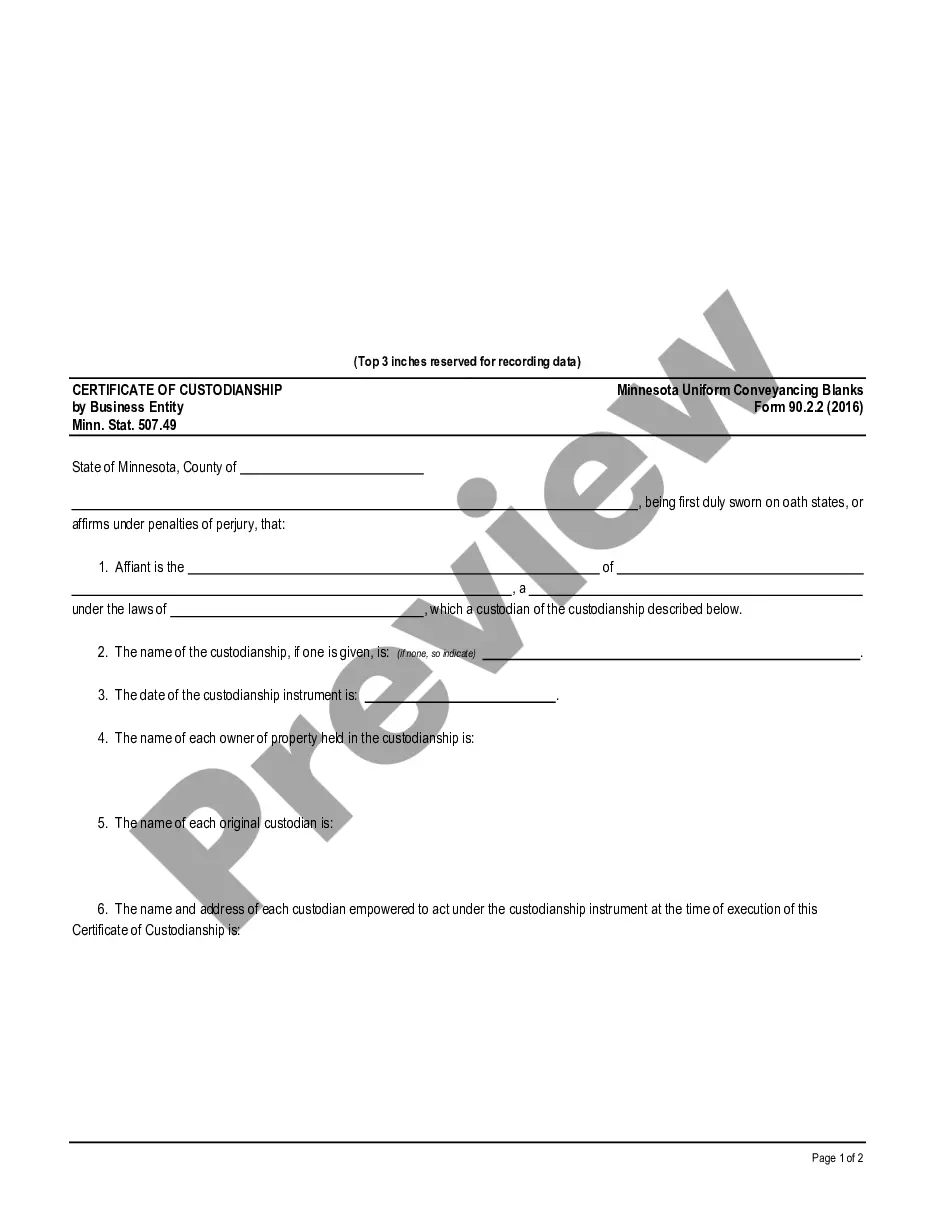

Non Homestead Affidavit Withholding

Description

How to fill out Minnesota Affidavit Of Creditor Regarding Non-Homestead Status?

