Authorization For Release Of Employment Information With Credit Bureaus

Description

How to fill out Minnesota Authorization To Release Employment Information?

There's no further reason to squander time hunting for legal documents to satisfy your local state obligations.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our platform provides over 85k templates for any business and personal legal matters categorized by state and purpose.

Utilize the search bar above to look for another template if the current one does not suit your needs.

- All forms are accurately drafted and validated for authenticity, so you can be assured of obtaining an updated Authorization For Release Of Employment Information With Credit Bureaus.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before attempting to acquire any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents whenever required by navigating to the My documents tab in your profile.

- If you are a first-time user of our platform, the procedure will take a few additional steps to complete.

- Here is how new users can acquire the Authorization For Release Of Employment Information With Credit Bureaus from our library.

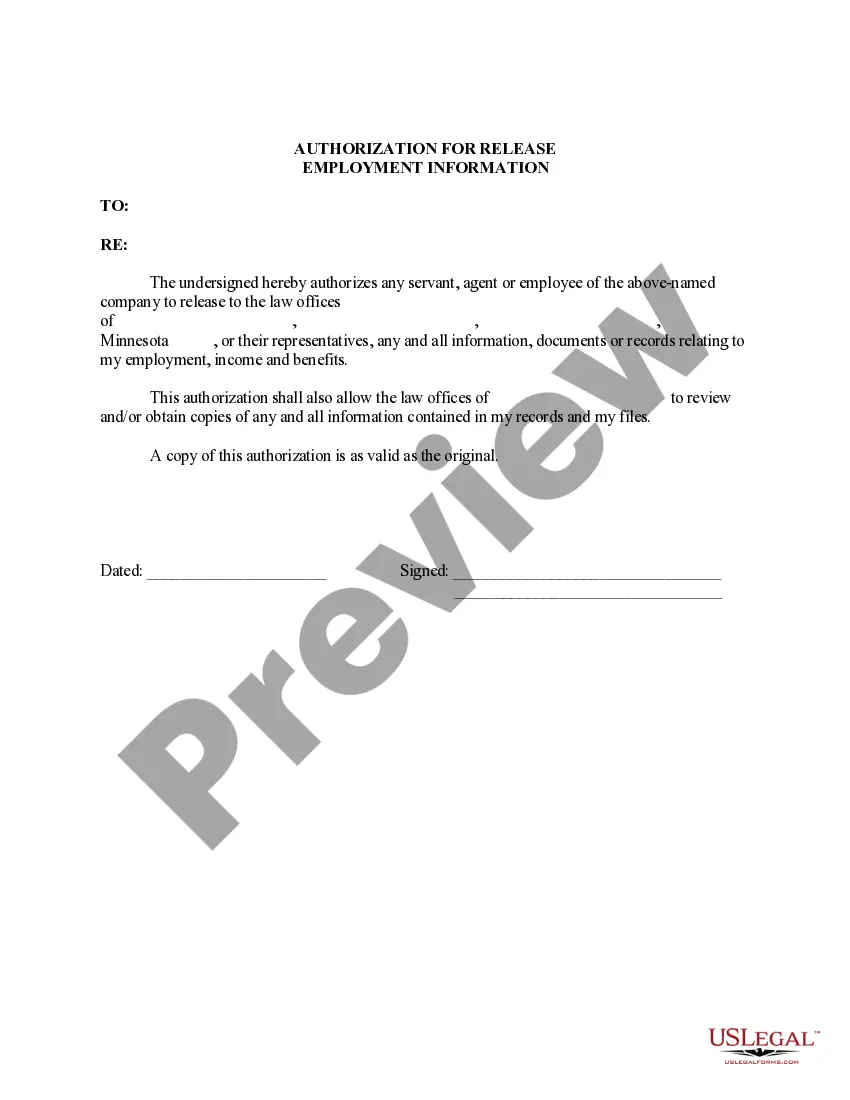

- Examine the page content thoroughly to verify it contains the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

A credit report authorization form is a document used to give permission to an individual or organization to perform a credit report only. This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act (FCRA) (15 U.S.C.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.

What is a Consumer Report? A consumer report contains information about your personal and credit characteristics, character, general reputation, and lifestyle. To be covered by the FCRA, a report must be prepared by a consumer reporting agency (CRA), a business that assembles such reports for other businesses.

Although there is no legal requirement to get the consumer's permission or signature to allow the bank to pull a consumer report (with the exception of a report for employment purposes), the bank could expose itself to civil liability if the consumer contends that the bank did not have a legitimate business need that