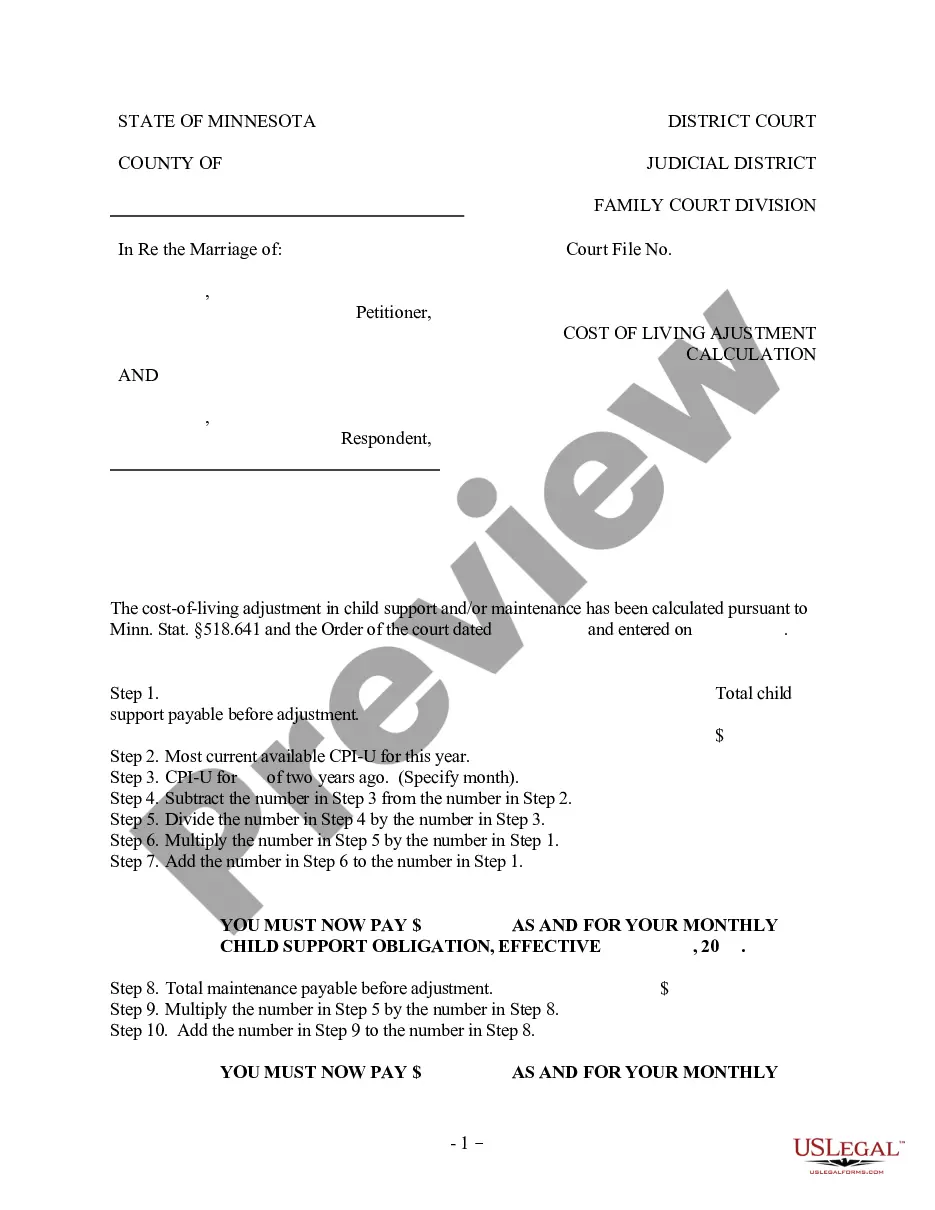

Child Support Cost Of Living Adjustment Calculator For Running

Description

How to fill out Minnesota Cost Of Living Adjustment Calculation For Child Support?

It’s no secret that you can’t become a law expert immediately, nor can you figure out how to quickly prepare Child Support Cost Of Living Adjustment Calculator For Running without having a specialized set of skills. Putting together legal forms is a long process requiring a particular training and skills. So why not leave the preparation of the Child Support Cost Of Living Adjustment Calculator For Running to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court documents to templates for in-office communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Child Support Cost Of Living Adjustment Calculator For Running is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and select a subscription option to buy the form.

- Choose Buy now. Once the transaction is through, you can download the Child Support Cost Of Living Adjustment Calculator For Running, fill it out, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

In general, child support guidelines in Texas include the following: Noncustodial parents are required to contribute 20 percent of net income (the base child support rate in Texas) for one child and an additional five percent for each subsequent child.

For instance, if you have one child, the paying parent will be obligated to pay 20 percent of his or her net income. Two children means a 25 percent obligation, three children means a 30 percent obligation, and so on. Texas places a cap of 40 percent of net income on child support obligations.

Simply add up all of your monthly fixed expenses, like rent or a mortgage payment, and your variable expenses, such as groceries and gas costs. Also factor in occasional but expected purchases, such as new tires. The resulting amount, assuming you aren't going to debt every month, is your cost of living.

Is there a limit to the amount of money that can be taken from my paycheck for child support? 50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.

A: The standard child support percentage is 20% of the parents' combined gross income. An additional 10% is added for each additional child. If there are extenuating circumstances, the court may call for a higher or lower percentage to reflect your situation.