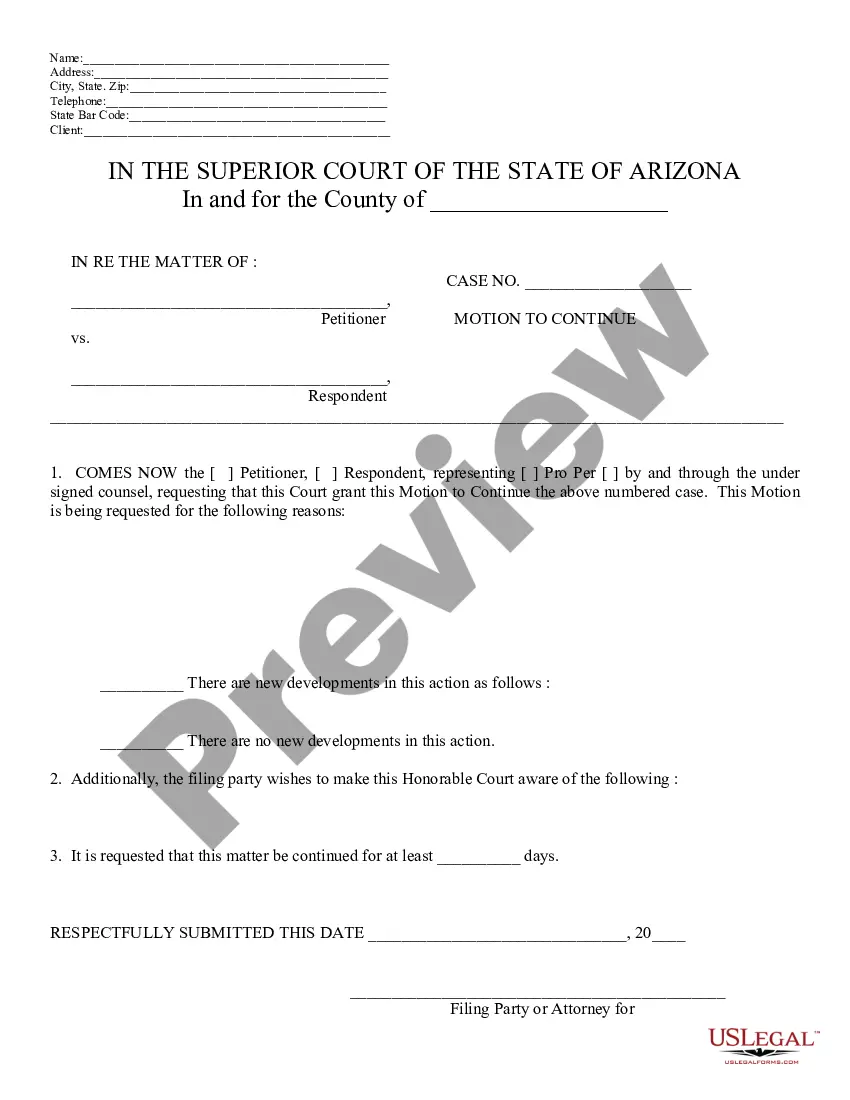

Which is the most dependable service for obtaining the Non Homestead Affidavit Withholding and other recent versions of legal documents? US Legal Forms is the answer!

It's the largest assortment of legal forms for any situation. Each template is expertly crafted and verified for adherence to federal and local guidelines.

Form compliance verification. Before acquiring any template, ensure that it adheres to your use case requirements and complies with the laws of your state or county. Consult the form description and use the Preview feature if accessible. Alternative document search. If there are any discrepancies, utilize the search bar at the top of the page to discover another template. Click Buy Now to select the correct one. Registration and subscription purchase. Choose the most suitable pricing option, Log In to or create an account, and complete your subscription payment via PayPal or credit card. Downloading the paperwork. Select the file format in which you want to save the Non Homestead Affidavit Withholding (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an outstanding solution for anyone needing to handle legal documents. Premium members can benefit even more since they can fill out and authorize previously saved documents electronically at any time using the integrated PDF editing tool. Explore it today!

- They are organized by area and state of utilization, making it easy to find the one you require.

- Users who are familiar with the platform just need to Log In to the system, verify their subscription's validity, and click the Download button next to the Non Homestead Affidavit Withholding to access it.

- Once saved, the template can be retrieved for future use in the My documents section of your account.

- If you do not yet have an account with our database, follow these steps to create one.

Form popularity

FAQ

What does Non Homestead mean? Non-2010homestead represents industrial, commercial and some agricultural property and second homes. It does not include a family's primary residence.

What is a homestead? Your homestead is the place where you have your permanent home. It is the place to which you plan to return whenever you go away. You must be the owner and occupant or be contracted to pay rent and occupy the dwelling.

When a person no longer owns or occupies the property as a principal residence, he or she must file a Request to Rescind Homeowner's Principal Residence Exemption (PRE), Form 2602, with the assessor for the city or township in which the property is located to remove the PRE.

Gather What You'll NeedHomeowner's name.Property address.Property's parcel ID.Proof of residency, such as a copy of valid Georgia driver's license and a copy of vehicle registration.Recorded deed for new owners, if county records have not been updated.Trust document and affidavit, if the property is in a trust.

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.