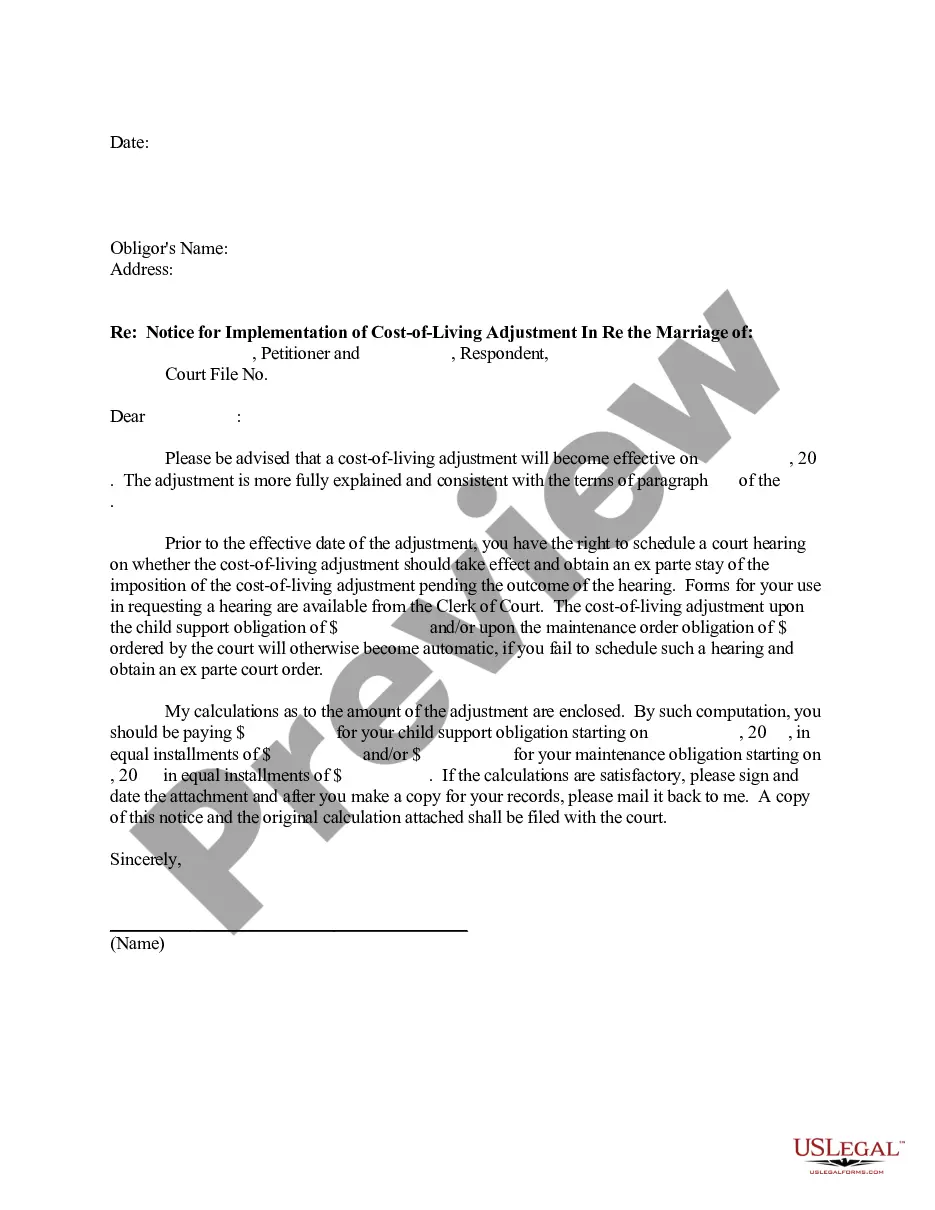

Cost Of Living Adjustment Letter Without Name

Description

How to fill out Cost Of Living Adjustment Letter Without Name?

What is the most reliable service to acquire the Cost Of Living Adjustment Letter Without Name and other recent editions of legal documents.

US Legal Forms is the solution!

Once downloaded, the template stays accessible for future reference in the My documents section of your account. If you don't yet have an account with our collection, follow these steps to set one up: Compliance assessment of forms. Before obtaining any template, ensure it conforms to your intended purpose and your state or county’s laws. Review the form description and use the Preview option if available. Alternative document search. If there are discrepancies, utilize the search function in the header to locate another template. Click Buy Now to select the correct one. Account registration and subscription purchase. Choose the most suitable plan, Log In or create your account, and proceed to pay for your subscription using PayPal or a credit card. Document downloading. Select the format you wish to save the Cost Of Living Adjustment Letter Without Name (PDF or DOCX) and click Download to obtain it. US Legal Forms is an excellent choice for anyone needing to manage legal documents. Premium users can take advantage of additional features as they complete and digitally sign previously saved documents anytime using the built-in PDF editing tool. Try it out today!

- It boasts the largest assortment of legal papers for any need.

- Each template is meticulously prepared and verified for adherence to national and local laws and guidelines.

- Documents are organized by region and state of use, making it easy to find what you require.

- Veteran users of the site simply need to Log In to the platform, verify their subscription status, and hit the Download button next to the Cost Of Living Adjustment Letter Without Name to obtain it.

Form popularity

FAQ

To write a salary increase recommendation letter, follow these five steps:Address the letter. Add your direct manager's name to the top of the letter.List specific reasons for the recommendation.Ask for a reasonable amount.Thank the reader for their time.Sign the letter.

The cost-of-living adjustment (COLA) is not required, and in some years there is no increase in the COLA. When the cost of living declines, recipients can expect no COLA increase the following year.

How is the Cost-of-Living Adjustment (COLA) determined? The U.S. Department of Labor calculates the change in the Consumer Price Index (CPI) for urban wage earners and clerical workers from the third quarter average of the previous year to the third quarter average for the current year.

You give annual salary cost of living adjustments, so you raise each employee's wages by 1.5%. So, if you have an employee who earns $35,000 per year, you would add 1.5% to their wages.

How is a COLA calculated? The Social Security Act specifies a formula for determining each COLA. According to the formula, COLAs are based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-Ws are calculated on a monthly basis by the Bureau of Labor Statistics.