenses such as groceries. Once you have these figures, organize them in your divorce budget worksheet with percentages. This will help you see how much of your income goes toward each expense category.

The 75-15-10 rule is another budgeting strategy that recommends allocating 75% of your income for needs, 15% for savings, and 10% for debt repayment. This rule is beneficial for those who prioritize meeting essential costs while still saving and managing debt. Integrating a Divorce budget worksheet with percentages into your financial planning can help you apply this rule effectively, allowing you to adjust your ratios according to your specific financial situation.

The 50%, 30%, 20% rule of budgeting suggests allocating 50% of your income to essential expenses, 30% to discretionary items, and 20% to savings or debt repayment. This method provides a straightforward framework for managing your finances effectively. By using a Divorce budget worksheet with percentages, you can ensure every category is funded appropriately, helping to maintain financial stability during a challenging time like divorce.

To calculate the 50/30/20 rule, first determine your total monthly income after taxes. Next, multiply your income by 0.50 to find out how much to spend on needs, 0.30 for wants, and 0.20 for savings or debt repayment. A Divorce budget worksheet with percentages can be a handy tool in this process, as it allows you to input your income and automatically generate the breakdown, making budgeting easier.

The 50/30/20 budget rule divides your income into three categories: needs, wants, and savings. For example, if your monthly income is $4,000, you would allocate $2,000 for essential expenses like housing and groceries, $1,200 for discretionary spending like dining out, and $800 for savings and debt repayment. Using a Divorce budget worksheet with percentages can help you visualize these allocations clearly and ensure you are adhering to this simple and effective budgeting strategy.

The 75-15-10 budget rule is another popular budgeting strategy that divides your income into three portions: 75% for living expenses, 15% for savings, and 10% for debt repayment. This rule can be particularly helpful when creating a Divorce budget worksheet with percentages. By understanding how to allocate your funds, you can minimize stress during your financial transition and work towards a more secure future.

Percentage guidelines for budgeting help you manage your income effectively. Many financial experts recommend a plan similar to the 50/30/20 rule, which can be utilized in your Divorce budget worksheet with percentages. By aligning your spending with these practical benchmarks, you can improve your financial health dramatically and ensure that you allocate resources wisely across different needs.